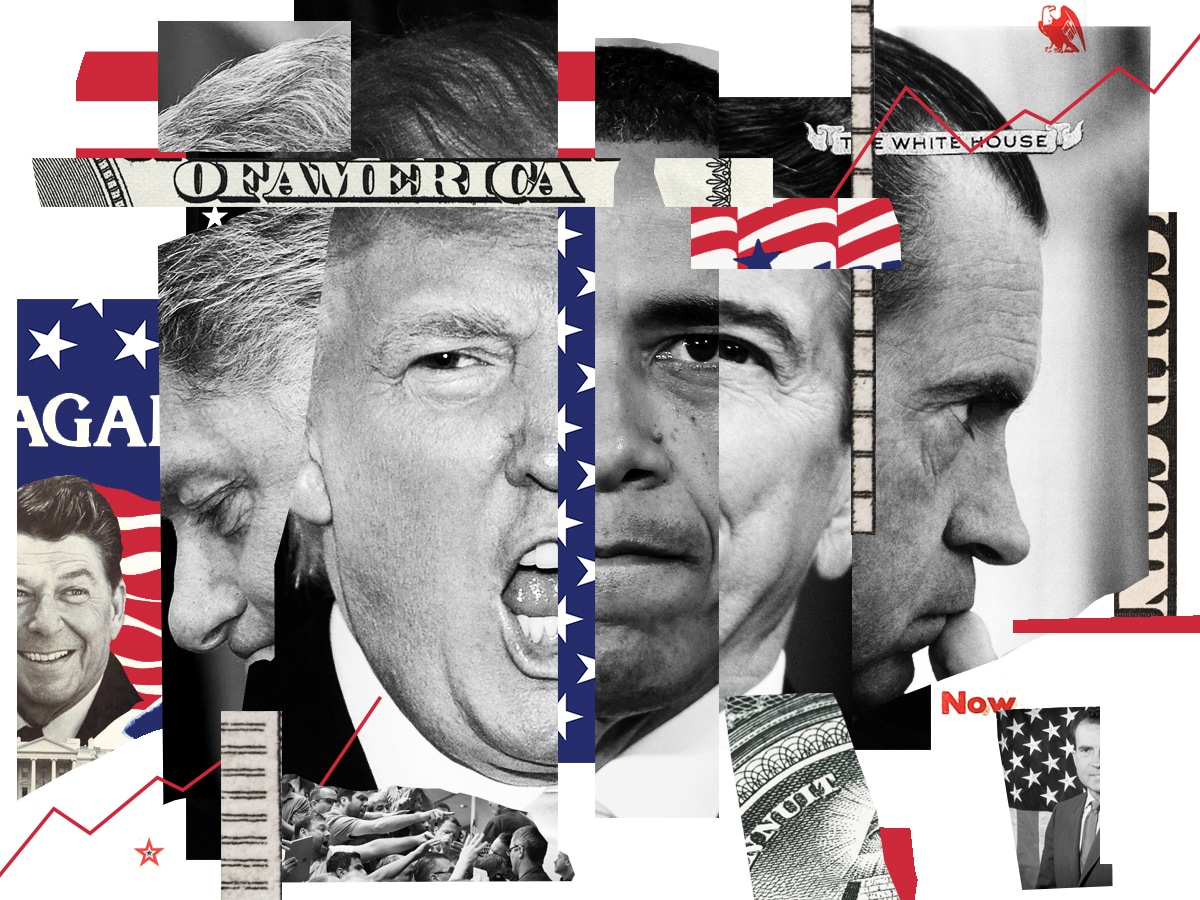

According to 45th US President Donald Trump, “the reason our stock market is so successful is because of me”.

On closer inspection, this statement may not hold. Despite inheriting bullish US markets from his predecessor, Wall Street has been plagued by the fastest ever market crash in history during Trump’s tenure.

Granted, the recent runaway gains in US markets could be a tick in the Republican’s column, but can these be sustained?

Ultimately, the question for investors ahead of the US election on 3 November is whether US markets will respond better to Trump or his Democratic Party rival Joe Biden.

If the Democrats succeed

The current president, of course, believes there’s no doubt about the outcome if we see a Democratic win at the beginning of November. “If Biden gets in, this market’s going to crash,” he told Fox Business in August. “He would tax this country into a depression-like 1929.”

Biden, in contrast, seems keen to turn the president’s financial virtue into a vice. “During this [COVID-19] crisis, Donald Trump has been almost singularly focused on the stock market, the Dow and the Nasdaq. Not you. Not your families,” he told voters during a speech in Pennsylvania.

But a Biden victory wouldn’t necessarily be bad for the US stock market. In fact, Biden’s steady approach could be a calming presence, especially if he brings a more conciliatory foreign policy agenda. “ I think the markets and the economy would be doing a lot better if we had stable leadership in Washington,” Jack Lew, former US secretary of the Treasury, told CNBC.

““I think the markets and the economy would be doing a lot better if we had stable leadership in Washington” - Jack Lew, former US secretary of the Treasury

Biden’s typically Democratic manifesto, which includes plans to increase corporation tax from 21% to 28% and capital gains tax from 23.8% to 39.6%, and raise taxes on earnings of over $400,000, has made corporate America shudder. Similarly, Biden’s proposed extension of the Affordable Care Act, which was introduced by Barack Obama in 2010, would bring down the cost of drugs and negatively impact pharmaceutical prices.

On the other hand, the extension would mean more health plans, boosting insurers. Meanwhile, Biden’s commitment to renewable energy and related infrastructure will serve stocks in this area well.

If Trump wins, such stocks are bound to suffer from his policies. Oil, for instance, will fare much better under a president who has ripped up the US’s climate change agreements, eased regulation on oil companies and approved drilling in an Arctic wildlife refuge.

It might be natural to assume that the stock market would thrive more under a Republican administration, but history tells us this is not always the case. Over the past half-century, Democratic Party presidents have overseen greater average annualised returns: 14.3% compared to the 10.8% realised by their more Right-wing rivals, according to analysis by Natixis Investment Managers and the Financial Times.

Not only that, but MarketWatch notes every Republican president for the last 100 years has suffered a recession in their first term.

It is important to remember that the US is a country where Congress, not the president, sets tax rates, passes spending bills and writes laws regulating the economy. Given all this, can one person in the White House really have that much impact on the US stock market anyway?

Yes, and no. As these examples of past presidents show, market returns can be equally influenced by presidential policy, behaviour or, in some cases, circumstances over which even the most powerful person in America has absolutely no control.

Richard Nixon

Republican

20 January 1969 – 9 August 1974

S&P 500 return: -20.4%

Nixon was undoubtedly the architect of his own downfall, albeit helped along by Bob Woodward and Carl Bernstein, the journalists whose coverage of the Watergate Scandal eventually led to his resignation. As the 37th US president, he could reasonably argue that the events preceding the stock market’s woeful performance during his truncated tenure weren’t his fault.

The spending of his predecessor Lyndon Johnson on the Great Society and the Vietnam War at the end of the 1960s boosted economic growth but rocketed inflation to 4.7% in 1968. This resulted in increased imports and a huge balance of payments deficit.

4.7%

Level of inflation in 1968

Nonetheless, Nixon’s attempts to bring inflation down with monetary restraint simply pushed unemployment rates higher. He decided to introduce the “Nixon shock” — a series of measures that included a 90-day wage and price freeze, surcharges on imports and, most controversially, suspending the Bretton Woods system of international financial exchange, thereby preventing convertibility of US dollars to gold.

Nixon, who had geared his fiscal policy around getting re-elected, was duly returned in 1972 by a landslide, a moment that saw the S&P 500 reach its zenith for the era. It hit a high of $113.35 on 8 November 1972.

The removal of the gold standard led other nations to raise the price of the metal, however, sending the dollar value down, making imports more expensive and creating more inflation. Meanwhile, unemployment continued to spiral all the way up to 5.2% in 1972.

Then, as the Watergate Scandal developed, confidence in the government went into free fall. A recession followed in 1973 and — with the S&P 500 20% down on its level when he’d come to power — Nixon quit.

20%

Price drop of the S&P 500 since Nixon came into office

Ronald Reagan

Republican

20 January 1981 – 20 January 1989

S&P 500 return: 117%

When former actor Ronald Reagan took the presidential stage, unemployment in the US was 8.5% and inflation was at 8.9%. The economy was gripped by stagflation following Gerald Ford’s three-year presidency and six months into Reagan’s first term, it went into a recession.

But the ex-screen cowboy had already taken the bull by the horns. Just three weeks after Reagan’s inauguration, he removed petrol price controls and lowered the oil windfall tax before presenting the Economic Recovery Tax Act, which cut the top tax rate from 70% to 50% and slashed corporation tax.

Reagan promised the move, in tandem with former Fed chairman Paul Volcker’s interest rate hikes, would “provide incentives to invest and build businesses”, according to the Reagan Foundation. As far as the markets were concerned, Reaganomics — which also included market deregulation and huge defence spending in the US’s successful bid to win the Cold War — were a hit.

Entrepreneurism sent the S&P 500 up 25% in the first six months of 1987 and — despite the crash later that year — the benchmark index was 117% higher at the end of his presidency than the beginning.

25%

Price rise of the S&P 500 in first 6 months of 1987

Critics will point to the measures of Reaganomics as the reason why the US was in debt for the first time since the First World War, but it paved the way for one of the most sustained periods of prosperity in the country’s history.

Bill Clinton

Democrat

20 January 1993 – 20 January 2001

S&P 500 return: 209.7%

Aside from a well-documented, ill-advised dalliance in the Oval Office, Clinton was in the right place at the right time. He took office as the 42nd US president at the start of 1993.

At the time, America had been recovering from the Great Recession when Clinton stepped in to sign his predecessor George Bush Senior’s radical new North American Free Trade Agreement. Over the next eight years, Clinton oversaw the rise of the internet and the subsequent economic boom that led to the inflation of the dotcom bubble.

Of course it wasn’t all happenstance. His Deficit Reduction Act meant that Alan Greenspan, former chairman of the Federal Reserve, could cut interest rates, which prompted an investment boom. Budget cuts and tax hikes for the wealthiest Americans, while unpopular, also reassured volatile bond markets.

Even Clinton’s impeachment trial couldn’t halt the market’s rise, between the start of proceedings on 8 October 1998 and his acquittal on 12 February 1999 the S&P 500 rose 28%.

28%

Price rise of the S&P 500 between start of impeachment proceedings and Clinton's acquittal

Barack Obama

Democrat

20 January 2009 – 20 January 2017

S&P 500 return: 182%

Barack Obama’s economic policies may have been the polar opposite of Reaganomics, but the first African-American US president can cite an even better stock market return.

Obama came to a market decimated by the 2008 financial crash and unsurprisingly his early years were dominated by economic stimulus policies, which included the $831bn American Recovery and Reinvestment Act, the 2009 bailout of the near-collapsed US car industry and the Jumpstart Our Business Startups (JOBS) Act.

Much of this was funded by the antithesis of Reagan’s approach. Obama raised taxes, capped military spending and created the Patient Protection and Affordable Care Act, Obamacare.

As with Reagan’s contrasting policies, Wall Street soared.

Admittedly the only way was up for Obama. As he was sworn in, the Dow Jones Industrial Average plunged 3.9% to 7,949.09 — its largest inauguration day plunge since 1896, according to Investopedia. After bottoming out in March 2009, the US market entered one of the longest bull runs in its history.

Donald Trump

Republican

20 January 2017 – present

S&P 500 return: 47% through 28 September

Compared to former presidents, Trump has boasted the most direct business experience of any.

His term has seen corporation tax plunge more than 40%, a drop in income tax, the lowest unemployment figures in half a century and three interest rate cuts that have prompted bumper consumer spending, sending the US stock market soaring.

As COVID-19 hit 2020, zero interest rates and unprecedented fiscal stimulus have prompted a mammoth splurge on bonds and boosted equities to record highs. The S&P 500 is up 46.85% in the four years to 29 September since Trump came to power.

46.85%

Price rise of the S&P 500 in four years since his inauguration

US industry stocks will likely soar again if Trump’s traditionalist, isolationist policies sown in this first term are allowed to take root in a second. It’s also likely that tech stocks, of which Trump is not a fan — he once tweeted that he’d “go after” Amazon [AMZN] on market competition grounds — will continue to boom.

In the short term, however, neither Trump nor his rival Biden’s potential victory engenders as much fear as a messy, contested poll outcome. Trump has already suggested postal vote fraud will prevent him conceding the election. Meanwhile, Biden’s supporters think he has too big an opinion poll lead to lose it fairly.

This could mean an even longer period of uncertainty than in 2000, when it took five weeks to establish that George Bush had defeated Al Gore — uncertainty which wiped billions off the markets.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy