At the time of writing, we’re still enjoying one of the longest bull markets in US equities in history. However, there are myriad signs suggesting this bull is growing weary.

There are plenty of defensive strategies an investor may implement in response, generally involving some form of asset and/or market diversification. But of the strategies we’ve researched, we believe none provide better defence – and offense – than a tail strategy based on put options.

Successful market timers may immediately see the value in adding a tail strategy to their portfolios. But even investors who don’t consider themselves market-timers may still benefit from a tail risk strategy.

This is because of its ability to help investors sidestep brutal market drawdowns, keeping investors in the market. With all this in mind, we would argue that using a tail risk strategy seems to offer significant help – to market timers and buy-and-hold investors alike.

“We would argue that using a tail risk strategy seems to offer significant help – to market timers and buy-and-hold investors alike"

Traditional defensive strategies

First, to avoid any hate mail, please understand I’m not declaring an imminent market crash based on the aforementioned four red flags in part one of this series. We all know markets can keep climbing far past the point logic would suggest otherwise.

And as most of you know, I’m a trend follower at heart, so I’m simply noting that this is all cause for caution, suggesting that this bull’s better days are behind us.

Put another way, I believe we’re seeing yellow warning lights, not red. Red will come if and when the trend finally rolls over, whether that’s in a month, a quarter, or even several years from now – but the precise timing of that market shift isn’t something I’m trying to predict.

But returning to the present moment, you don’t have to look hard to find reasons to be cautious of the markets. However, what’s the answer?

Pulling your money out and shoving it under the mattress isn’t a logical response. So, what then? What can investors do now to help protect themselves?

Well, you buy car insurance to protect your car, right? And homeowners’ insurance for a fallen tree or a break-in? Ditto for life insurance as a protection for your family. Well, do you apply the same logic to your portfolio?

“Pulling your money out and shoving it under the mattress isn’t a logical response”

Portfolio protection can take many forms. First, you don’t have to invest 100% in stocks. We often say the best way to hedge a risk is to not take the risk in the first place.

No one says you must own equities, and cash and bonds are an acceptable “sleep at night” choice. So instead of 100% in stocks, investors could own 80%, or 60%, or even less with the remainder in cash or bonds.

Second, you don’t have to limit yourself to only US markets. We feel this choice is a no-brainer. We’ve spoken often over the past few years about how moving into cheaper foreign equities can be a wise choice in a world dominated by more expensive US shares.

Particularly, we believe moving into the cheapest markets by long-term valuation metrics could still potentially deliver double digit returns going forward.

Additional diversification into foreign bonds, and/or real assets like real estate and commodities, historically, has done a great job of helping to lower overall portfolio volatility and drawdowns.

It does not guarantee protection, but on balance, it helps. Third, you could add liquid alternatives. Incorporating strategies like trend following and managed futures, or long-short and market neutral equity, can also help to hedge equity risks.

Now, most investors are familiar with these three choices. But there’s a fourth, one we’re going to cover in the next section – and while it too is defensive, if used tactically, it can also be an offensive strategy.

“Now, most investors are familiar with these three choices. But there’s a fourth ..."

To be clear, it’s not for everyone. It’s probably also not for “all the time”. That said, when used wisely and strategically, it has the ability not only to help protect a portfolio during drawdowns, but actually to profit from it.

To contextualise this strategy, we’ll look at how this strategy performs when added as a permanent fixture in a portfolio.

Implementing a defensive strategy

The “defensive-but-also-potentially-offensive” strategy centres around buying put options.

If you’re unfamiliar with options, it’s beyond the scope of this article to dive into them in detail, but there are plenty of great educational resources out there that can get you up to speed.

The basic idea is that if the market (or your stocks) rolls over, a put option you’ve previously purchased will enable you to either sell your equities at the pre-determined strike price (play defence), or if you don’t own the underlying investment, you’ll be able to profit as the underlying’s market price falls, therein increasing the value of the put you own (play offense).

We refer to this as a “tail risk” strategy. The name comes from the statistical distribution curve, where extreme events tend to occur in either “tail” of the curve.

“This “defensive-but-also-potentially-offensive” strategy centres around buying put options"

In our case, we’re looking to protect ourselves from those extreme market drawdowns that exist in the far left-side of the distribution curve’s tail.

For simplicity’s sake, and since the data is public, the tail risk strategy we will utilise is one that buys monthly 5% out-of-the-money options on the S&P 500.

We then invest 90% of the portfolio in 10-year US government bonds. (Note: while we sourced the data from the CBOE, this is a different strategy than the CBOE S&P 500 5% Put Protection Index (PPUT) that holds a long position in the S&P 500 Index. We have also replicated numerous variants with our own datasets but elected to publish with the CBOE data since it is public.)

So, let’s now add this tail risk strategy to our earlier comparison to see how it measures up.

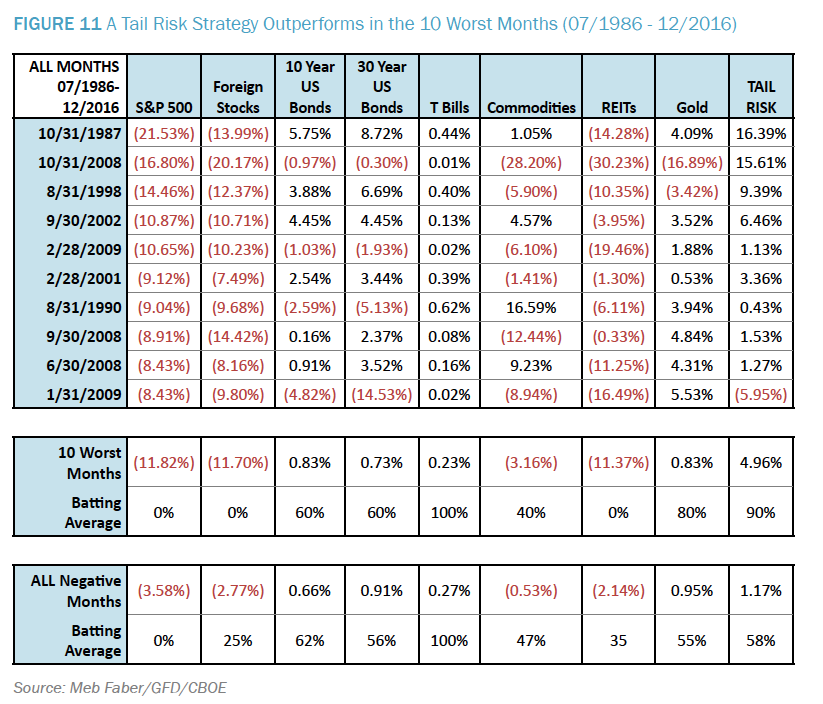

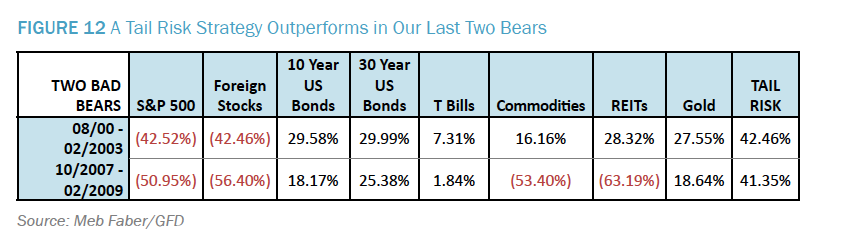

Notice in the table below that a simple tail risk strategy had a nice 90% batting average and the highest return at 4.9% during the worst stock months. The only reason it was not 100% was the #10 month of 1/2009, which is the “least bad” of these 10 worst months.

Now, for those of you who consider yourselves market timers, you’re likely incredibly excited about the potential returns here – as you should be.

But investors who consistently time markets accurately are a rare breed. What about investors who don’t consider themselves market timers? Might such a tail risk strategy have any benefit for them?

After all, a tail risk strategy is great when timed well. But what if you allocate to such a strategy prematurely? What’s the impact on a portfolio?

These are important questions. Therefore, when evaluating a tail risk strategy, non-market timers have to examine bull markets as well as bears.

Fortunately, as you’ll see in next week’s part four of this series, there’s still a strong case to be made for this strategy, even if the timing isn’t perfect.

This is part three of a four-part series on how best to implement a tail risk strategy in an ageing bull market.

By Meb Faber, who is the co-founder and chief investment officer at Cambria Investment Management, and creator and host of The Meb Faber Show podcast. He is the author of 'Invest with the house: hacking the top hedge funds' and 'Global asset allocation: a survey of the world’s top investment strategies’.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy