Analysts are raising concerns that Covid-related lockdowns extending from Shanghai into Beijing will further disrupt supply chains, industry production, commodities demand and hit China’s gross domestic product growth.

The prospect of extending lockdowns across the world’s second-largest economy rattled markets across the region on Tuesday, with Australia’s S&P/ASX 200 down 2.2% at the open. By the close, the ASX 200 was down 2.1% at 7318. Materials, down 5%, and Energy, down 4%, were the biggest drags on the index, Mineral Resources down more than 10% during the day, BlueScope dropping 9% and South32 down 8.9% intraday.

Woodside lost 4.7% and Santos was 4% lower after oil prices dropped further overnight.

Mining & Energy shares together are the second-largest group of stocks by market cap on the ASX and therefore any impact on these sectors will effect the overall index. Fears of another Shanghai-type lockdown in the Chinese capital, Beijing, began after mass Covid testing started in the region and prompted a major sell off in commodities.

China is a major customer for Australian resources, particularly for iron ore producers Fortescue, BHP and Rio Tinto.

Markets across Asia were mixed, with Australia, Singapore and New Zealand all lower. The NZX 50 closed 0.8% lower. US equity futures are heading lower.

Overnight, WTI crude futures fell 3.38%, to US$98.62 per barrel and Brent futures were down 2.40%, to US$102.17 per barrel. However, both have now recovered and trading at 0.80% & 1.10% higher respectively. Investors are concerned about global energy demand given the Chinese lockdowns and also moves to raise interest rates in the US.

Morgan Stanley has lifted its oil price forecast for the second half of 2022 amid heightened fears of a supply shortfall flowing from Russia and Iran, according to The Australian. In a research note, the bank explains that while oil demand projections have softened in recent weeks, there is now a “high risk” that the European Union will impose an import embargo on Russian crude. The emerging supply deficit has resulted in analysts raising their third and fourth quarter estimates for global benchmark Brent crude by $US10, to $US130 and $US120 respectively.

Precious metals continued to fall against a stronger US dollar and bond yields. Spot gold is trading at US$1,903 after a 1.50% drop since Monday to a low of US$1,892. Silver slumped 2.35% to US$23.69 per ounce, a 2-month low but has now recovered to US$23.90 (1.10%).

The Australian dollar has weakened over the past few sessions, trading just above US72c, compared with the start of April when the currency briefly traded above US76c.

AUD/USD US72.09c

WTI currently US$99.62 a barrel

Brent crude oil US$103.92 a barrel

Spot gold US$1902.79 an ounce

Bitcoin US$40,458

CMC Markets APAC & Canada Analyst Azeem Sheriff has provided today's technical analysis:

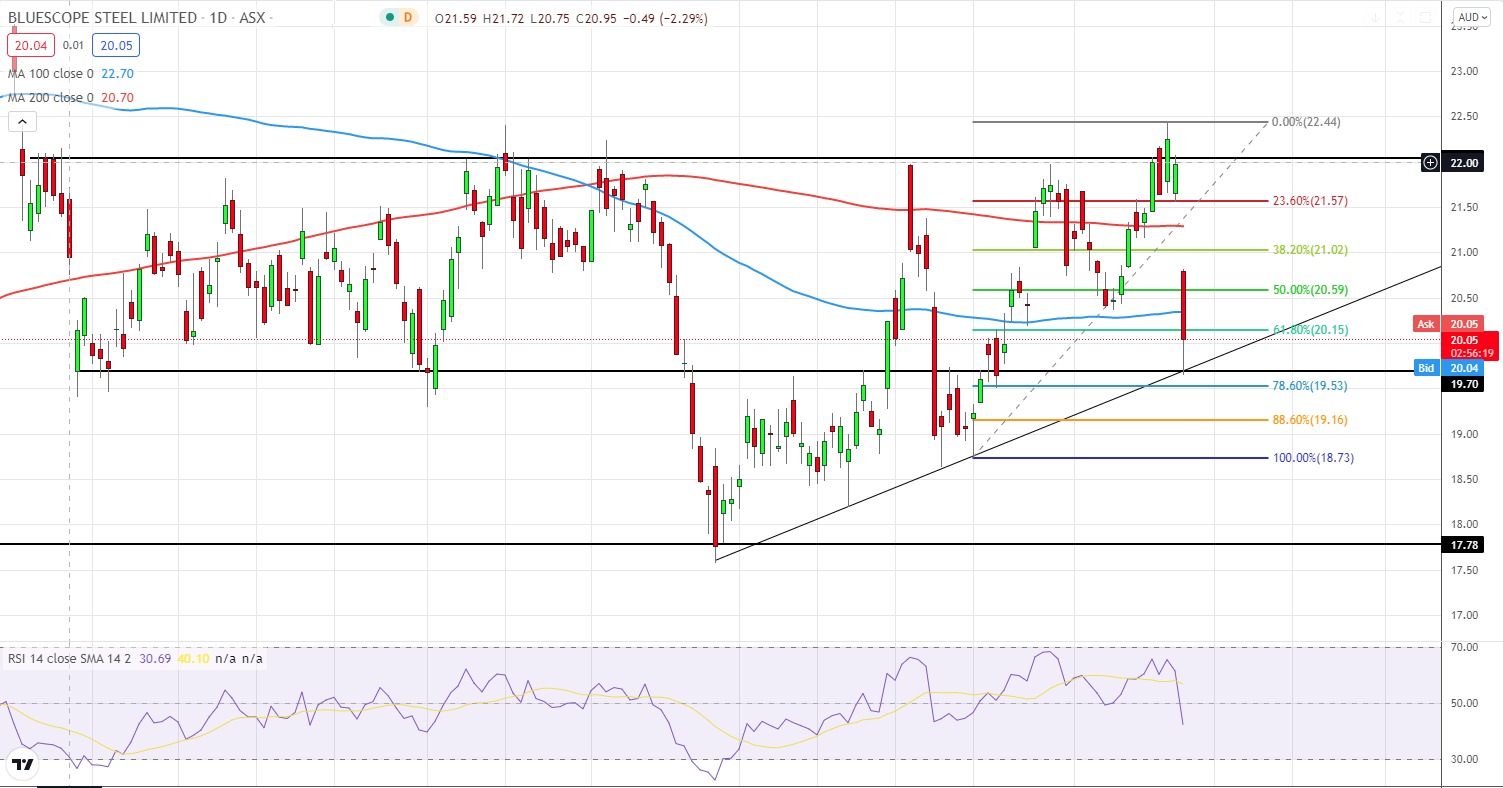

Technical Strategy (26 April 2022) – BSL (Bluescope Steel) (1m forecast – short term)

BSL Daily Chart

Technical Analysis:

Key Technical Elements

- Rebound off an ascending trendline (5th touch over last 4 months)

- Rebound off key support level at $19.70

- Price to hover around key pivot level of $20.50

- Price ranging (consolidating) between $22 key resistance & $19 key support since Sept ’21.

- 100 & 200 day EMAs remain flat with no directional bias.

- RSI entering into oversold territory.

- Waiting for the close around the 61.8% & 78.6% fib levels to confirm retrace.

- Overall, potential bullish bias based on above technicals, playing the range.

Key Price Levels

- Resistance 2 @ $23.10

- Resistance 1 @ $22

- Support 1 @ $19.70

- Support 2 @ $17.80

Time stamped: 26 Apr 2022 at 1:30pm AEST

Source: TradingView

Disclaimer: This is not investing advice and should be read as general information.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.