When we looked at the banking sector back in July, there was little prospect that things would improve as we headed into the second half of the year.

The major US banks had already set aside $32bn in loan loss provision in Q1, and they followed that up with another $41bn in Q2, as the virus continued to burn across the US.

The overall loan loss figures are much higher than this if the entire US banking sector is included, but nonetheless the direction of travel was clear. Bank balance sheets were likely to remain under pressure in the weeks and months ahead, not only in the US, but across the UK and Europe as well.

While coronavirus cases in the US appeared to have plateaued in September, they are now starting to rise again, while the same cannot be said for the UK and Europe where after a summer hiatus infection rates are now starting to rise exponentially, though some parts of the UK have seen a higher prevalence than others.

In July the S&P500 had yet to recover its year to date losses and while it now appears to have done so, there is no guarantee that it will be able to hang onto these gains as we head towards next week’s November Presidential election, and a chill winter of discontent as lockdown restrictions get reimposed across the US, Europe and the UK.

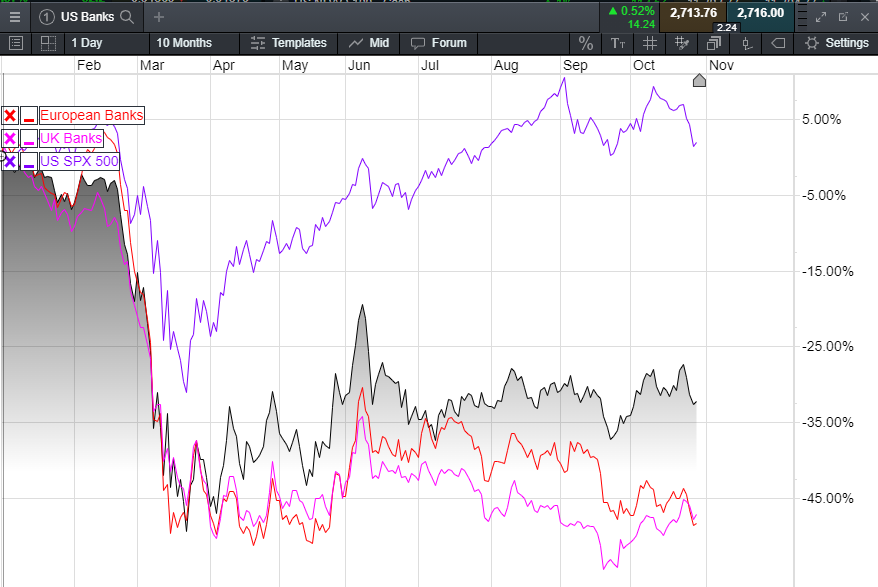

With respect to the share price performance of US, UK and European banks since July there has been remarkably little variation in terms of the overall share price performance.

The banking sector overall has been a serial drag on all of the major indices, with the S&P500 only recently moving into positive territory year to date, and to new record highs, while the CMC Markets US banking basket is down just over 30%, which is a slight improvement on its July levels of -35%.

One shouldn’t read too much into this similar performance given that US banks have come down from a much higher baseline, but the declines do nonetheless highlight where the pressures lie when it comes to the weak points in the global economy, as rising unemployment puts upward pressure on possible loan default rates.

In terms of loan loss default provision in Q3, the set asides appear to be slowing down, after US banks pared back their provisions quite sharply, which seems odd given that the uncertainty around the US election, and the lack of new stimulus, suggests that things could well get a lot worse before they get better, even if weekly jobless claims have continued to decline since the $600 stimulus check aid finished at the end of July.

With $73bn set aside in H1, in Q3 these bank loan loss provisions slipped back sharply to $5.4bn, with Citigroup accounting for $2.3bn of that, while JPMorgan Chase set aside $611m, well below the $10.5bn it set aside in Q2.

This slowdown in provisioning would appear to suggest that the major US banks think the worst is behind them, and certainly recent economic data would appear to suggest that, however there is also a concern that the US economy may well already in a so called “Wile E Coyote” moment, with an uncertain outcome from next month’s Presidential election a possible catalyst for a sharp drop.

The slowdown in provisioning is also strange given that the Federal Reserve once again extended its curbs on US banks dividend payments and buybacks until the end of the year. The Fed said it wanted US banks to maintain a high level of capital resilience after summer stress tests suggested that banks could be exposed to up to $700bn of loan losses in a worst-case scenario.

It is highly likely that these dividend and buyback restrictions will get extended once more as we head towards 2021, as another wave of infections prevents any sort of escape velocity for economic activity.

UK authorities have also made significant strides in addressing the resilience of its own banking sector, though unlike the US, we do still have one big UK bank in the hands of the taxpayer in the form of the newly renamed NatWest Group, while the others have been left to fend for the scraps in fairly low margin banking services of mortgages, loans and credit cards.

One big mistake, UK policymakers did make was forcing a lot of UK banks to curtail their trading operations in the wake of the financial crisis in the mistaken belief that it was everyday so-called casino investment banking that caused the crisis, rather than the financial jiggery pokery of the packaging and repackaging of CDO’s of mortgage, and other risky securities.

This is now playing out in the relative performance of the share prices of NatWest Group, Lloyds Banking Group, Barclays and HSBC, where we’ve also seen enormous provisions in respect of non-performing loans.

So far this year we’ve seen Lloyds Banking Group set aside £4.1bn in respect of bad loans, with an expectation that this will come in at the lower end of £4.5bn to £5.5bn by the end of this year.

NatWest Group numbers painted a similar picture, having posted impairments of £801m in Q1, and an attributable profit of £288m, the bank posted Q2 impairments of over £2bn. The bank said it expectsfull year impairments of between £3.5bn and £4.5bn.

As for Barclays they set aside a Q2 impairment charge of £1.6bn, on top of the £2.1bn it set aside in Q1, making a total of £3.7bn compared to £900m a year ago. In Q3 this was increased by another £608m taking the total provision to £4.3bn, however the bank was slightly more optimistic about the future in terms that provisions were likely to be much lower in the second half of the year.

While all three of these UK banks are acutely vulnerable to widespread consumer defaults, along with HSBC, at least HSBC and Barclays have other revenue streams from their investment bank and overseas operations.

This has certainly helped Barclays which has seen its investment division start to perform better than expected in recent quarters, which in turn has helped it in respect of any underperformance in its domestic retail operations.

As for HSBC, they set aside £5.3bn in H1 in respect of non-performing loans, and said at the time that this could rise by another £5bn over the rest of the year, as it wrestles with its own restructuring plan, as well as walking a perilous tightrope between its China business, and its UK and US businesses.

In their most recent Q3 numbers they posited a slightly more positive outlook, saying that loan losses could well come in at the lower end of expectations for the full year, which is encouraging, however that also assumes no new deterioration in outlook as we head into winter.

Given recent events and the direction of travel with respect to the virus his view looks rather optimistic which suggests that talk of dividends being resumed at the end of Q4, is rather premature, and could well be blocked in any case by the Prudential Regulation Authority.

European Banks

In Europe, authorities there have been fewer strides made in implementing the necessary processes to improve resilience here, with the end result that the banking sector in the euro area is still sitting on very unstable foundations with trillions of euros of non-performing loans, and several banks in the region one large economic shock away from a possible collapse.

Spain’s Santander has been a notable standout in this regard, when they wrote down the value of their UK operation by €6bn and slumped to a €11bn loss, while setting aside €6.6bn in respect of non-performing loans in the first half of this year, and another €2.54bn in Q3.

Another Spanish bank, BBVA has also taken steps to address the upcoming economic tsunami facing the European banking sector, by setting aside €4bn so far this year.

The biggest components of the CMC European Banks share basket are comprised of BBVA, Santander, Societe Generale, ING and BNP Paribas, yet it is notable that it is the Spanish banks who appear ahead of the curve on loan provision, while the rest of the big banks in the European banking sector appear to have set aside less than €20bn between them, so far year to date.

The rest of the sector in Europe appears to be ill-prepared for a significant rise in credit losses, and while some of these banks are in much better shape than they were five years ago, there still seems an awful lot of complacency amongst European bank CEO’s, despite the weakness being seen in their share prices, and the likelihood that more economic pain is about to come their way in the form of a second wave, with Germany, France, Italy and Spain imposing ever more stricter conditions.

As if to underline some of the complacency over non-performing loans Germany’s biggest bank Deutsche Bank has set aside a pitiful €761m this year in respect of loan defaults at a time when the German economy has just gone into a one-month partial lockdown, following on from the total lockdown seen in March, April. Let’s hope this complacency doesn’t come back and bite it hard.

A recent survey outlined the scale of the problem in Europe with estimates that over half of Europe’s small and medium sized business could face bankruptcy next year if revenues don’t pick up. One in five companies in Italy and France anticipate filing for bankruptcy within 6 months according to a survey conducted by McKinsey and Co in August of 2,200 SME’s. Coming on top of the problems in the region already, this is likely to be a catastrophe unless EU leaders step up to the plate with a rescue plan.

Nowhere is that better illustrated than in the various CMC Markets share banking baskets so far this year.

Banking Sector Comparison YTD

Source: CMC Markets

Despite their fairly lofty valuations the share price losses for US banks have seen a much better recovery from the March lows than has been the case with its UK and European counterparts.

This has probably been as a result of recent optimism over the rebound in US economic data, however the recovery also needs to be set into the context of the wider picture that US banks are well above their post financial crisis lows, whereas their European and UK counterparts are not.

Another reason for this outperformance on the part of US banks (black line) is they still, just about, operate in a largely positive interest rate environment, and also have large fixed income and trading operations, which are able to supplement the tighter margins of general retail banking. They have also taken more aggressive steps to bolster their balance sheets against significant levels of loan defaults.

It’s also notable that UK banks have also underperformed, and some of this may well be down to concerns about a looming no deal Brexit, as well as concerns that the Bank of England may well go down the potentially destructive negative rates route.

This refusal to rule out the prospect of negative rates has had the effect of further suppressing UK gilt yields pushing both the 2 year and 5-year yield into negative territory, and eroding the ability of banks to generate a return in their everyday retail operations.

It is becoming slowly understood that negative rates have the capacity to do enormous damage to not only the bank’s overall profitability, but there is also little evidence that they can stimulate demand. If they did Japan, Switzerland and Europe would be booming, and they aren’t.

In conclusion the various CMC Share baskets give the ability for the user to diversify their risk exposure across a wide range of sectors, by either spreading the risk of exposure across a wide range of assets, or alternatively acting as a hedge to an underlying long position.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.