G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets NextGen platform and follow us on Twitter:

Azeem Sheriff -

CMC Markets -

Trading Idea of the Day

ASX:WBC - Westpac Banking Corp - BULLISH BIAS

- Key levels on the chart - consider taking trades from key support/resistance zones.

Banks began rallying on Thursday, back of positive earnings results from Bank of Queensland.

Higher net interest margins is the key theme with BOQ and it appears to have increased over last quarter adding to its increased revenue and earnings which drove the stock price up by 10% upon release.

We can anticipate the other major banks to follow a similar theme with their NIM, adding to positive earnings results later in October and early November. With Westpac's earnings released on 8th November, will be an interesting one to watch!

ASX & Economic Key Events

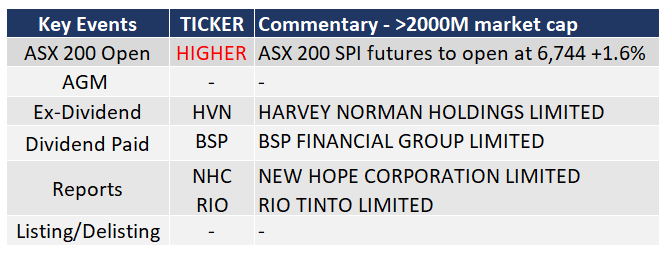

ASX Key Events Calendar (TODAY)

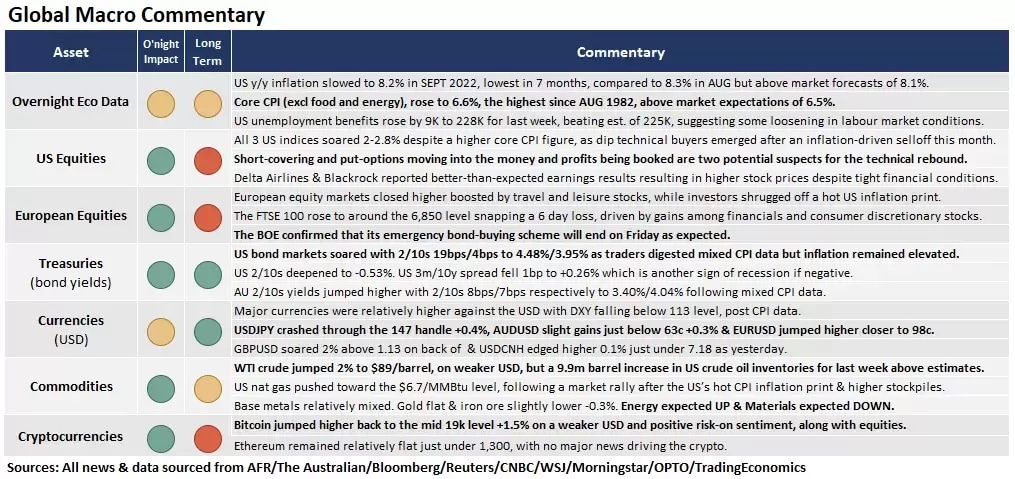

Economic Key Events (TODAY)

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Where are Porsche shares headed amid growing EV ambitions?

Podcast of the Day: Discipline Funds CIO Cullen Roche on finding opportunities in a bear market

APAC Daily Report

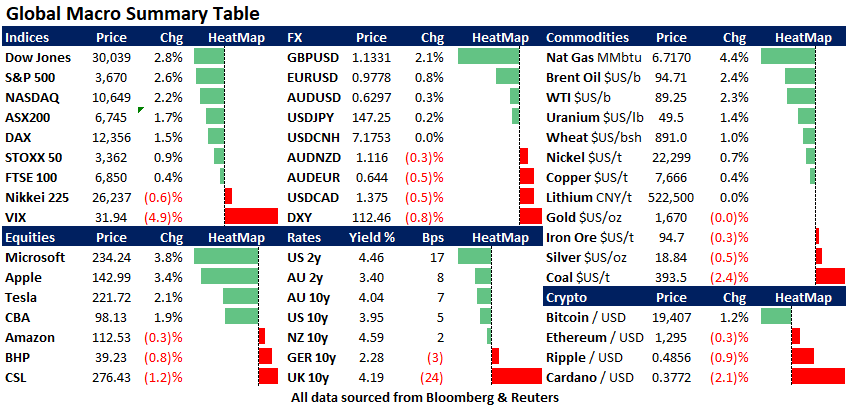

Market Snapshot & Highlights as of 8am AEST

EXPECTATIONS: Energy LOWER (lower oil) & Materials LOWER on overall lower base metal prices.

Global Markets Headlines

- Biden administration asked Saudi Arabia to postpone OPEC decision by a month, Saudis say (CNBC)

- U.S. inflation increased 0.4% in September, more than expected despite rate hikes (CNBC)

- British pound jumps on reports UK government may reverse parts of its tax-cutting proposals (CNBC)

- Globally critical chip firm tells U.S. staff to stop servicing China customers after Biden export curbs (CNBC)

- Fed officials expect higher rates to stay in place, meeting minutes show (CNBC)

- Asian economies may have to brace for rising debt and capital flight, IMF warns (CNBC)

- ECB may need to hike rates above 3%, Belgium central bank chief says (CNBC)

Inflation Pushes Social Security COLA to 8.7% in 2023, Highest Increase in Four Decades (WSJ)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.