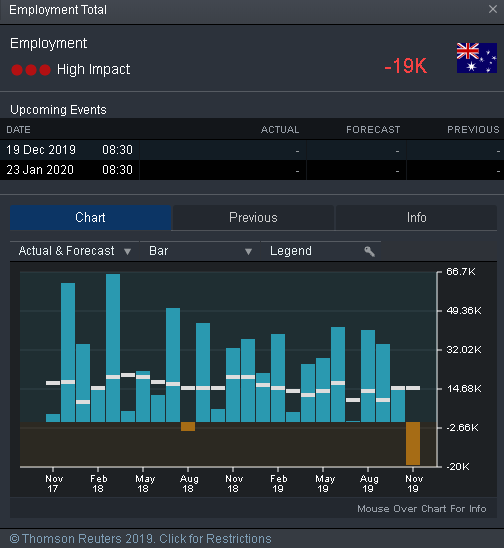

Disappointing jobs data sent the AUD/USD 36 pips lower, to 0.680 area. Monthly change in total employment dropped to 19k, marking its worst reading in over three years.

The number is also far below the market forecast of a 15k increase in jobs. The unemployment rate remains unchanged at 5.3%.

The big question will be, is this a one-time miss or going to be a persisting issue? As the global cyclical slowdown deepens and external demand softens, the Reserve Bank of Australia (RBA) will probably have to extend further support to the economy by lowering interest rates. It has already cut down rates three times this year to a record low of 0.75%.

Technically, AUD/USD is testing a key support level at around 0.680 area, breaking below which will lead to further downside towards 0.678.

Asian markets are set to open mixed today. Traders tend to stay on the side-lines while waiting for fresh catalysts from trades and Hong Kong. The overall sentiment is still dampened by uncertainties surrounding these two issues.

President Trump said, “We are close, a significant phase one deal could happen, could happen soon” at the Economic Club of New York yesterday and he also threatened that “If we don’t make a deal, we are going to substantially raise those tariffs.”

The S&P 500 closed flat last night at 3,093 points as investors stroke a careful balance between trade uncertainties and upbeat earnings season. Technically, the S&P 500 is staying in an upward trend and its immediate resistance can be found at around 3,107 points (100% Fibonacci Extension).

Australia – change in unemployment

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.