Last month we saw the biggest one day fall in US markets since September last year as concerns about a possible impeachment of US President Trump prompted a bout of significant market nerves.

For some time now there has been concern that the lack of volatility in global markets pointed to a general feeling of complacency amongst market participants about the potential for a big market sell off.

I share this concern, particularly since volatility indicators are at multi year lows, and as an analyst I tend to be a believer in mean reversion.

What this tends to mean that prices or values generally return towards their long term historical average, given time. When these values deviate away by a large enough variable then the more likely they are to snap back aggressively.

This is where we are now with respect to the VIX stock market volatility average in the US, which saw its lowest value since 1993 earlier this month.

While US company earnings have been fairly positive, a lot of the gains seen in the past few months have been predicated on a significant number of promises about US fiscal and tax reform that have as yet been unfulfilled. The risk is that these promises may never come to pass which means that a readjustment in market expectations could prompt a reassessment of asset valuations.

We’ve already seen the valuation in other asset classes start to reassess the likelihood of what the current US administration is likely to deliver and this has created a significant divergence between these markets and the stock market in particular.

The US dollar index which at one point this year was up over 5% on an expectation of a significant fiscal stimulus has given up all of those gains, while US bond markets have seen long term yields do the same thing.

The US 10 year yield which was at one point at 2.6% when the Federal Reserve hiked rates in December is now back around the 2.2% level where it was prior to President Trump’s win, while gold prices which fell sharply after Trump’s win have also bounced back.

The only asset class to have kept the faith in the Trump rally so far has been the stock market which is up over 10%, and still near all-time highs, despite recent sharp sell-offs.

This type of divergence or dislocation is unusual and would suggest that at some point we need to see some form of correction. The biggest problem will be around the timing of any readjustment, and for that we need to heed the words of John Maynard Keynes, “the market can stay irrational longer than you can stay solvent”

In short stock markets may go higher in the short term but a painful correction could well be coming in the weeks ahead, and given the market reaction to a recent research note from Goldman Sachs entitled “Is FANG mispriced” this could come sooner rather than later.

Since the lows of 2009 investors have become accustomed to a “buy the dip” mentality when it comes to buying stocks and in the last three years this has become a reflexive reaction, as investors set aside concerns about valuations and focus more on the momentum side of the market.

This has seen stocks like Facebook, Amazon, Apple, Microsoft and Alphabet account for $600bn worth of stock market gains so far this year.

Looking at these gains over a longer period of time these $600bn worth of gains are small beer when viewed through a lens of a longer period of 7 years, and it is here that the recent momentum starts to look even more inelastic and in danger of snapping back, or at least seeing a pause for breath over an extended period of time.

This is where technical analysis can offer clues on a historical basis as to when a stock price is overextended on a time vs price analysis, when viewed against a long term historical average.

These can act as warning signs to overzealous investors even if they are less precise about timings of a probable reversal.

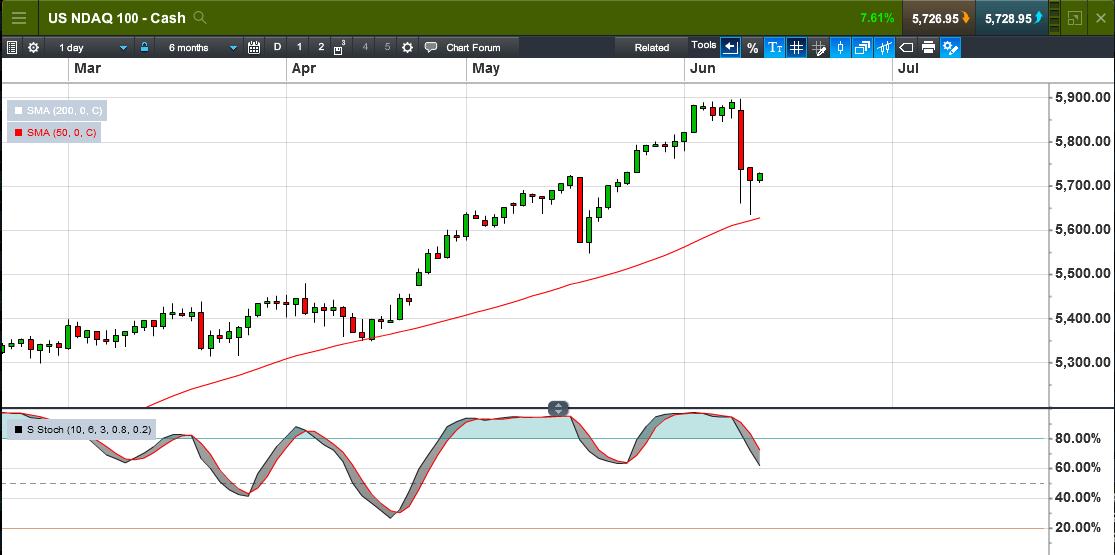

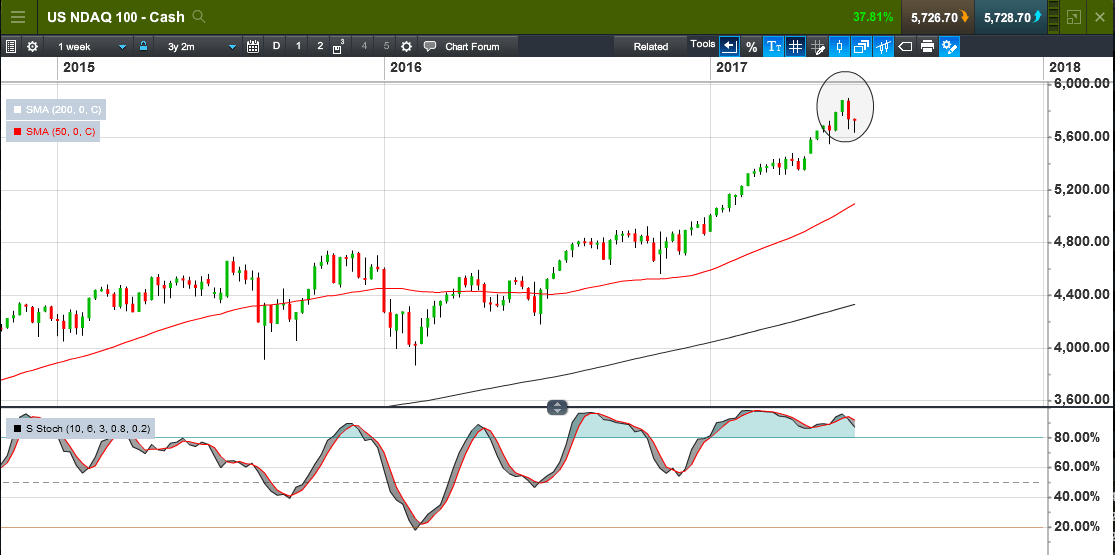

Last week the Nasdaq100 posted a significant weekly reversal of the sort we haven’t seen in some time which suggests that investors are already starting to become a little twitchy.

More importantly the price action is a fair distance away from its long term 200 day moving average, and last week’s falls could see a sharper move lower on a move below the 5,600 level.

Looked at on a weekly chart on a long term basis we can see further evidence of a stretched price action relative to historical long term averages.

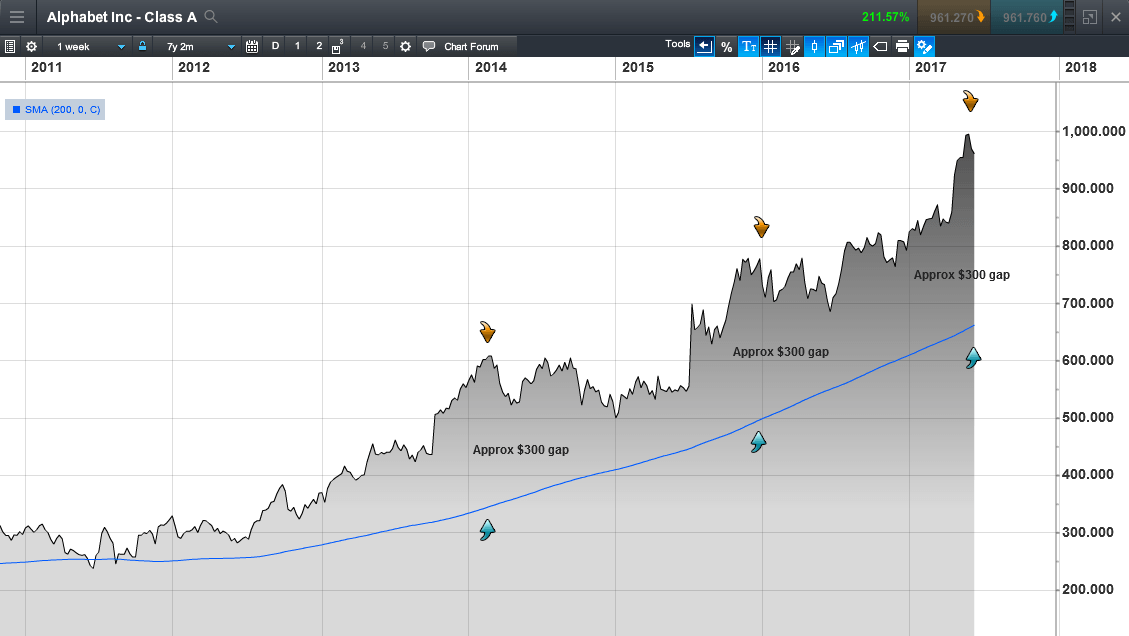

Starting with Google owner Alphabet, since 2011 the share price is up over 200%, however on two different occasions in that period when the price action moved too far away from its 200 week MA a period of consolidation followed.

In 2014 this took the form of a gradual decline, or sideways consolidation for 18 months before a sharp break higher to the peaks in 2015 before a similar sideways consolidation over a 12 month period.

There is a possibility we be about to see the same thing start to happen now, but we should also look for confirmation on other similarly valued stocks.

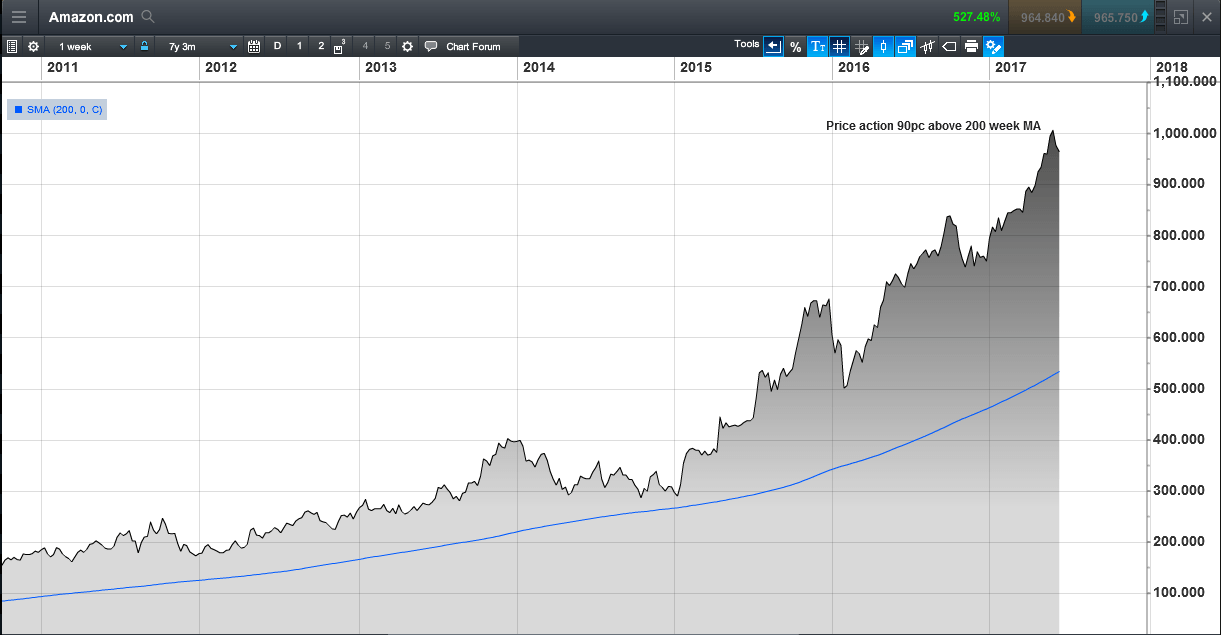

The story for Amazon is a little different trending quite nicely from 2011 until the beginning of 2015, and then the share price moved aggressively higher, so much so that the price action is now 90% above its 200 week MA, and up 527% since the end of 2010.

Quite simply that sort of gap simply isn’t sustainable in the long term which would suggest one of two things needs to happen. Either we get a period of consolidation for about 12-18 months, as the market adjusts to the higher valuation, or we get a sharp correction lower.

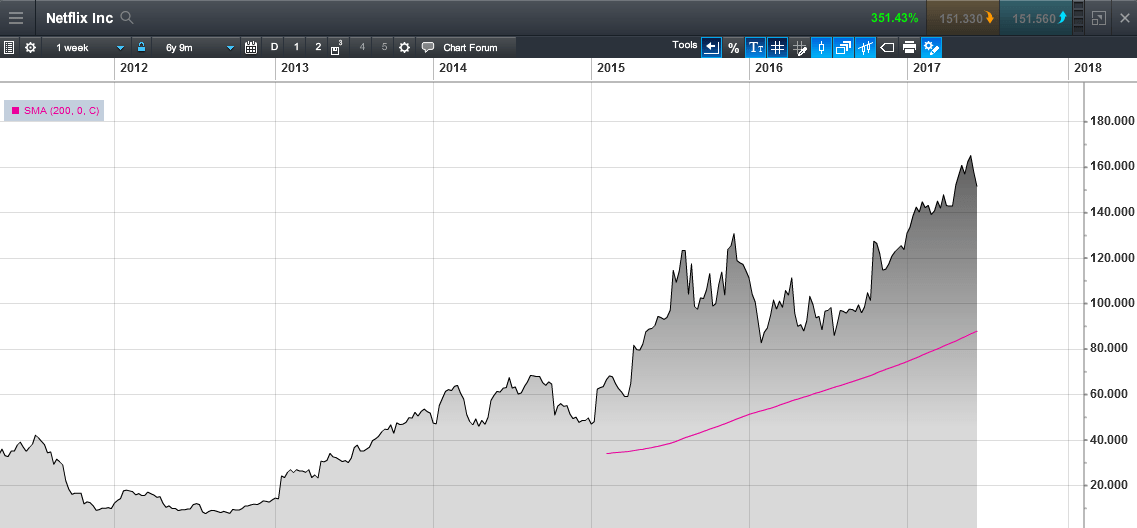

It’s a similar story for Netflix, up 351% since 2011 which trades on a forward earnings multiple of 144, which is similar to Amazon, which means that markets are pricing in much faster and higher growth in the future.

Its share price is also trading well away from its 200 week MA, and as such does appear to look rather stretched.

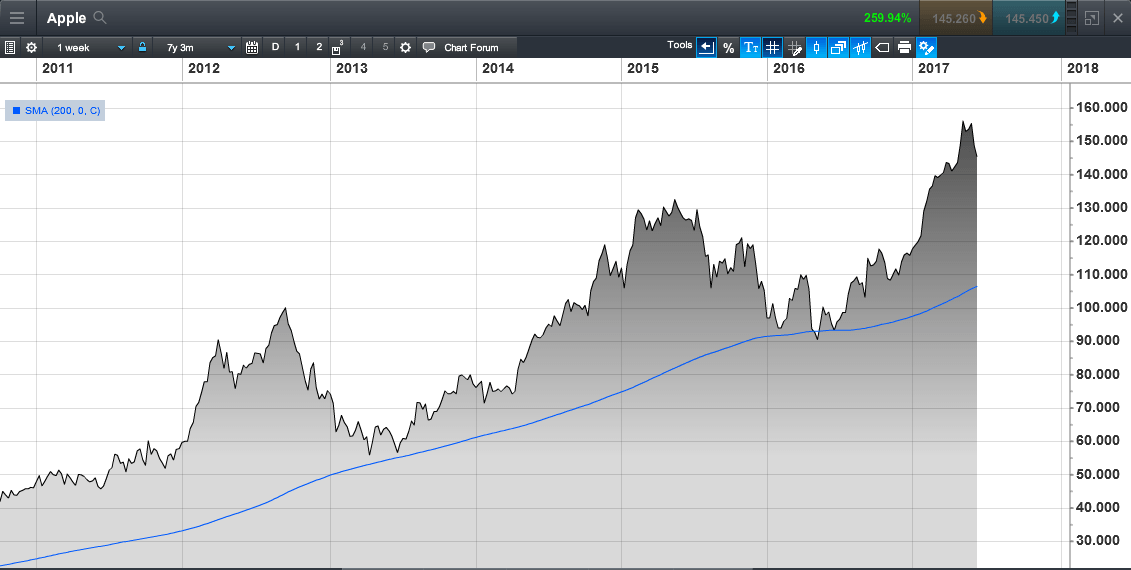

When compared to a more established company like Apple the move higher over the past few years has been much steadier where we’ve seen the share price move higher, in 2011 and 2012 before slipping back towards its long term average, before moving back higher again in mid-2013, peaking in 2015, before moving back lower again into 2016.

In 2016 we once again found support before the rally up to today’s current peaks, where we once again look a little overextended, and ripe for a correction.

A common theme of all of these charts has been how the price action has moved way beyond their long term averages. What these charts don’t tell us is whether the companies are overvalued or undervalued on a relative basis.

They simply tell us that in the context of historical norms the move higher has happened too quickly, and become overextended, and is at risk of a slowdown or a sharp correction.

A good proportion of the gains in the S&P500 has been as a result of the gains in these big beast stocks over the course of the past 12 months.

Furthermore only two of these stocks pay a dividend, Microsoft 2.2% and Apple 1.7%, which while OK, is still a small return for two companies that can see peak to trough declines of between 15% and 25% in the share price when they do correct lower.

CMC Markets is an execution only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.