Nokia’s

[NOK] share price has been on a downward trend since it released its Q3 2019 earnings results on 24 October, slumping to a new five-year low on 7 November, closing at $3.57.

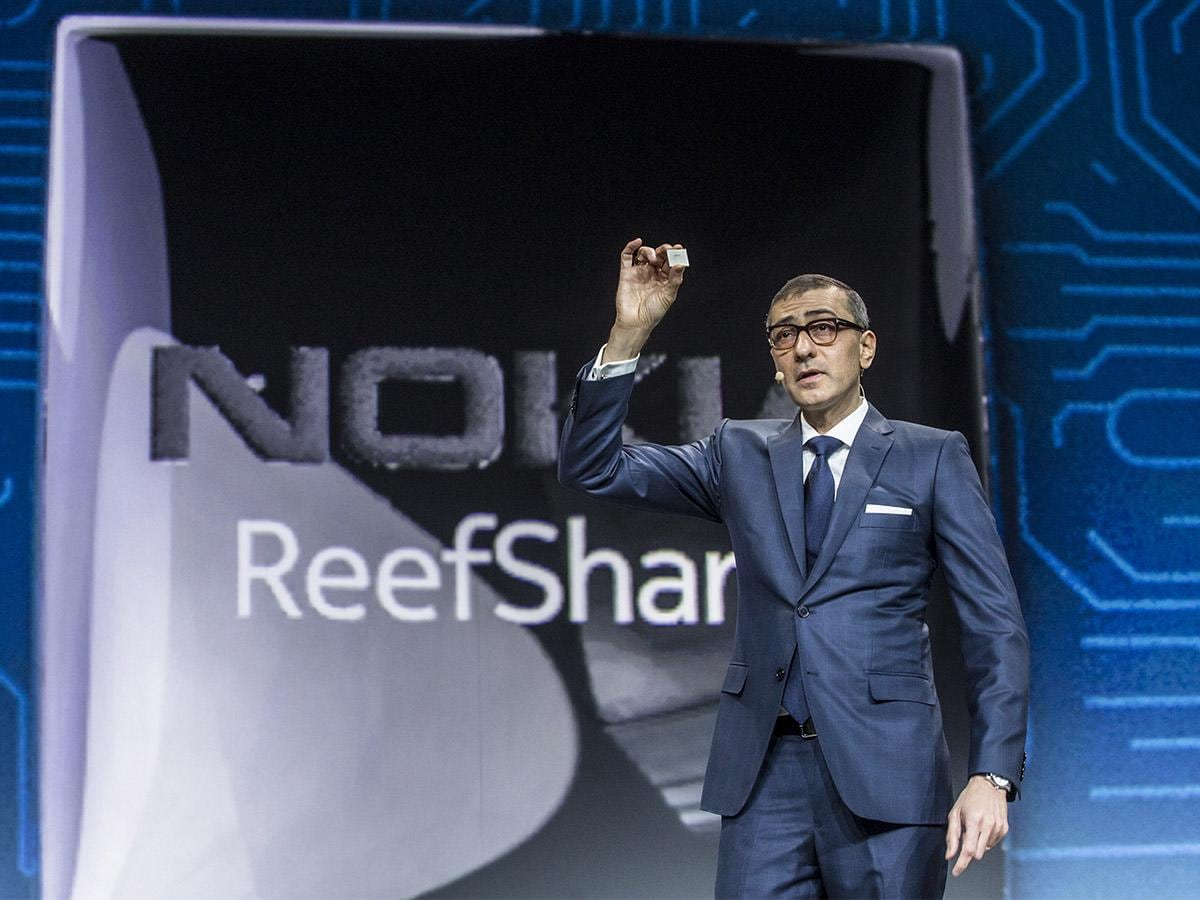

Nokia lowered its full-year 2019 and 2020 estimates, with CEO Rajeev Suri saying that additional investments in 5G technology and margin pressures meant it no longer expected to hit its previous targets.

Perhaps best known for the durable phones it released in the early years of mass-market mobile phone adoption, the Finnish company is currently racing to become one of the biggest names in the emerging 5G market. As a result, Nokia and its telecoms competitors

Ericsson [ERIC] and China’s Huawei [002502], are pouring cash and resources into developing and rolling out this next-gen communications technology. In its recent announcement, Nokia’s CEO Rajeev Suri admitted: “It is not unusual at this early stage in a new technology cycle to have high product costs.”

What happened?

Since Nokia’s Q3 report was released, its share price has seen an overall decrease of 24.3%, falling from $4.71 to $3.57 by 7 November’s close. On results day, Nokia endured its second-worst one-day decline since July 2000, falling by 23.7% to $3.90. The share price has continued to fall.

As well as revising its full-year estimates downwards, Nokia also caused concern among investors with its decision to halt dividend payments. The Finnish company’s board has decided not to distribute dividend instalments in Q3 or Q4, in order to improve its cash position and enable it to keep investing in 5G projects.

The sudden change may have spooked investors, but Nokia’s overarching statistics should offer some reassurance. For example, Q3 saw revenues increase year-over-year from €5.5bn to €5.7bn. The balance sheet had also returned to the black, at €264m compared to an operating loss of €54m recorded last year. Net sales had also increased year-on-year by 1%.

€264million

Q3 2019 operating profit

Nokia’s future

Suri remains positive about the year ahead. In a statement, he said: “We expect Q4 to be strong, with a robust operating margin and an increase in net cash of approximately €1.2bn.”

The company remains fully invested in dominating the 5G space and currently has 48 deals and 15 live networks launched to date. Nokia has a long-term target of a 12% to 14% operating margin (up from 4.6% at present) and expects to resume its dividend distributions when its net cash position recovers to €2bn.

| Market cap | $19.87bn |

| Forward P/E | 13.13 |

| EPS (TTM) | -0.19 |

| Price/Book (MRQ) | 1.14 |

Nokia share price vitals, Yahoo finance, 11 November 2019

Concerning the recent drop in share price and concern from investors, Suri added: “We expect that we will be able to progressively mitigate these issues over the course of next year. To do so, we will increase investment in 5G in order to accelerate product roadmaps and product cost reductions, and in the digitilisation of internal processes to improve overall productivity.”

The stock is currently looking cheap, with its PE ratio (TTM) currently sitting at 14.64 compared to the industry’s 21.54. Analysts have set an average share price target of $4.85, representing a potential 51.1% upside for traders on the stock’s current value.

Continue reading for FREE