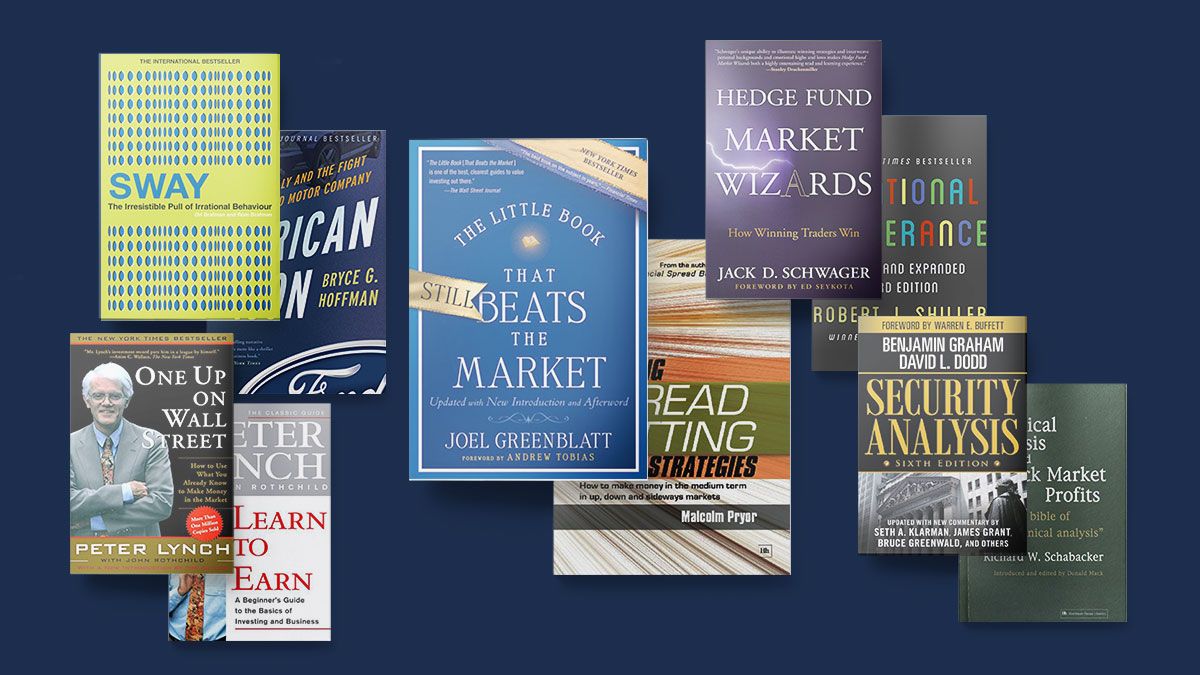

Whether just starting out or looking to refresh your knowledge and boost your confidence, these books can help traders to take steps toward mastering time-tested strategies, with indispensable lessons from industry greats such as Peter Lynch and Benjamin Graham.

1. Sway: The Irresistible Pull of Irrational Behaviour by Ori Brafman and Rom Brafman

In this compelling book the authors draw on the latest research in social psychology and behavioural economics to reveal the forces that affect our decision making in fields as wide as medicine and the legal system. Understanding better what sways you and others in the markets – and how danger and risk affect us – is a must for any successful trader.

2. Learn to Earn by Peter Lynch and John Rothchild

In this accessible beginner’s guide, Lynch and Rothchild explain the basics of how the stock market operates, how to read a stock table in the daily newspaper and understand a company’s annual report. They show not only how to invest, but also how to think like an investor.

3. American Icon: Alan Mulally and the Fight to Save Ford Motor Company by Bryce G Hoffman

The colourful inside story of the turnaround of Ford Motor Company under the leadership of CEO Alan Mulally is a lesson in grit and ingenuity. As the motor industry collapsed in Detroit, Ford was pulled back from the brink of bankruptcy by implementing Mulally’s bold strategy. For traders, it shows how good governance and the fundamentals can help support change in share price.

4. Irrational Exuberance by Robert J Shiller

As well as pinpointing the causes of asset bubbles, Nobel Prize-winning economist Robert Shiller recommends urgent policy changes to lessen their likelihood and impact, and usefully suggests how we can decrease risk before the next bubble surely bursts.

5. One Up on Wall Street by Peter Lynch with John Rothchild

It’s no surprise that legendary mutual-fund manager Peter Lynch has sold more than a million copies of his seminal work. He shows how average investors can beat the pros to companies that will reap financial rewards, as well as how to research stocks and take advantage of the right kinds of investment opportunities.

6. Security Analysis by Benjamin Graham and David Dodd, with a foreword by Warren Buffett

As relevant today as when they first appeared in 1934, the techniques and principles of Benjamin Graham, “the father of value investing,” have certainly withstood the test of time. The sixth edition is brought up to date with commentary from some of today’s leading Wall Street managers. “A road map for investing that I have now been following for 57 years,” writes Warren Buffett in the foreword. If it’s good enough for Warren, it’s good enough for us.

“A road map for investing that I have now been following for 57 years” - Warren Buffett

7. Hedge Fund Market Wizards: How Winning Traders Win by Jack D Schwager

Through in-depth interviews with the best of the best, Jack Schwager delves into traders’ wins and failures to demonstrate what can be learnt from each. There are also 40 insightful lessons in how to effectively manage capital, from finding the right trading method to learning to appreciate diversification.

8. The Little Book that Still Beats the Market by Joel Greenblatt

This little tome is a useful tool in any trader toolbox. Greenblatt explores, in a straightforward and accessible way, the basics of successful stock-market investing and then reveals his tried-and-tested formula: buy above-average companies at below-average prices.

9. Winning Spread Betting Strategies by Malcolm Pryor

A great guide for budding spread betters is Pryor’s indispensable manual. In this useful book he explores the lie of the land and outlines the key strategies for success, using handy charts to illustrate his methods.

10. Technical Analysis and Stock Market Profits by Richard Schabacker

For some incisive trading wisdom – dating to 1932 no less – it would be wise to revisit this practical book for investors. It has remained vital and instructive, revealing repeating patterns, trends and weaknesses, all factors to be aware of for market profits while avoiding perilous pitfalls.

Bonus: Extraordinary Popular Delusions and the Madness of Crowds by Charles Mackay

Another, even older book, is one of the best treatises on market psychology and what really drives financial markets: greed and fear. As an example, Scottish author Charles Mackay tells the tale of 18th-century “tulipomania,” a speculative madness surrounding the value of tulips that led to the ruin of many Dutch and English investors. It might date back to 1843, but the moral of blindly following popular financial manias remains as current as ever.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy