Dan Zanger has never worked for a big hedge fund or on a trading floor. He’s never been an analyst or investment manager and doesn’t have a university degree.

The only training he has in picking stocks was gained from attending seminars by Investor's Business Daily founder William J O'Neil in the mid-1980s.

Yet Zanger holds the world record for making the biggest gains of any trader in a one year period — an increase of 29,233% — as well as in an 18-month period, having turned $10,750 into more than $18m in the run-up to the dotcom bubble.

29,233%

Zanger's gains in 1 year - the current world record

“The $18m figure was simply the highest amount I could get audited,” he says. “The real figure was over $40m.”

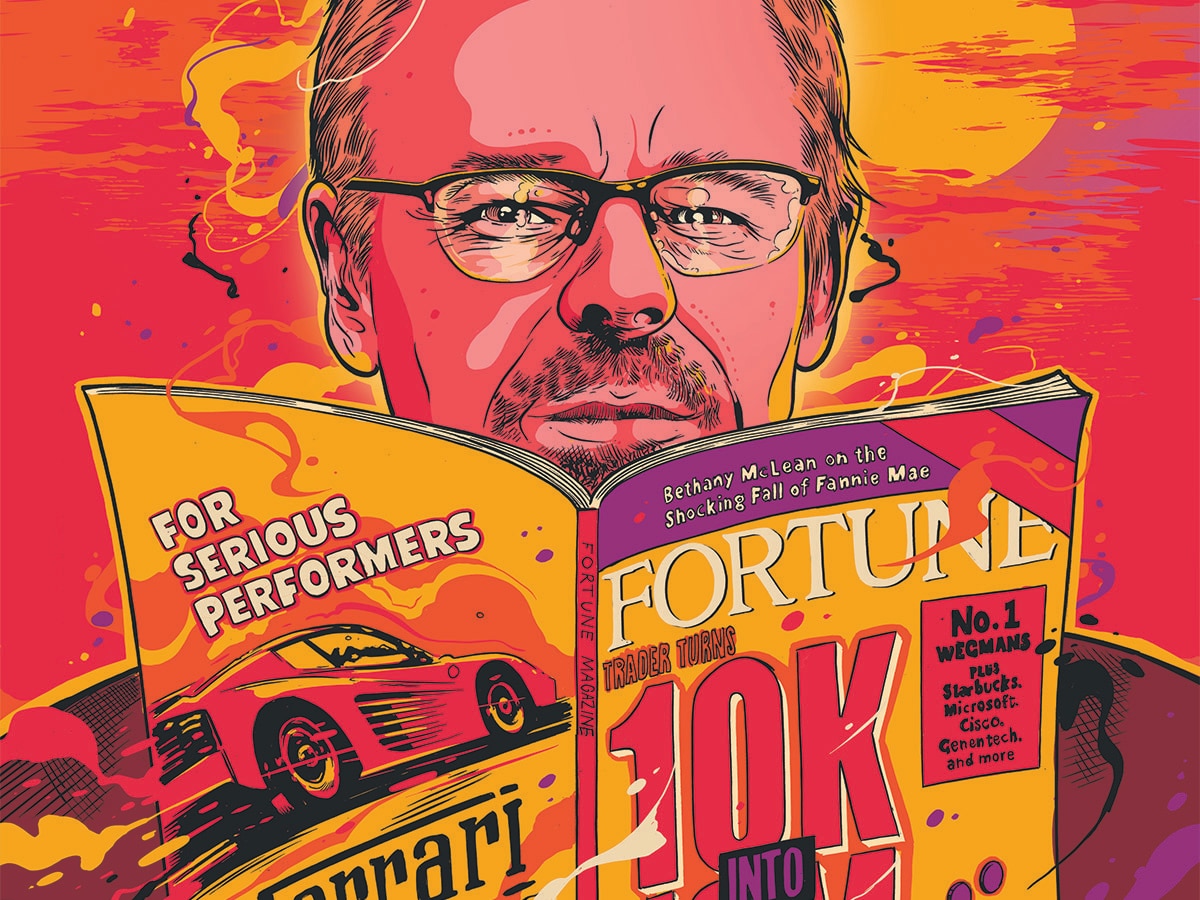

The furore surrounding his success propelled Zanger from a swimming pool contractor to big-name trader. It earned him his own weekly television show on the LA Business Channel and a glowing profile feature in the December 2000 issue of Fortune.

While it was a time of monumental market gains, the Fortune article pointed out just how rare this was.

“We've all met a Dan Zanger — or 20: the guy at work who won't shut up about how he's whipping every fund manager on the planet with his tech portfolio … The only difference? Zanger appears to be telling the truth. His 1999 tax return and trading records show capital gains of $14,232,878 … No one was able to equal Zanger's universe-beating numbers.”

Zanger hasn’t stopped there. He continues to trade, having found further success after the dotcom bubble and financial crisis periods. But his career hasn’t always been a success.

More than half of his account was wiped out during “brutal” corrections more than once, each time trading his way out of the bottom he found himself in.

Here, Zanger candidly talks Opto through his biggest successes — and failures — and the tricks of the trade these experiences have taught him.

I look for stocks with high trading volume and spectacular earnings that can lead to sustained rallies.

The high volume allows me to buy a large amount of stock without the worry of being able to offload them.

It takes 30,000–50,000 shares or more before I'm really starting to load up. Plus, when volume starts to dry up, it’s a good indicator that the stock is set to drop and it’s time to start reducing.

Volume doesn’t work alone because you can have a lot of volume without the stock going anywhere, it’s just churning.

I'm looking for stocks that have a lot of volume and can go places. Apple [AAPL] and Facebook [FB] are good examples of these types of opportunities in a post-financial crisis.

“I'm looking for stocks that have a lot of volume and can go places. Apple [AAPL] and Facebook [FB] are good examples of these types of opportunities in a post-financial crisis”

Apple is very liquid and has had spectacular earnings. Its P/E was around 10 when I bought it. I don't know how anybody could not back up the truck on that one and load it all up.

Right after Facebook went public in 2012, its share price collapsed. It bottomed out and then started to chip away, leading to spectacular earnings in July 2013 and it gapped up from $26 to $35.

At the time volume was around 15 million to 20 million shares a day, so it wasn’t an issue to accumulate 350,000 shares — the stock just kept going and I couldn’t get enough. I sold at around $60. Of course, I should have stayed longer, but I'll take it.

After a stock has had a long run of six to 10 months, volume starts to dry up.

There’s very few high-level buyers left. Now all the stock the existing big buyers hold can become ammunition.

If they suddenly dump it and trigger a domino effect with the price falling there will be no one to buy the large volume of stock you own, and you get trapped.

And each time you’re able to make a sale, the price of the stock may drop $0.50 or $1. You know you're in trouble when the price of the stock drops in reaction to your sale.

“You know you're in trouble when the price of the stock drops in reaction to your sale”

I always have an eye on where the next correction could be.

It took going through a couple of brutal corrections to work out how to spot when one’s coming. For me, it’s when a lot of junk stocks you’ve never heard of start making big moves.

That's a very frothy market. When that happens it usually means that the market is topped out and getting ready to make a nice sized correction.

“It took going through a couple of brutal corrections to work out how to spot when one’s coming. For me, it’s when a lot of junk stocks you’ve never heard of start making big moves”

When I first started trading the markets in the early 1990s, everything was going up. I was pretty happy with myself and thought: ‘This is pretty cool, this is the life for me.’

Unfortunately, I had never been through a correction with money in the game. When it came it almost cleaned me out. My $440,000 was cut to $230,000 in a couple of weeks.

That was a hard lesson, a very depressing, brutal experience. I was already spending the money in my head, I had a Ferrari picked out, I thought I was going to buy a house in Beverly Hills. The fantasies took over my rationale.

In 1995, the market started taking off again, but I just couldn’t get going. Then there was a mini-crash in October 1997 and I was completely wiped out. My account went below zero.

These corrections are brutal, man. When they come quick and you’re leveraged, you get cleaned out.

I sold my car to raise some capital and get back into the market.

I said to myself, these bastards will never get me again. By the time the tech bubble burst I was up over $40m and I was ready for it this time — I could see it coming.

I shorted Amazon [AMZN] in December 1999 and it promptly plunged. Then I shorted Yahoo and it promptly plunged. The list goes on.

After the bubble completely burst on 10 March 2000 I calculated that the market was ready to bounce back led by the fibre optic and telecommunications stocks at the start of October 2000.

I loaded up. Then (the now-defunct) Nortel Networks, an industry leader, forecast weaker than expected earnings. That news story sent the whole industry down overnight.

I lost more than 50% of my account. This time the crash was caused by something that was hard to foresee: a news story that was able to cause a very fast domino effect because everyone was still on edge from the dotcom bubble.

I look for stocks that have the chance to dominate their space.

That was a key aspect of stocks I picked after the dotcom bubble including Google [GOOGL], Baidu [BIDU] and Taser [now called Axon, AAXN].

It’s also what drove momentum in the stocks I picked in the run-up to the bubble. These things would be doubling, tripling in two days, one after another.

The moves were just staggering … Qualcomm [QCOM], CMGI [now called Steel Connect, STCN], Amazon, Yahoo.

Charts are my first port of call. I use two charting programs, of which I have 800 to 1,200 stocks in each. I go through them manually two or three times a week. I'm looking for specific patterns.

If a stock has a really good pattern but I don't know a whole lot about it, then I'll go into the earnings.

“If a stock has a really good pattern but I don't know a whole lot about it, then I'll go into the earnings”

The ‘cup and handle’ has been one of my favourite patterns over the past 25 years.

The start of the handle needs to be up near old highs, not halfway to old highs. You can't have a cup that’s halfway on one side and all the way up on the other side.

I wouldn't touch it, I'll leave that to the rookies. Typically, the stock won't go anywhere or it will fail and go lower.

Things can change very quickly.

Once I sold a load of Google stock because it was the only thing up on a very bad day in the market and I thought surely it’s got to plunge soon.

I sold it, went to the bathroom and it was down dramatically when I came back — somebody had put earnings up on the Google website by mistake. They had missed on everything.

My biggest single trade was a short on eBay.

In January 2005, eBay [EBAY] was breaking horizontal channels left and right. Running into earnings, I did something I don’t normally do — I made a trade before the report came out, shorting 160,000 shares.

It missed. It was having problems getting traction in China. The stock gapped down $20 on me — a $3.2m gain in 20 minutes.

I started covering pretty quick. It kept going down, but you need to know when to take profits. When it’s a popular stock there’s normally a vicious snapback because people see it as being on sale.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy