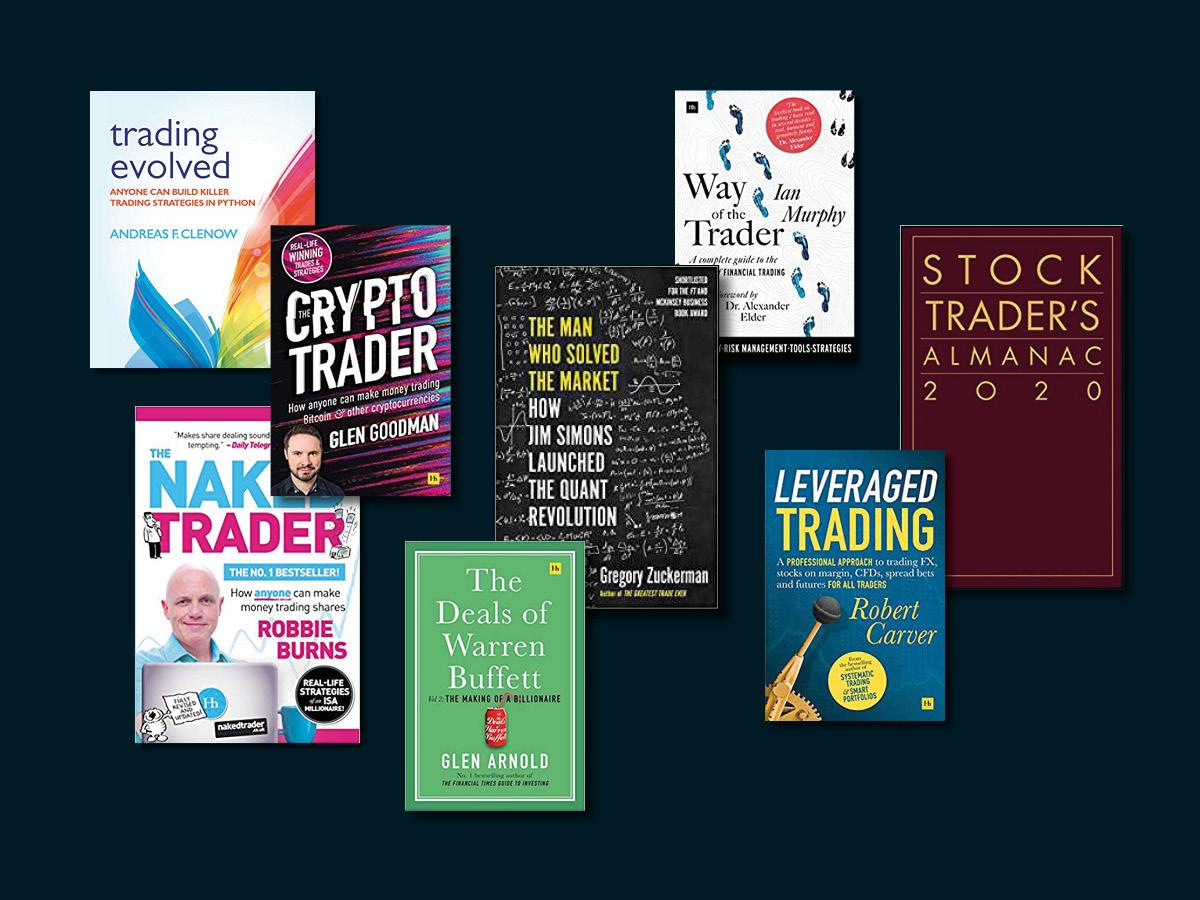

From understanding how to build your own quantitative trading system to exploring the trading rationale of legendary investors such as Warren Buffet and Jim Simons, there’s a trading book for everyone this holiday season

As the year comes to a close and following such a period of uncertainty, novice traders and seasonal stalwarts alike may be looking to adapt or develop their trading strategy, boost their confidence, broaden their knowledge or simply relax with a good book in hand.

Several authors who have recently published books relating to the markets have told Opto about what they’re writing about and why.

The Deals of Warren Buffet, volume 2: The making of a billionaire

By Glen Arnold

With 14 books on investing and the financial markets under his belt, Arnold – a value investor based in the UK – has published the second instalment in his Deals of Warren Buffet series. For Arnold, the sage of Omaha is “the greatest living investor”. Indeed, Buffet impressively started investing when he was just 11 years old and since then has built himself a net worth of about $80bn.

Arnold has written the book off the back of a series of newsletters, which detail short case studies on Buffet’s investments and analyse the rationale behind these. Volume two kicks off where volume one left off in the 1980s, while also exploring the philosophical ideas of what it means to be a value investor.

The Man Who Solved the Market: How Jim Simons launched the quant revolution

By Gregory Zuckerman

When it comes to investing, there is no one with a better track record than Jim Simons. His firm, Renaissance Technologies, has had an average annual return of 66% since 1988, however, it’s one of the most secretive on Wall Street.

In his latest book, specialist writer at The Wall Street Journal Zuckerman has decided to tell the story of Simons to the world. “While the book is about Jim Simons and his life, it's not really a biography,” Zuckerman tells Opto. “It's really about how he and his colleagues solved the market and achieved these crazy returns [through pioneering quantitative trading].”

“It's really about how he and his colleagues solved the market and achieved these crazy returns [through pioneering quantitative trading]” - Gregory Zuckerman

Leveraged Trading: A professional approach to trading FX, stocks on margin, CFDs, spread bets and futures for all traders

By Robert Carver

Carver has been investing in the markets on an off for nearly 20 years and while he has written two previous books on the matter, his latest offering is for those that are a bit less experienced. It’s a guide for individuals hoping to get a better understanding of leveraged products and how to trade them, covering the common mistakes that people make and how to avoid them.

The book details “the main things you should think about when you're trading that many people don't think about”, such as what size a position should be. For Carver, this is “a direct function of the leverage you're taking, but also about the cost of trading”.

Way of the Trader: a complete guide to the art of financial trading

By Ian Murphy

Murphy is an independent trader based in Ireland who specialises in trend following. For many, this type of trading strategy is considered the most profitable, but also one of the most difficult.

Throughout his career, Murphy has documented his trading practises and any lessons he’s learnt along the way, compiling them into his first book, which he describes as “a complete guide from complete newbie, complete beginner, right up to where you need to be to trade professionally”. The emphasis of the book is on the psychology of trading, as Murphy admits, “it took me a long time to realise that money is made and lost in psychology not in technology”.

“It took me a long time to realise that money is made and lost in psychology not in technology” - Ian Murphy

The Crypto Trader: how anyone can make money trading Bitcoin and other cryptocurrencies

By Glen Goodman

With 20 years of trading experience, Goodman understands what it’s like to “lose his shirt” when it comes to a bad trade. He mentions this in his first chapter, as he explains “ it’s a good analogy with the cryptocurrency world, as loads of people lost their shirt on Bitcoin in 2017”.

However, Goodman was not one such trader. He learnt important lessons from the Dot.com boom, which had a very similar set of circumstances and was able to call the top of the market in December 2017, taking his profits before the crash. In The Crypto Trader, he provides a practical guide to understanding cryptomania and how to trade it.

Stock Trader’s Almanac 2020, 53rd annual edition

By Jeffrey Hirsch

Written as a day-to-day guide for investing in the markets, Stock Trader’s Almanac is back with its 53rd edition. Hirsch, who is the chief market strategist at Probabilities Fund Management, has written this edition as a continuation of his father’s work, which originally started back in 1966.

“I was born and raised on stock market cycles, patterns, trends and technical analysis,” Hirsch tells Opto. He officially took over the family business in 2001 and since then has been the editor-and-chief of this four-year cycle book, which details the cycles, trends and patterns traders need to know to reduce risk.

“I was born and raised on stock market cycles, patterns, trends and technical analysis” - Jeffrey Hirsch

Trading Evolved: anyone can build killer trading strategies in python

By Andreas Clenow

The extreme technicalities of trading aren’t lost on Clenow. As the chief investment officer at ACIES Asset Management in Switzerland and author of two previous books on trading strategies, he is well-versed in the area and understands the programming needed to create, for instance, a Monte Carlo simulator.

In an effort to help make programming less daunting to traders, Clenow’s latest book is a practical guide to understanding the basics of how to build a quantitative analysis system. “In my view, if you want to be in this business you need to understand programming,” he explains. “That scares people a lot, so I figured that I’d write a book that explains this in a way that almost everybody can get.”

“In my view, if you want to be in this business you need to understand programming. That scares people a lot, so I figured that I’d write a book that explains this in a way that almost everybody can get” - Andreas Clenow

The Naked Trader: How anyone can make money trading shares

By Robbie Burns

A full-time trader, trained journalist and writer, Burns has written several revealing books on trading. In the fifth edition of The Naked Trader, he strips back the financial jargon that can distract traders starting out.

This edition includes new material on his recent trades, which Burns says includes “some of the mistakes I’ve made and some of the things I got right” in the past four years. His main idea is to keep it simple: “if you start making a loss on something, get rid of it” but “if you start winning on something, keep piling in and keep trying to make as much profit as you can on it”.

“If you start making a loss on something, get rid of it. If you start winning on something, keep piling in and keep trying to make as much profit as you can on it” - Robbie Burns

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy