Wall Street embraced a huge rebound overnight, paring some losses from the previous week as the world’s most systemically important central banks are ready to ease.

BOJ purchased over 100 billion yen of ETFs yesterday and conducted a second day repo-operation to buy 500 billion yen of Japanese government debt today. The Fed is widely expected to cut interest rate in the upcoming FOMC meeting on 18th March, and the futures market points to a 50bps cut as recession fears ramped up recently.

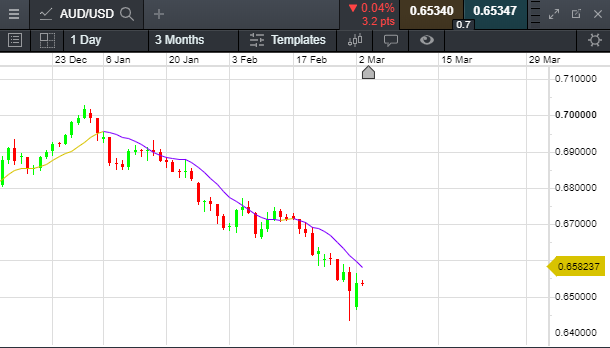

RBA is going to release its interest rate decision at 11:30am Singapore time. The market has seemly priced-in a rate cut scenario given the rapidly deteriorating business sentiment due to coronavirus’s global impact. Futures market priced in 27 bps of cuts to the 0.75% cash rate at the end of Monday, according to Bloomberg. AUD/USD has rebounded along with risk assets overnight, and there is probably little juice for short bets now as a cut decision has more or less been baked-in. In the event of a hold decision, Aussie is likely to strengthen sharply.

S&P 500 index soared 4.61%, lifted by utilities (+5.86%), information technology (+5.70%), consumer staples (+5.48%), real estates (+5.06%) and financials (+4.87%).

Crude oil prices extended a second-day rally as market sentiment improves. Rising oil prices also reflect improved outlook of oil demand, as business activities are gradually back to business as usual in most parts of China. Technically, Brent has found strong support at US$ 51.0 area and since rebounded. Immediate resistance level can be found at US$54.7 and then US$ 57.2 area.

AUD/USD

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.