Global hedge funds are reporting varying performances for 2018 with the likes of Odey European seeing some of the highest increase in returns at 53% while QIM’s Quantitative Tactical Aggressive saw some of the lowest, declining by 42.1% due to violent stock swings, slumping oil prices and the tech sell-off.

Overall, however, the industry saw its biggest annual loss since 2011, declining 4% on a fund-weighted basis, according to Hedge Fund Research, with the Preqin All-Strategies Hedge Fund benchmark indicating a 2.27% loss for December 2018 and a 3.42% loss for the full-year.

The S&P 500 meanwhile dropped 6% last year, allowing the industry average to beat the index for the first time in a decade.

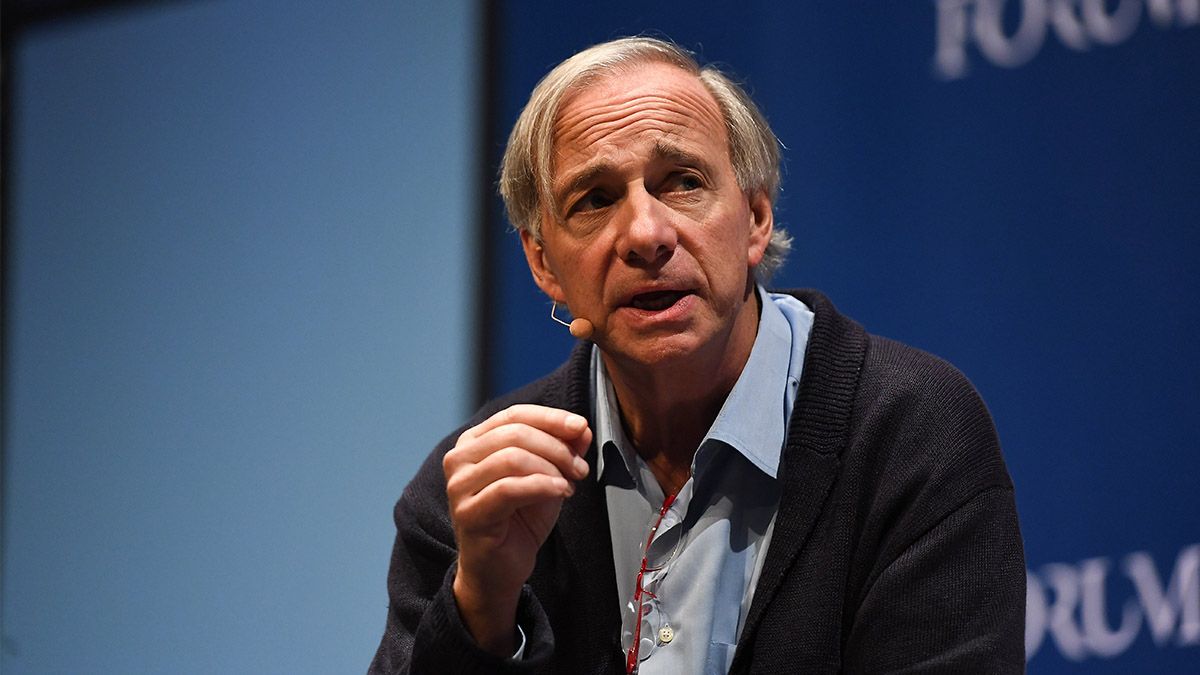

Bridgewater Associates, the world’s biggest hedge fund, was among the winners, seeing 14.6% gains in its main Pure Alpha fund, while David Einhorn’s Greenlight Capital reported 34% losses.

14.6%

Bridgewater Pure Alpha fund's gains in 2018

In addition, many prominent hedge funds closed their doors in 2018, including Omega Capital, Highfields Capital Management, Criterion Capital Management, SPO Partners and Jabre Capital Partners.

In the third quarter of 2018, hedge fund liquidations rose to 174, which exceeded the 144 launches in the quarter due to a decrease in incentive fees for new funds.

What's next?

Nicole Boyson, finance professor at Northeastern University, said hedge funds, in general, struggle justifying fees when stocks have performed steadily since the financial crisis.

“When you have a really long bull market, investors are paying you 2% management fee and 20% incentive fee, [you’re seeing] some outflows and you see some managers just getting frustrated,” she said.

“When you have a really long bull market, investors are paying you 2% management fee and 20% incentive fee, [you’re seeing] some outflows and you see some managers just getting frustrated,” - Nicole Boyson, finance professor at Northeastern University

While hedge funds are not fully immune to market volatility, their 2018 performance raises the prospects of further capital outflows and undermines the industry.

“December proved, if proof was needed, that most liquid hedge funds tend to behave like the market,” Reyl & Cie’s head of alternative assets, Nicolas Roth said. “Hedge funds providing access to complex and less liquid markets are the way forward to shield portfolios from market gyrations.”

Despite the performance slump, the industry saw very few wholesale departures by investors and traders. Although, analysts do expect growth to slow in the industry as it approaches saturation levels with over $3tn in assets under management.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy