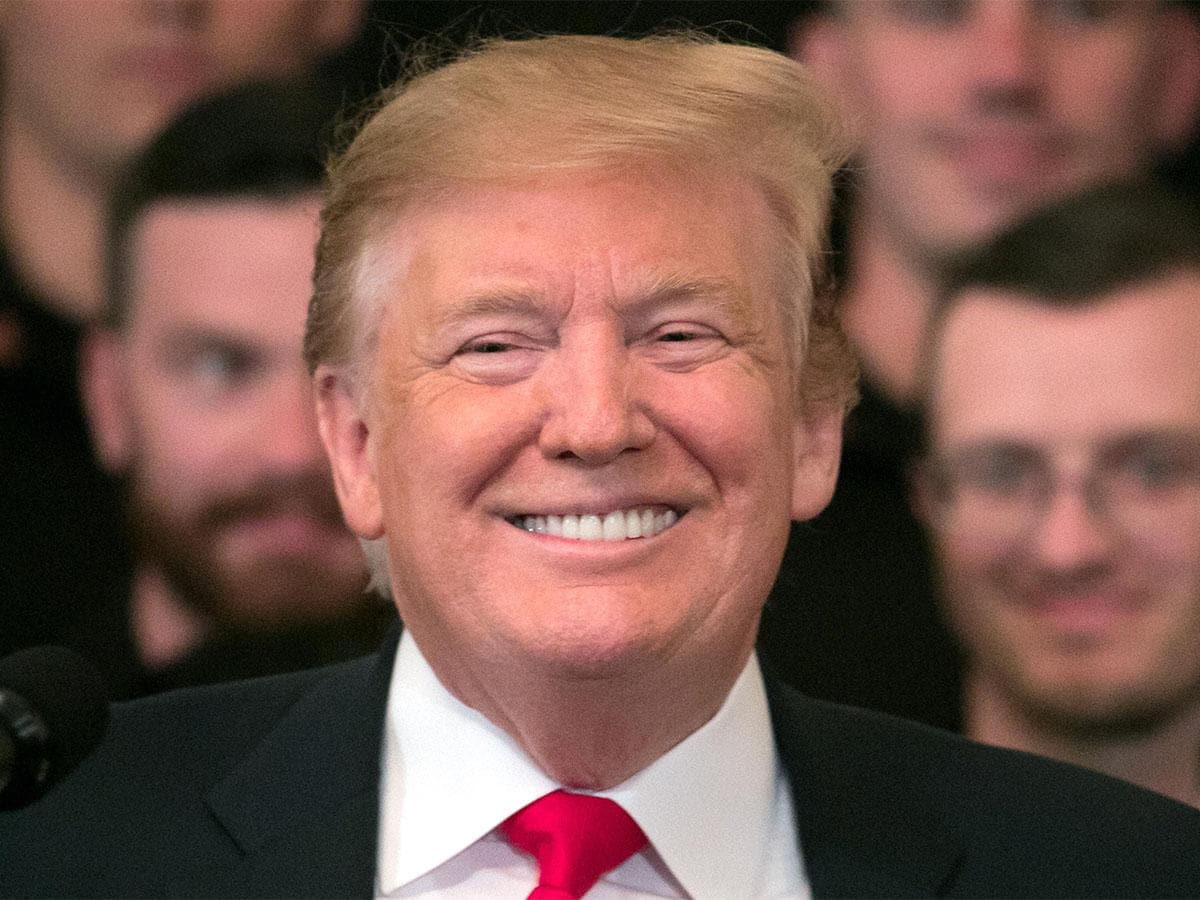

It wasn’t only environmental activist Greta Thunberg who was left distinctly unimpressed by US president Donald Trump at the United Nations General Assembly on Tuesday (24 September) as he declared censorship was a “challenge to liberty.”

Trump pointed to the “immense power” that a “small number of social media platforms” were building and the growing influence they were having over what individuals see and do. At close that day Facebook [FB] was down 2.96% at (24 September) and Amazon [AMZN] was off 2.44%. Meanwhile, Netflix [NFLX] dropped 4.26%, Apple [APPL] fell 0.47% and Alphabet [GOOGL] fell 1.32%. The FAANG stocks were left nursing a $56million market value blow following his remarks around Big Tech censorship, figures from Bloomberg show.

Tom Essaye, a former Merrill Lynch trader, pointed out that the speech was a reminder that this is a new risk facing big tech companies, and something that “from a valuation standpoint” needed to be considered. “The president has a belief that social media companies are extremely powerful and not particularly favourable to his policies or potentially his point of view.”

What’s on the horizon?

Among a general climate of negativity –the Dow closed down 0.53% and the S&P 500 0.84% on Tuesday as Trump faced a formal impeachment over his dealings with Ukraine and possible interference in the 2020 Presidential election – the tech-heavy Nasdaq Composite Index fell 1.7% on Tuesday, the most of the major equity indexes according to Bloomberg.

Investors and traders fretted that Trump’s speech was a signal that the industry could soon face extra scrutiny from free speech activists and federal antitrust regulators. However, Trump’s speech was not the first instance of such rhetoric.

-1.7%

The Nasdaq's dip on Tuesday

Earlier this month New York attorney general Letitia James, alongside seven other states and the District of Columbia, launched an antitrust investigation into Facebook focused on the company's industry dominance. Previously, Democratic 2020 presidential candidate Tulsi Gabbard has declared that big tech monopolies need to be broken up to protect people’s right to speak freely online.

Facebook has received renewed negative press after the Federal Trade Commission, in July, announced it had reached a $5bn settlement with the social media giant for data privacy violation in the Cambridge Analytica scandal. In January, Alphabet was fined €50m in France for breaking European Union data laws including enabling targeted ads without a user’s specific consent.

Are there still opportunities?

In July Facebook’s share price recorded a year-to-date high of 204.87, which has since dwindled to 182.80 at close on Wednesday (25 September); Amazon suffered too, falling from a July high of 2,017.41 to 1,768.33. Since May Netflix shares have dropped from a high 385.03 to 264.75, while Alphabet dropped 1296.97 in April to 1245.94 on Wednesday.

Bank of America Merrill Lynch’s head of US equity and quantitative strategy Savita Subramanian told MarketWatch back in May that it could be time for traders to log off. At the time, Subramanian suggested that these companies would be “smacked down” by regulation. She pointed to the fact that Facebook CEO Mark Zuckerberg was testifying in front of Congress, something that she notes all the financial CEO’s were doing 10 years previously.

| Amazon | Apple | Netflix | Alphabet | ||

| Market cap | $513.15bn | $864.57bn | $991.31bn | $115.20bn | $855.75bn |

| PE ratio (TTM) | 30.42 | 72.51 | 18.63 | 103.59 | 24.92 |

| EPS (TTM) | 5.91 | 24.10 | 11.78 | 2.54 | 49.53 |

FAANG stock vitals, Yahoo finance, 26 September 2019

“I think what we see for tech companies over the next 10 years will be similar, not as bad, but similar to what we’ve seen in other sectors, where tech companies have had essentially a free ride and they’re now about to start to see the costs and pain associated with regulation.”

But the FAANGS, in particular Facebook and Alphabet, still have some bite according to George Salmon, equity analyst at Hargreaves Lansdown, who also in May wrote that the “reams of data” Alphabet had access to, while meaning regulators would be keen to keep watch, was also what made it so attractive to investors.

“Google controls what appears where in a search and can offer bespoke advertising space. Customers are happy to pay – after all, Google is so dominant in its space it's commonly used as a verb.”

He says there were also “still some reasons for optimism” in regards to Facebook. “The public business remains a major draw for advertisers – which means it’s the pace of growth, not growth itself that’s under question. Analysts still expect operating profits to rise by close to 50% by 2021.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy