The Euro has been on a steady climb for the last several months but cracks have started to emerge in the trend at the same time that the ECB may be starting to talk the single currency back down. EUR appears to be reaching a technical tipping point that could be accelerated by this week’s ECB decision and comments

Technicals:

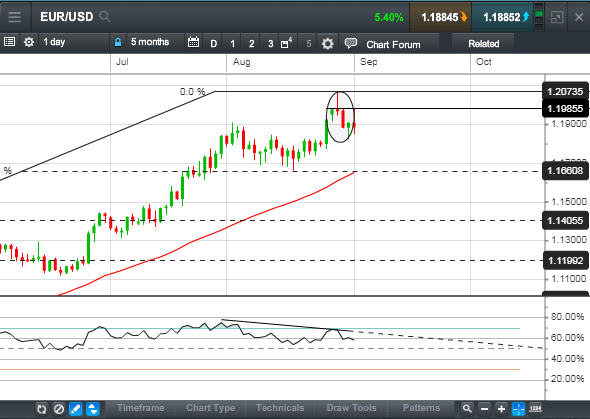

Since the start of 2017, EURUSD has been under steady accumulation, rallying up from $1.0325 to a recent test of $1.2000.

Last week, however, a number of bearish technical signals emerged. A breakout over $1.2000 failed to hold in a buying climax/bull trap/shooting star. This key reversal day arrived in the middle of a bearish Evening Star three day topping pattern.

Adding to the problems, a new high for the pair was not confirmed by the RSI a negative divergence that indicated upward momentum was slowing. On Friday, a second attempt to break though $1.2000 failed and the pair now looks vulnerable to a correction. Next potential support appears near $1,1900 then $1.1830.

Fundamentals:

The Euro’s big rally this year was propelled by a number of factors including:

A retreat in the US Dollar

Anticipation that the ECB would back away from its dovish stance and accelerate tapering back QE stimulus.

Speculation that the EU would hold the upper hand in Brexit talks.

Decreasing political risk concerns after populist forces lost elections in the Netherlands and France.

In the last week, some of these trends have shown signs of reversing. The Evening Star top in the Euro was mirrored by a Morning Star bottom in the US Dollar index, so the USD effect could be about to reverse.

For this week, the ECB may be the most important factor. Just as EURUSD approached $1.2000 for a second time, the ECB announced that a decision on QE tapering would likely come in December, which was viewed as dovish as the street had been expecting an announcement in October. This suggests that the ECB may be starting to get worried about the rising currency and could be set to throw up a wall near $1.2000. This week’s ECB statement and press conference with President Draghi may give a better indication of whether the central bank is thinking enough is enough on allowing the single currency to rise.

This week also could confirm whether we have reached a turning point in EURGBP as well. The Euro has been outperforming the Pound for months but staged a technical reversal at about the same time that ECB negotiators were expressing frustration with the progress of talks. It seems that they thought the UK was going to come to the table grovelling and instead have found out the hard way that the UK is going to be a lot tougher in talks than the EU had considered. Because of this the end result is not going to be as one sided as EUR bulls had thought and not the easy win the EU had been looking for.

CMC Markets is an execution only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

CMC Markets Canada Inc. is a member of the Investment Industry Regulatory Organization of Canada and Member-Canadian Investor Protection Fund / Membre-Fonds canadien de protection des épargnants. CFDs are distributed in Canada by CMC Markets Canada Inc. dealer and agent of CMC Markets UK plc. Trading CFDs and FX involves a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. CMC Markets is an execution only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities.

CFD and FX trading with CMC Markets is only available in jurisdictions in which CMC is registered or exempt from registration, and in Alberta is available to Accredited Investors only. CMC Markets neither solicits nor accepts business or accounts from residents of the United States of America.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.