Driven by big cap technology momentum plays, the NASDAQ 100 staged a stellar performance through the first half of 2017. In the last few days, however, technical indicators have aligned to signal the index may be vulnerable to a significant correction. Earnings reports from Apple and Tesla Motors could save the bull market or become the last hurrah before bears take over.

Technicals:

The NASDAQ 100 not only participated in the big bull market which followed the US election, it has been one of the top performers, capitalizing on the performance of big technology momentum plays like Facebook, Apple, Amazon.com, Netflix and Google, plus Tesla Motors and Nvidia.

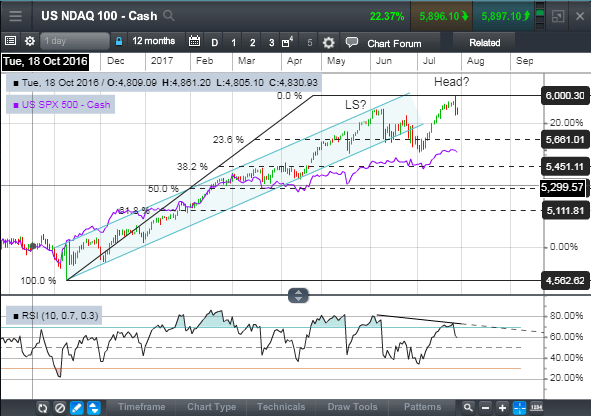

Recently, however, a series of bearish technical signs emerged. The index broke out to a new high last week but after reaching the 6,000 round number, it sold off sharply, staging a bearish key reversal day. This suggests that with 6,000 achieved, earnings season heading into its back half and the weakest plus the most volatile time of the year for stocks looming ahead, some traders have started to take profits.

To make matters worse technically, the new high was not confirmed by the RSI, a negative divergence that indicates weakening upward momentum. At the same time, overbought RSI conditions suggest the advance has been overdone and a correction possible. It’s too early to say for sure but last week’s big bearish reversal may also have been the head of an emerging head and shoulders top.

Initial pullback support has emerged near 5,835 with support tests in a deeper correction possible near 5,800 then 5,660 a 23% retracement of the previous uptrend.

Fundamentals:

Comparing the price line of the chart with the purple line which represents the return on the S&P 500, the NASDAQ advanced farther than its peers in the last few months, leaving it more vulnerable to a deeper selloff in a correction.

Because the NASDAQ moved up so much in recent months, valuations have become stretched and strong earnings have been needed to justify frothy share prices. For the most part, companies have been up to the challenge, but the market reaction has been limited, indicating strong results were already priced in. For example, on the back of very strong earnings, Facebook only gained 3%. On the other hand, disappointing results sent Twitter down 14%. Amazon traders defended $1,000 despite week earnings on higher investment in business growth.

This week two make or break reports are Apple Tuesday evening and Tesla Motors Wednesday evening. In addition to results, comments on upcoming product launches like the iPhone* and Model 3 could attract significant attention from the street.

CMC Markets is an execution only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

CMC Markets Canada Inc. is a member of the Investment Industry Regulatory Organization of Canada and Member-Canadian Investor Protection Fund / Membre-Fonds canadien de protection des épargnants. CFDs are distributed in Canada by CMC Markets Canada Inc. dealer and agent of CMC Markets UK plc. Trading CFDs and FX involves a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. CMC Markets is an execution only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities.

CFD and FX trading with CMC Markets is only available in jurisdictions in which CMC is registered or exempt from registration, and in Alberta is available to Accredited Investors only. CMC Markets neither solicits nor accepts business or accounts from residents of the United States of America.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.