After falling more than 6% the day before its Q3 earning release, Best Buy stock [BBY] was slightly buoyed with a 2% gain following a widely positive reporting on Tuesday, the same day the S&P 500 Retail ETF fell 3.3% amongst a wider retail sell-off.

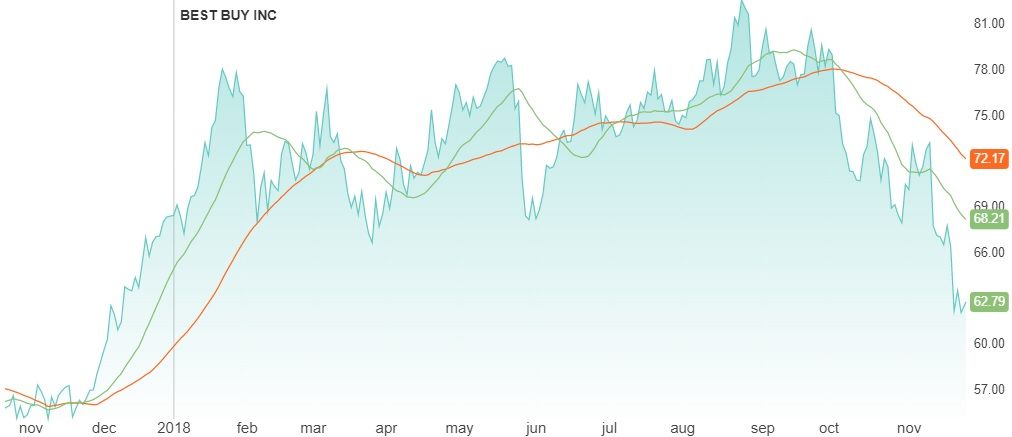

The consumer electronics retailer reported under a ‘death cross’ – a chart pattern that indicates a potential sell-off, and entered bear market territory on 19 November after its stock had fallen by 21% since peaking three months ago when it reported solid second-quarter figures.

Best Buy share price performance, NASDAQ interactive chart, as at 26 November 2018

Q3 earnings results

But with strong numbers and a moderate gain in stock price, the Q3 earnings saved the company from the cross and the bear. The Minnesota-based company beat its own third-quarter estimates, as well as analysts, reporting a rise of 4.3% on comparable sales, topping analysts’ estimates for a 2.7% rise.

Revenues of the electronic retailer topped estimates of $9.57bn, rising by 2.9% to $9.59bn, while its net income rose to $277m, compared with last year’s third quarter results of $9.3bn in revenue and $239m in net income.Revenues of the electronic retailer topped estimates of $9.57bn, rising by 2.9% to $9.59bn, while its net income rose to $277m, compared with last year’s third-quarter results of $9.3bn in revenue and $239m in net income.

The only downside was the company’s margins slipping by 30 basis points to 24.4%, driven by higher supply chain and transportation costs.

“Similar to the first half of the year, our top-line performance was helped by a favourable environment and driven by how customers are responding to the unique and elevated experience we are building,” Hubert Joly, Best Buy’s CEO, said in a statement.

| Revenue percentage change, Q3 YoY | +2.9% |

| Earnings per share (EPS) percentage change, Q3 YoY | +19.2% |

| Performance YTD | -7.0% |

| Market cap | $17.17bn |

| PE Ratio (TTM) | 16.40 |

Best Buy stock vitals, Yahoo finance, as at 26 November 2018

Best Buy’s ‘Building the New Blue Strategy’ drives growth

As one of the market’s most surprising turnaround stories, Best Buy has continued to make significant progress on its New Blue strategy for 2020. It has also expanded its In-Home Advisor programme with the acquisition of GreatCall for $800m in August, a health services provider for ageing consumers.

Joseph Feldman, analyst at Telsey Advisory Group, praised Best Buy’s strategy to leverage shop-in-shops, expand its businesses and improve pricing, e-commerce and the customer experience.

“That said, future success is dependent on the growth of services, which is still in the early stages of rollout, although this acquisition helps. The operating margin is likely to remain under pressure as technology spending is necessary to keep pace; labor investment, especially training, is crucial to a service-based operating structure, and supply chain speed and efficiency are paramount to success in retail,” he added.

A boost in guidance, but is it a worthy investment?

Best Buy has raised its full-year guidance for revenue and EPS to reflect its outperformance in the third quarter.

In the crucial holiday quarter, the company expects to bring in revenue between $14.4bn and $14.8bn and comparable sales growth of up to 3%, with non-GAAP EPS in the range of $2.48 to $2.58. It expects to see full-year revenue of between $42.5bn and $42.9bn compared to last year’s $42.4bn.

While Amazon’s [AMZN] growing dominance across the retail sector remains a concern, retailers are adapting by expanding their business offerings to remain competitive. As the last traditional consumer electronics platform, analysts are quick to point out its recent sale of underperforming stores and expansion into connected smart-home services as strong growth indicators.

Michael Pachter, analyst at Wedbush Securities, says Best Buy “appears to have settled on the right formula for long-term growth” and expects a strong fourth quarter.

Looking ahead, Best Buy’s long string of quarterly earnings beats could suggest a strong performance in retail’s golden quarter with analysts reporting buy ratings.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy