US stock market had a lacklustre session yesterday where the S&P 500 and Nasdaq 100 declined by -0.5% and -0.4% respectively. Interestingly, the worst performers were the previous session best winners; energy and financial related stocks sold off; S&P energy sector (-2.7%) and financials sector (-1.2%). The only bright spot was from the communication services sector that managed to have a meagre gain of +0.3%.

The US dollar continued to shed its losses led by the AUD (+0.8%) and EUR (+ 0.6%) against the USD at the end of yesterday’s U.S session where a better than expected US consumer sentiment for September had no effect to reverse the US dollar losses, the Conference Board’s Consumer Confidence Index jumped to 101.8 in September (89.2 consensus) from an upward revised 86.3 from 84.8 in August.

Chinese technology juggernaut, Alibaba Group’s Investor Day 2020 had swung into full-mode on its second day where financial highlights from these business segments took the limelight; Digital Media & Entertainment, Local Services, Cainiao Network and Alibaba Cloud Intelligence. Positive results were revealed. Alibaba’s share price managed to hold on to its current cumulative gain of 2.2% seen so far since Monday and traded close to the upper limit of its 52-week range at 299.00 with a close of 276.93 at end of yesterday’s US session.

China financial system managed to breathe a sign of relive after “too big to fail” property giant China Evergrande Group had avoided a cash crunch after it reached an agreement with a group of strategic investors to avoid repayments that would put a significant strain on its balance sheet.

In addition, latest economic data from China had continued to indicate recovery from the ravages inflicted by the COVID-19 pandemic. The Caixin manufacturing PMI for September was at 53.00 within market consensus and almost the same as August figure of 53.1.

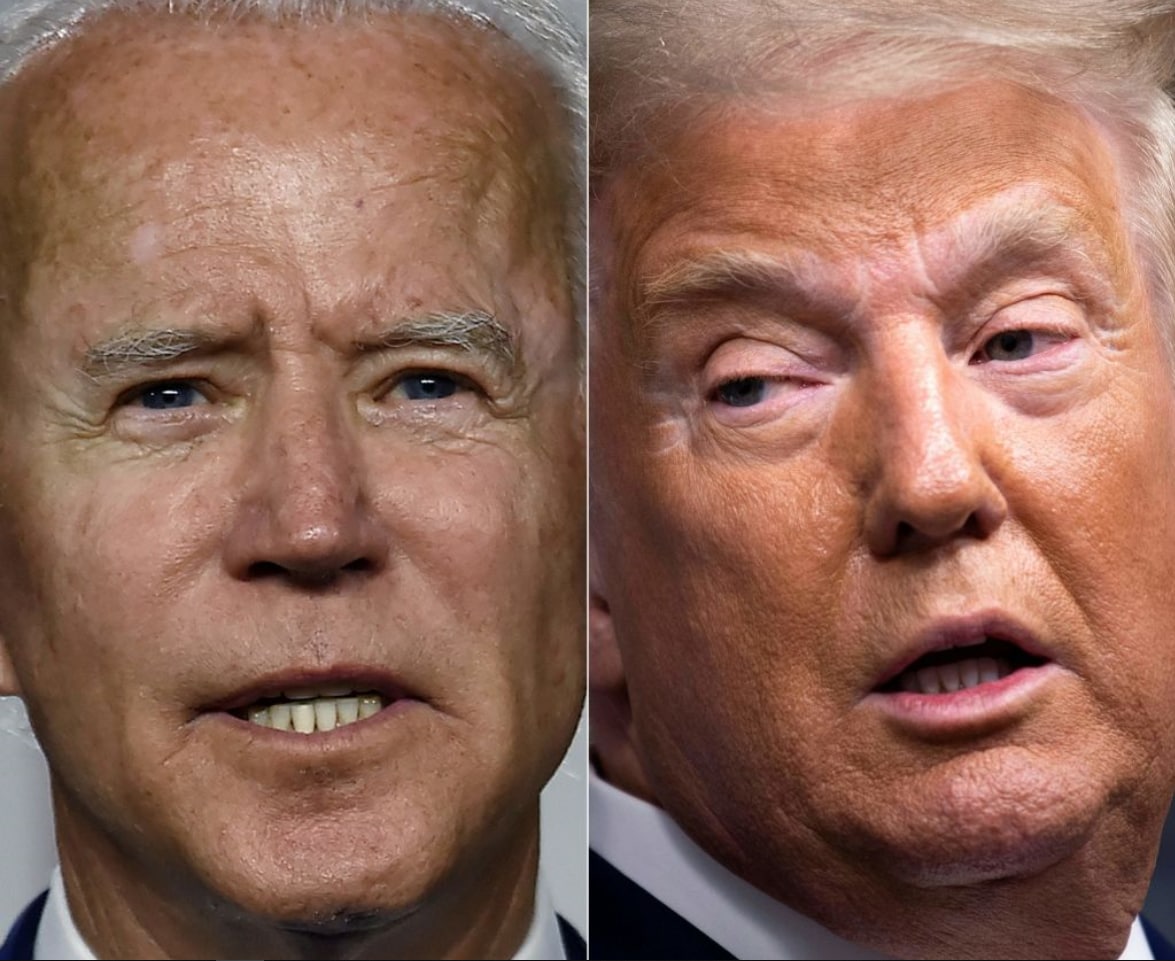

The first US presidential debate between Trump and Biden had kick-started at this time of the writing; stock index futures on the S&P 500 and Nasdaq 100 rose by around +0.3% with gains seen in the key Asian stock markets except for Japan; Japan’s Nikkei 225 (-0.2%), Hong Kong’s Hang Seng Index (+1.7%), China’s CSI 300 (+0.5%) and Singapore’s Straits Times Index (+0.3%).

Chart of the day – Nikkei 225 is tracing out a potential “topping” configuration

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.