This is the CMC Markets APAC Q4 Outlook, presented by market analysts Tina Teng, Azeem Sheriff & Leon Li. You can follow us on our socials below.

CMC Markets AUSNZ - (Twitter)

Tina Teng - (Twitter)

Azeem Sheriff - (Twitter)

Leon Li - LinkedIn

This outlook has been broken into 3 sections and hyperlinks are provided for reference/navigation.

Click here to read Part 1 (US Market)

Click here to read Part 2 (Australian Market & AUD/USD)

China markets outlook for Q4

Although the lockdown in Shanghai formally ended at the beginning of Q3, certain restrictions remained in other regions. In July, China's macro-economy still faces challenges. The scale of new social financing, real estate investment, consumption, and industrial production slowed down.

China's real estate industry broke out in July with the supply interruption of property buyers, which hit market confidence. To stabilise the housing market, the Chinese central bank (PBOC) provided 200 billion yuan of special funds to support investment, and local governments set up rescue funds to ensure the handover.

To boost residents' demand for real estate, The PBOC lowered the interest rates by ten basis points of 400 billion one-year medium-term lending facility (MLF) and 2 billion seven-day reverse repo operations on August 15. Subsequently, the PBOC cut the 1-year and 5-year loan rates by 5/15 basis points to 3.65%/4.3%, respectively.

It is expected that the GDP in Q3 will recover from that in Q2, but it is difficult to achieve significant growth.

China's weak economy, the risk of overseas interest rate hikes, and geopolitical conflicts with Taiwan put significant pressure on Chinese stock markets. As of September 27, the SSE Composite Index has fallen near 9% since its July high of 3,425.

CSI CN sectors performance for the last three months

Looking forward to Q4, the recent trading volume continuously declines, indicating that investor sentiment has turned cautious.

There might be a bear correction at 3,000 support in the short term. However, as China is unlikely to end the zero-covid policy in the near term, the economic recovery is still unstable. With the acceleration of the global economic downturn, China's export growth may slow down in Q4. In addition, the Federal Reserve (US central bank) is likely to raise interest rates above 4% by the end of 2022, which puts downward pressure on global stock markets, including China.

SSE Composite Index, Weekly

SSE Composite Index, Monthly

- The SSE Composite Index may face resistance on 3,150 – 3,240.

- Watch the support level near 3,000. If price breaks below this level, it will further decline toward the April low of 2,863.

- The probability of a sharp decline in Q4 is small because China may further use policy tools to support economic recovery. Price below 3,000 may be a reasonable buy point for long-term investors.

- From the perspective of sectors, under the background of policy support, the consumption and real estate sectors showed strong resilience in Q3. The valuation is low, and real estate investment may recover in Q4. If the Chinese government relaxes epidemic control, social consumption will recover.

- In terms of new energy vehicles, as subsidies will end at the end of Q4, the overseas economic downturn may lead to a decline in export growth, and the US has introduced the Inflation Reduction Act to subsidise local industries, which may hurt the development of China's new energy vehicle industry.

The weak Chinese yuan may not find the light at the end of the tunnel in Q4

Source: CMC Markets as of 29th Sep 2022

The offshore Yuan has depreciated sharply against the US dollar since August 15, 2022, with a cumulative depreciation of 7.8% in Q3. The main reason is the US-China monetary policy divergence.

Looking forward to Q4, there is still pressure on the yuan because the Federal Reserve is more hawkish than before.

In the short term, there is a potential technical correction for the yuan in the first half of October. Watch the short-term support at 7.145. If the price breakdown this level, it may further move down to the medium-term support at 7.

The PBOC has implemented several policies to protect the exchange rate, such as lowering the reserve requirement ratio for foreign exchange deposits of financial institutions by 2%, from 8% down to 6%. In addition, the PBOC raised the foreign exchange risk reserve for forward-exchange sales from 0% to 20%.

After the Federal Reserve further raised the federal funds rate by 75 basis points in September, the labour market and inflation may slow down in Q4, and the European Central Bank (ECB) and the Bank of England (BOE) may raise interest rates sharply, limiting the strong US dollar to rise in the short term.

We hold a bullish bias for USD/CNH for the medium-term, with a target of 7.4 for Q4.

Commodities outlook for Q4

Gold, Monthly

Since March 2022, gold has entered a bear market from the high of 2,071. Gold had hit a record new low in September, the sixth consecutive month of decline.

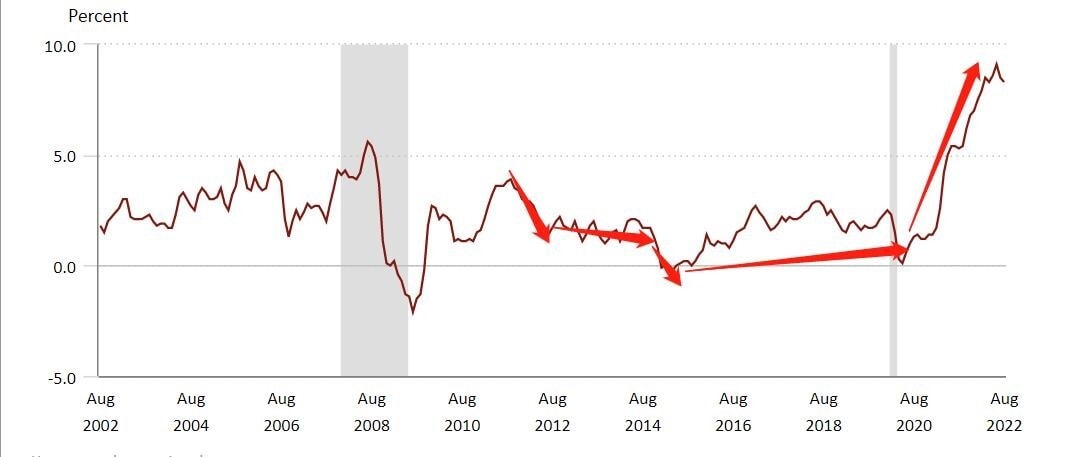

As shown in the below charts, the current gold trend is similar to 2012-2013.

As can be seen from the above two charts, gold maintains a high correlation with the US inflation rate. As currency devaluation promotes inflation, investors can consider increasing their holdings of gold to cope with asset devaluation. However, gold may not be attractive to investors when inflation slows down.

The current US inflation (headline rate) is still above 8%, far from the target of 2%.

When gold bottomed out in December 2015, it corresponded to the fact that US inflation was near zero, and the economy fell into deflation.

Therefore, gold has a risk of further decline to 1,600. Moreover, if the Russia-Ukraine war ends, gold may likely be sold off.

The bottom for gold may be around the 1,432 level.

Source: CMC Markets as of 27th Sep 2022

As of 27th September 2022, WTI crude oil had fallen by more than 30% since July. The main reason is that the Federal Reserve began to raise interest rates by 75 basis points in July, and the strong dollar had put pressure on oil prices. Moreover, the United States released strategic oil reserves to compensate for the supply shortage, and the global economic downturn triggered demand concerns.

- The current price is oversold; watch the short-term support at 75-77.

- Considering that the Russia-Ukraine war may escalate, European sanctions will restrict the oil supply.

- OPEC+ may cut production to support oil prices.

- The scale of the release of US strategic oil reserves will gradually decrease over time, or potentially stop.

- Iran nuclear agreement faces uncertainty in the short term.

- A potential rebound to the resistance on 85 if the price holds above 75. A further move up to 93.5 is also possible, if the price breaks above 85.

In the long-term, the Federal Reserve may raise interest rates by 75 and 50 basis points in November and December. The global countries will face downward pressure on the economy and hit demand. These factors put pressure on oil prices.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.