G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets Invest platform and follow us on Twitter:

Azeem Sheriff -

Tina Teng -

CMC Markets ANZ -

CMC Markets Singapore -

CMC Markets Canada -

Trading Idea of the Day

ASX:PLS - Pilbara Minerals Ltd - BEARISH BIAS (short term)

- Key levels on the chart - consider taking trades from key support/resistance zones.

Sky high oil prices and tight supply make oil an appealing investment.

A decade of low oil prices and ever-increasing ESG concerns have caused a structural undersupply of fossil fuels. Conflict in Eastern Europe has put further pressure on oil supply across Europe.

- Increased oil and gas pricing globally have made Occidental a cash printing machine in 2022.

- Occidental Petroleum is a US oil giant focused predominantly on shareholder returns through dividends, share buybacks and debt repayment.

- Buffett has a view that oil prices over the coming decade will be much higher than most people expect. Berkshire now owns over 20% of the entire company and has SEC approval to buy a lot more.

- Buffett, also likes the low P/E and Oxy’s focus on returning cash to shareholders.

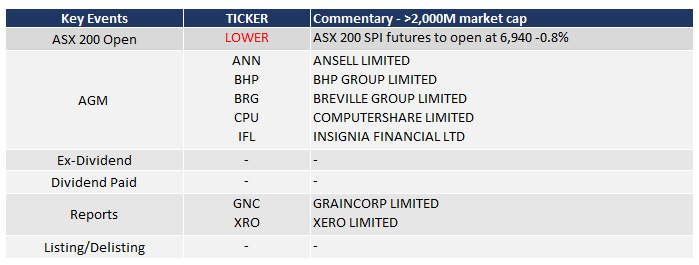

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

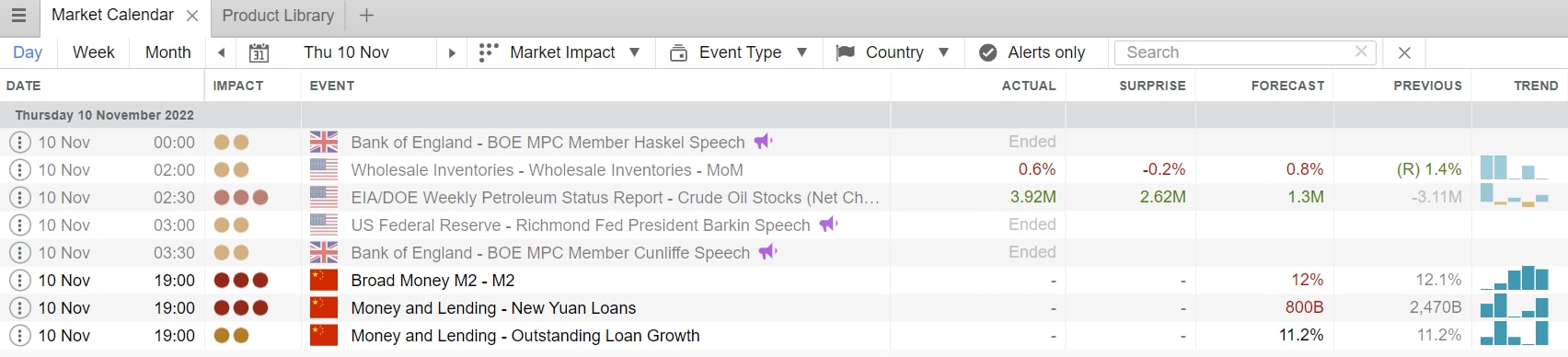

Economic Key Events (TODAY)

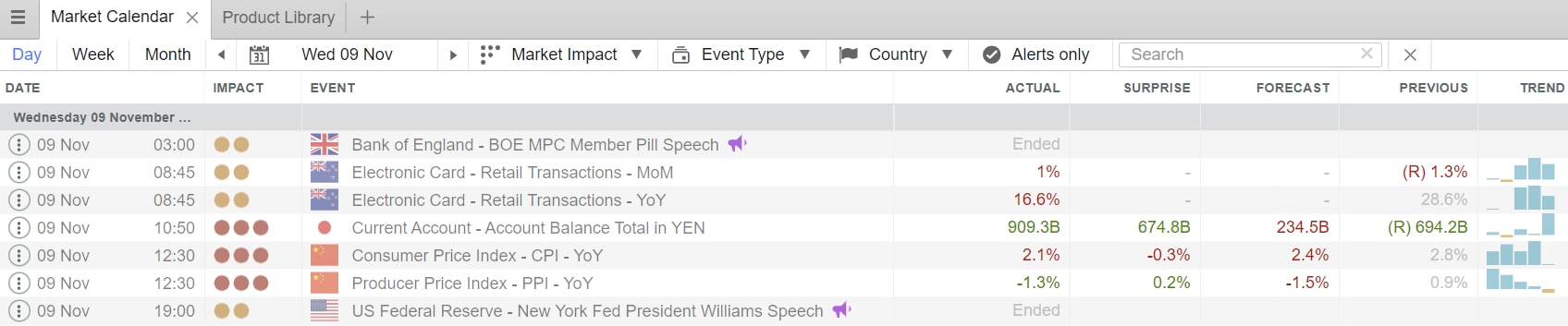

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Will slowing services growth eat into the Apple share price?

Podcast of the Day: Doomberg on Nord Stream sabotage and monetary mayhem

APAC Daily Report

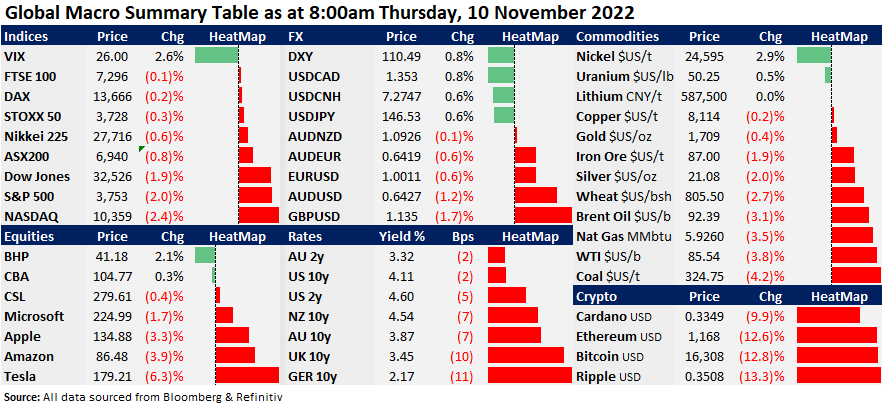

Market Snapshot & Highlights as of 8:00am AEDT

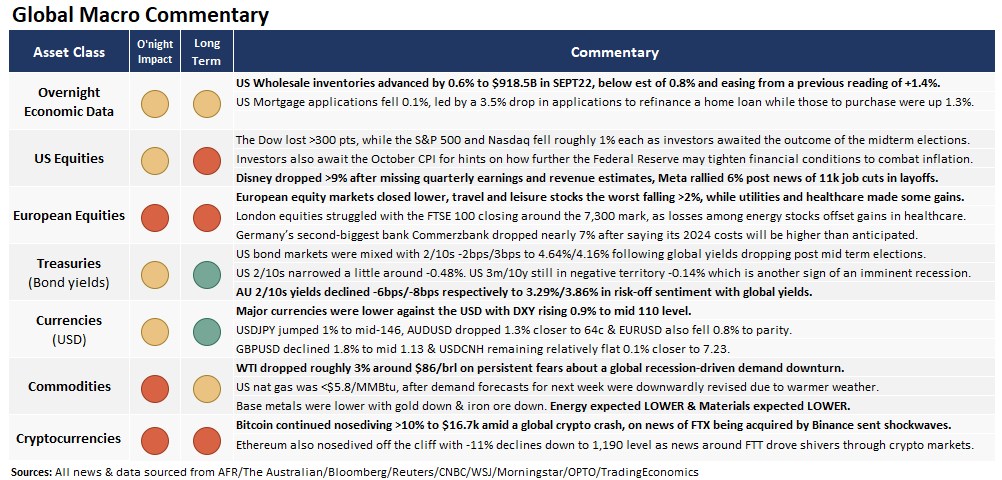

EXPECTATIONS: Energy LOWER (lower oil prices) & Materials LOWER on overall lower commodity prices.

Global Markets Headlines

Several key races are too close to call, leaving control of Congress up in the air (CNBC)

Elon Musk took over a struggling business with Twitter and has quickly made it worse (CNBC)

Bitcoin tumbles to its lowest in nearly 2 years; Solana drops another 40% (CNBC)

Tesla sinks to almost two-year low on Elon Musk stock sales, Twitter distraction (CNBC)

Meta laying off more than 11,000 employees: Read Zuckerberg’s letter announcing the cuts (CNBC)

Binance CEO tells employees he didn’t ‘master plan’ FTX demise (CNBC)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.