Just under a year after the UK voted to leave the EU, Brexit talks are finally set to begin on Monday, with the clock ticking towards a March 2019 Brexit date.

There have been a lot of twists and turns over the last year, let alone the last month, which has a number of technical indicators pointing in opposite directions. This week may give a better idea of whether sterling bulls or bears are likely to gain the upper hand going forward..

Technicals

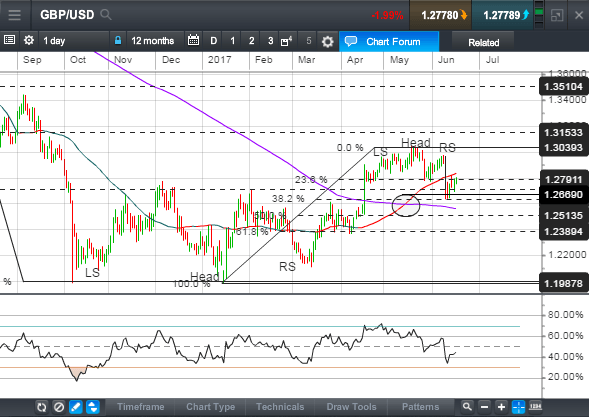

Following last year’s Brexit decision GBP collapsed, but between October and March a head and shoulders base formed. Cable had started to trend back upward until UK prime minister Theresa May called an election, after which a smaller head and shoulders top formed. The election result, which sent the Conservatives scrambling for a coalition, tipped over sterling’s bandwagon but heading into the start of actual face to face negotiations (rather than the threats and posturing in the media over the last year), technical indicators are mixed, suggesting indecision and uncertainty among traders.

Example

Cable completed a head and shoulders base in March, it also completed a smaller head and shoulders top earlier this month.

Cable completed a bullish Golden Cross of the 50-day average over the 200-day average back in May. Since then, the pair has dropped under the 50-day average but is holding above the 200-day average.

The RSI fell under 50 signalling a downturn, but has held 40 indicating a longer term uptrend remains intact.

The pair completed a 38% Fibonacci retracement to $1.2630 and rebounded, but has been unable to reclaim the 23% retracement level near $1.2790.

So what should traders think about all of these conflicting signals? Normally we would go with a clear majority decision but in this case with more or less a 50-50 split, the longer term indicators should be regarded as dominant until broken.

Cable currently finds itself stuck between its 50 and 200-day averages and the 23% and 38% retracements of its January to May uptrend. It’s possible that the pair could bounce around between $1.2560 and $1.2840 or a narrower $1.2635 to $1.2790 in the near term. Whichever way it breaks out of these ranges could set the tone for the longer term with next downside support near the $1.2500 round number and next resistance near $1.2900 then the $1.3000 round number.

Fundamentals

Over the last year (and most likely going forward), sentiment toward sterling has shifted based on what developments have been seen as meaning for the UK’s Brexit negotiating position and the economy.

The initial reaction to the decision to leave, which came as a complete shock to most in the market who had been overly complacent about a remain win, was to listen to EU rhetoric and sell down the pound. The pound’s collapse, however, sowed the seeds for its recovery by handing the UK a currency devaluation money-printing central bankers could only dream of, while igniting the UK economy. As traders gained confidence the UK could thrive outside the EU, sterling recovered through the winter.

The initial reaction to the Conservatives losing their outright majority and having to seek a coalition partner put pressure on the pound once again, but this was short-lived as talks started with Northern Ireland’s Democratic Union Party.

The subsequent rebound indicates that given time to think about it, traders see the election result as a minor setback on the road to Brexit but not a show stopper. A big Conservative win would have strengthened Theresa May's hand and a Labour win (outright or coalition) could have been seen as improving the EU’s hand, but the Conservative coalition result leaves the balance of power pretty much where it was before the election was called. The question now is whether the election has cleared the air for one side or both and if the UK or EU are prepared to compromise to get a deal done or if both sides are prepared to keep butting heads.

It’s normal heading into talks that each side stakes out the most extreme position possible so that they have room to negotiate and compromise. As talks start, we will see if either side is willing to offer any olive branches to get the process going. Some of the key issues that may come up this week include: how far apart are the two sides on the Brexit bill (payments by the UK to meet commitments vs amount owed to the UK for its contribution to existing EU assets), the status of London as Europe’s financial hub and what to do about UK citizens living in the EU and EU citizens living in the UK. These issues and others could set the tone for the talks to come.

In addition to GBP/USD, the start of Brexit talks may also impact trading in UK stocks; the FTSE has tended to trade opposite to GBP since the Brexit vote and has been forming a head and shoulders top of its own. The euro, European indices and the EUR/GBP channel cross may also be impacted this week.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

CMC Markets Canada Inc. is a member of the Investment Industry Regulatory Organization of Canada and Member-Canadian Investor Protection Fund / Membre-Fonds canadien de protection des épargnants. CFDs are distributed in Canada by CMC Markets Canada Inc. dealer and agent of CMC Markets UK plc. Trading CFDs and FX involves a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts.

CMC Markets is an execution-only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities. CFD and FX trading with CMC Markets is only available in jurisdictions in which CMC is registered or exempt from registration, and in Alberta is available to Accredited Investors only. CMC Markets neither solicits nor accepts business or accounts from residents of the United States of America.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.