During a recent interview, I was asked how can the economy recover in 2021? Of course, I do not expect a phone call from the new Biden administration anytime soon. However, I did come up with some ideas and hope that somewhere, a little fly on the wall, can whisper into President-Elect Biden’s ear. After all, I am coming from the perspective of no politics and pure pragmatic ideas that would positively impact the stock market.

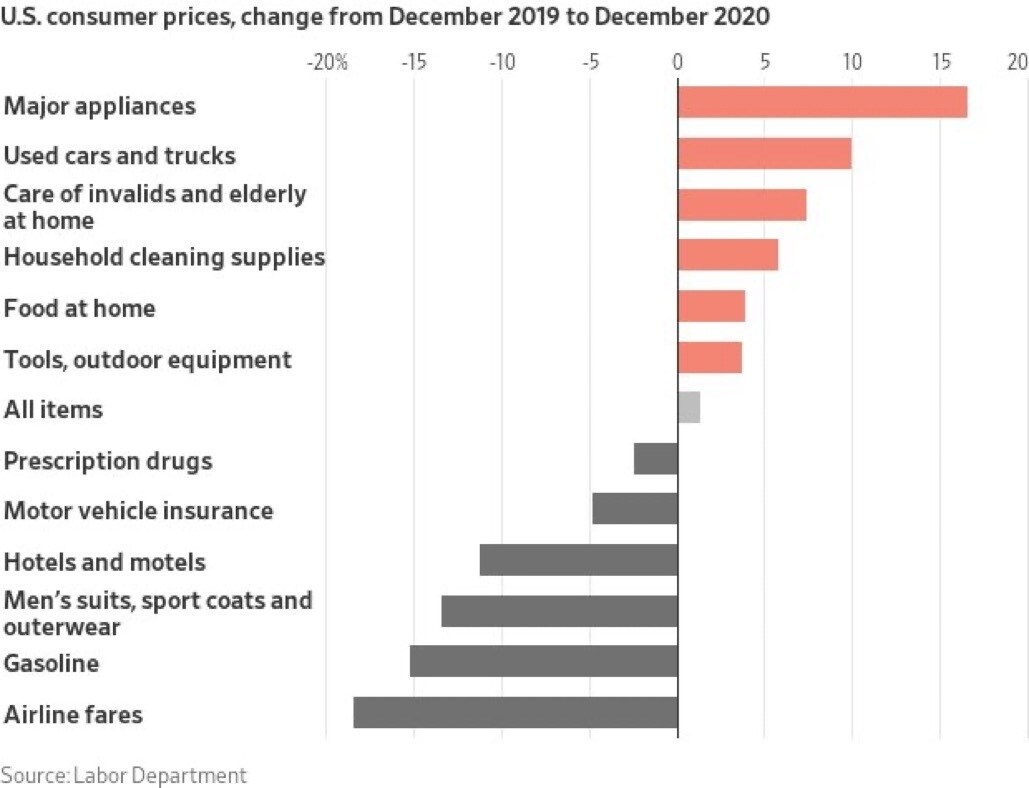

If you look at the chart from the U.S. Labor Department, it is plain as day which areas of the economy are suffering because of the pandemic.

Major appliances used cars and trucks, and care of the elderly and invalids are the top three areas that consumer prices soared.

In the bottom three, are airline fares, gasoline, and men’s suits, sport coats and outerwear. Naturally, hotels and motels came in as the fourth lowest.

Interestingly, the low inflation that the Central Banks talk about can be seen here as food, lumber, copper, and steel are not included in the CPI. By subtracting those items and focusing mainly on travel and gas, how can we boost spending and help the economy grow?

Stimulus

Stimulus is on Biden’s lips. He wants to help lower-earning families, extend unemployment benefits, and raise minimum wage by passing a $1.9 trillion relief package. Will this help the economy grow?

A safety net and increased wages will help to a degree. However, for the growth of the gross domestic product that many economists anticipate seeing as 2021 progresses, we will likely need more.

A vaccine rollout will also help because the main goal for a growing economy must be to open businesses up again and allow folks to get back to work. Mask requirements may be needed, as well as more readily available COVID-19 tests. Just like we must show passports, visas and for domestic travel, we must ensure that home tests are cheap, and the results are known quickly. Having documentation that prove people are negative, will go a long way to ensure that economies worldwide can recover.

The other goal is to create more jobs to replace many that have been lost for good and encourage more consumer spending (especially for those men who stopped buying suits so we ladies can see them in something other than workout clothes).

A long-awaited infrastructure bill would serve many purposes in the U.S. It would bring the country closer to competing with Asian countries who have far superior infrastructure systems in place. It would increase morale and most importantly, create a lot of jobs. It would also boost the Transportation Sector of the stock market.

The idea of infrastructure spending as an economic stimulus is rooted in Keynesian economics. According to the Keynesians, the government directly makes up for the lack of private sector demand by replacing it with demand from the public sector financed by deficit spending. Under certain circumstances, infrastructure spending can indeed stimulate broad, macroeconomic aggregates such as GDP or total employment. However, because infrastructure projects take a long time to get started, they cannot always provide stimulus in a timely manner to help during a recession.

National legalization of cannabis?

Hence, my second suggestion is timelier. In the U.S there are currently 109 million Americans living in areas where adults can use cannabis legally. Cannabis is legal for medicinal purposes in 36 states and completely legal in 15.

If the Federal government authorizes cannabis as nationally legal, it will create not only hundreds of thousands of jobs, but it will also expand opportunities in agriculture, technology, sales, marketing, distribution and so on. It will also boost the cannabis sector of the stock market and attract a lot more investors.

So, the plan for President Biden to grow the economy is threefold. First, support the most disenfranchised. Secondly, allow businesses to open by rolling out vaccines, ensuring mask-wearing and providing easily available COVID testing. Finally, build our roads, highways and transportation systems and let folks get high legally!

Bio

Michele 'Mish' Schneider currently serves as Director of Trading Research and Education at MarketGauge.com. She writes and produces daily market analysis in "Mish's Daily", and serves as a developer and trading mentor in several of our trading services, drawing on her 30+ Years of Trading and Teaching Experience.

Mish is a former floor trader on several New York Commodity Exchanges, including Coffee, Sugar and Cocoa NYMEX and FINEX in NYC. While on the trading floor Mish also served as a market analyst for two of the largest commodity trading firms at the time - Continental Grain, and Conti-Commodities.

Mish also wrote the best-selling finance book, Plant Your Money Tree; A Guide To Growing Your Wealth.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy