One of the main advantages in tracking options flow – which refers to the instruments used to gather insights on the price movements of a security – is noticing themes within industry groups.

Over the last few weeks, it has become clear traders are positioning for some considerable upside in Q4 and into 2020 for the top videogame publishers: Electronic Arts [EA], Take-Two Interactive [TTWO] and Activision Blizzard [ATVI].

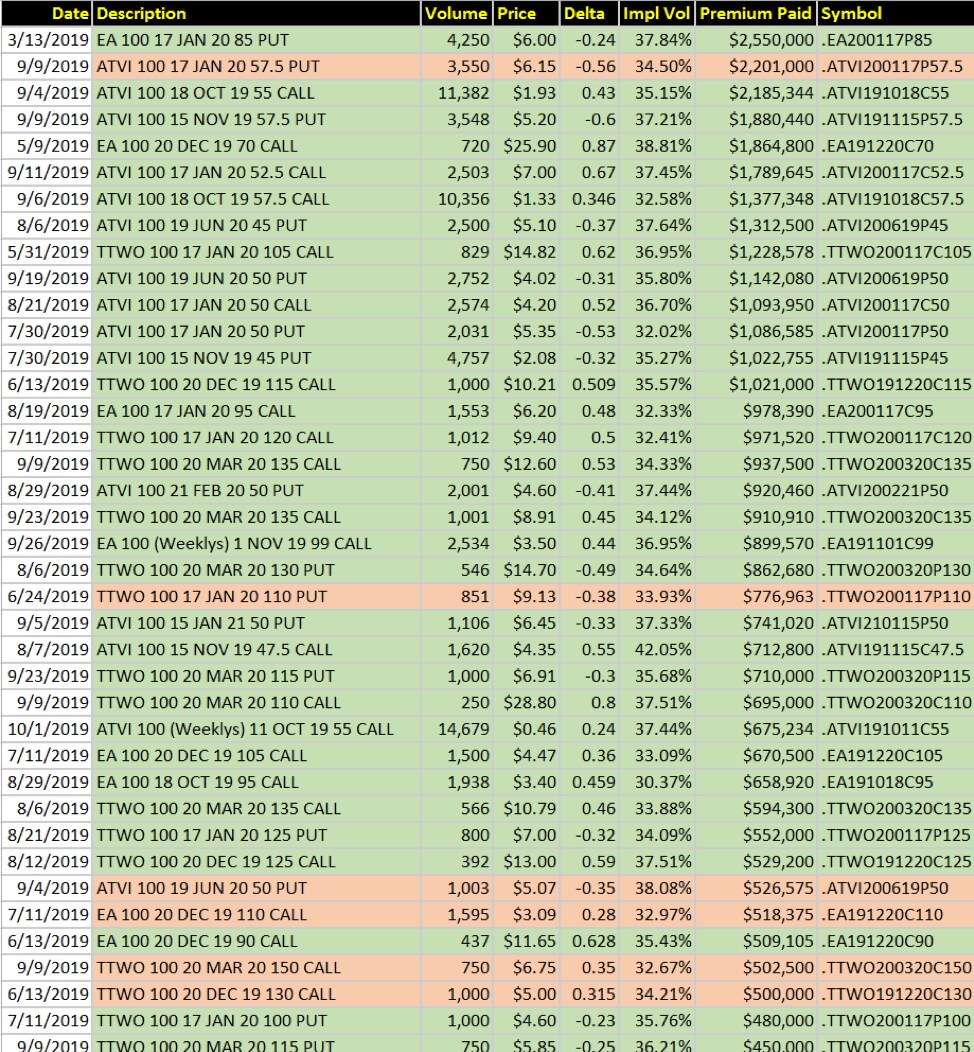

Below is a snapshot of the activity of each stock taken from the Options Hawk “notables database”. The colour green indicates a bullish stance, which could either specify calling a buy or opening a put (a put is a stock market device that gives the owner the right to sell an asset) sale on the stock, and vice versa for the colour red.

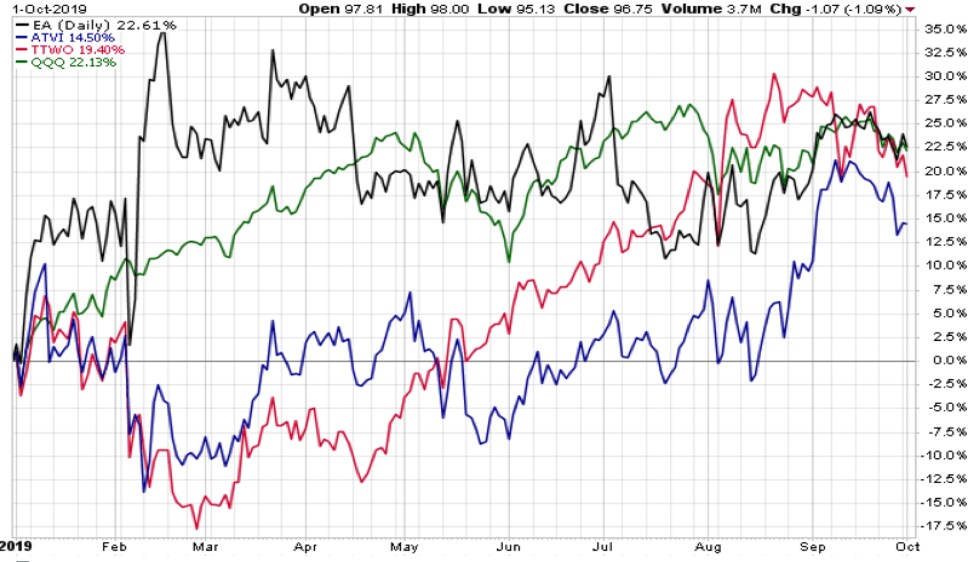

In terms of each stock’s performance year-to-date, we can see that both Electronic Arts and Take-Two Interactive are tracking in-line with the Nasdaq, while Activision Blizzard has lagged behind some.

Their paths have varied throughout the year so far, with EA starting the year strong but it has since consolidated, while both Activision Blizzard and Take-Two have started to gain momentum in Q3. See the chart below, courtesy of Stockcharts.com.

EA: an attractive value bet

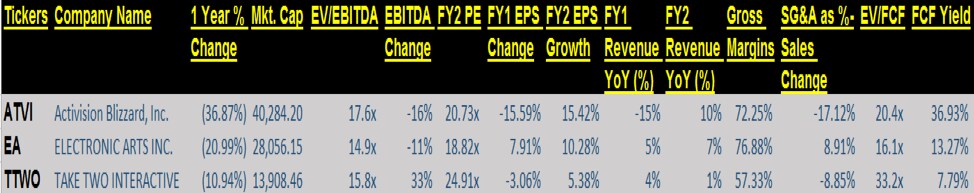

Looking at the fundamentals of this group, EA is trading at the cheapest valuation on EV/EBITDA, EV/FCF and P/E, while having the best gross margins of the group. EA also has the steadiest revenue and EPS growth outlook of the group.

On valuation, EA is the most attractive and trading at the midpoint of its five-year EV/EBITDA range of 10-20 times. With earnings season ahead, it is important to be aware of upcoming earnings announcement dates: EA is expected to report on 29 October, with both Activision Blizzard and Take-Two Interactive due to report on the same day, 7 November.

Mobile game developers show strong growth

US game developer Zynga [ZNGA] is another play in the group, however, it is not involved in console games and is focused more on mobile.

Zynga trades at a higher valuation of 21.5 times earnings and 20.3 times EV/EBITDA with gross margins around 70%.

The game developer has recently launched new titles such as 'Empires & Puzzles' and 'Merge Dragons!' with three new releases expected later this year.

It’s also seeing much stronger growth than its peers and with a small (against its peers) $5.6bn market cap, it could become a desirable M&A target. Zynga has also seen significant options positioning, including 10,000 $5 calls in December, 10,000 $6 calls in March and 35,000 $7 calls in January all placed in open interest as well as longer dated 35,000 $10 calls for January 2021, which were also bought in open interest.

Glu Mobile [GLUU] is another developer of mobile games. It’s the smallest of the group with a $795m market cap, trading at 19.2 times EV/EBITDA and 65% gross margins, not seeing the kind of options action as the others and not as attractive compared to Zynga.

Videogame market forecast to slow

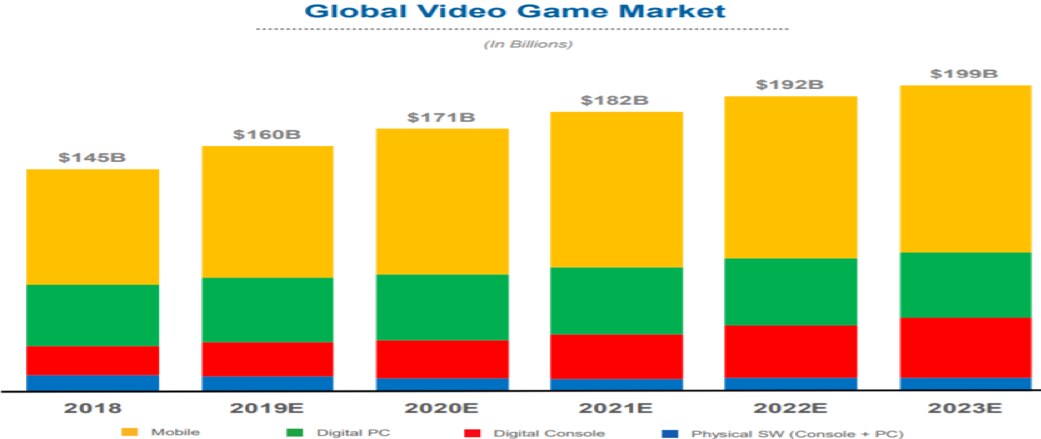

Taking a more broader industry view, NPD Group – a US market research company – posts monthly videogame sales figures that are suggesting a slowdown in the next few months. In August, it found that sales of $666m were down 18% year-over-year and were at a 20-year low, with declines across all categories.

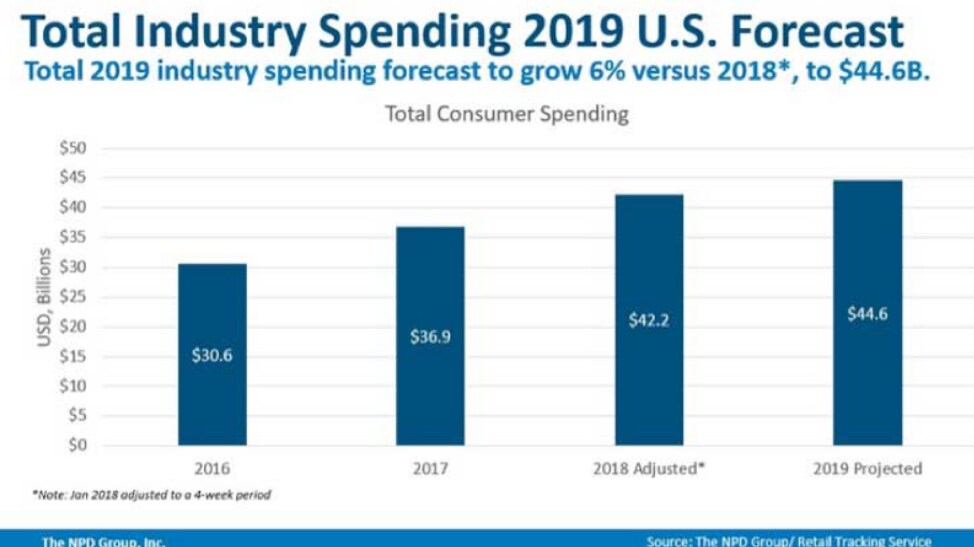

Although growth has slowed, NPD estimates 6% total growth for the US videogame industry across content, hardware and accessories, slowing from 14% growth in 2018 and 20% growth in 2017.

It is important to look forward when analysing companies, as the videogame industry remains in the middle innings of some strong secular tailwinds, which are driving strength in mobile/digital, incremental in-game purchases also known as microtransactions and the emerging esports theme.

Also, recent launches of subscription gaming services from Apple [AAPL] and Google [GOOG] are likely to drive increased spending. Cloud gaming is also looking to disrupt hardware with an estimated 900% increase in cloud gaming revenues expected between 2017 and 2023.

The industry is also looking forward to major new launches from Microsoft [MSFT] and Sony [6758] in the next generation of consoles, suggesting a strong gaming cycle is likely in 2020.

900%

Estimated revenue increase of cloud gaming between 2017 and 2023

As Q4 fast approaches and the holiday spending that comes with it, there are a number of key launches taking place throughout the group to jumpstart momentum into 2020.

Take-Two Interactive recently launched 'Borderlands 3', which sold 5 million copies in the first five days, tracking 50% higher than the previous edition.

The game developer will next be launching 'The Outer Worlds' and 'Red Dead Redemption 2' on PC. Activision Blizzard also launched 'Call of Duty Mobile' on 1 October, as part of its new focus on a major mobile opportunity with Diablo Immortal expected to launch in 2020.

It’s also seeing success with the recent launch of 'World of Warcraft Classic' and has a number of other launches planned over the next few quarters. EA will launch 'Star Wars Jedi: Fallen Order' in mid-November, while its 'Apex Legends' series continues to be very successful.

Ultimately, 2020 appears to be shaping up to be a positive year for videogame makers, with a number of positive tailwinds.

EA appears to have the best value out of the group, while Take-Two Interactive has the best titles and Activision Blizzard has a big opportunity in mobile. Lastly, Zynga is a pure play on mobile that has strong growth momentum.

This group of gaming stocks really offers something for everyone and with a rising tide ahead of them, it will lift all boats in this case.

By Joe Kunkle, who is the founder of Options Hawk, a service that provides news, analysis and option movement research. Alongside this, he runs his personal trading account and is head research analyst at investment firm Relativity Capital.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy