The world woke up Friday morning to the news that President Trump and First Lady Melania tested positive for the Coronavirus. Although the reports were that their symptoms were mild, the initial shock to the market sent prices sharply lower.

Nevertheless, as the shock wore off, analysts began the dialogue on whether Trump’s diagnosis, assuming his symptoms remain mild, could be a win for the market. Those who think yes believe that it reinforces the idea that you can be a “high risk” given that Trump is 74 and overweight, yet still have a light case of the virus and live to tell the tale. Secondly, Trump’s confusing stance on wearing a mask could now by default encourage those who had previously refused to start wearing one.

On the flip side, Trump’s diagnosis could also send a message that the economy cannot open as fast as many hope it will. Death rates and hospitalization rates will ultimately impact that the most.

Friday also brought investors the last Non-Farm Payroll numbers until after the US Presidential election. The numbers were lower than expected. Furthermore, the manufacturing numbers, although they have risen in the last 3 months (factory orders), did not rise as fast as many economists thought they might. As a result, the near-term macro outlook suggests that the economy may have had an initial pop from its nadir but could be showing signs of stagnating from here.

The X factor? Enter the stimulus package. Many believe it is completely dead with the house passing a 2.2 Trillion dollar package only for it to fail in the Republican-majority Senate. Nevertheless, Nancy Pelosi came out and said, given the news about Trump, she is more encouraged the two sides can make a deal. This is the main fuel for the market right now, especially if Trump’s condition remains stable.

Another interesting result of the news on Friday is that the drug companies are even more incentivized to get a vaccine at the ready along with a treatment for the symptoms. Therefore, Moderna, Pfizer and Inova all outperformed the NASDAQ and S&P 500.

I continue to believe that some package will get done before the election, as evidenced by the interesting market rotation that happened on Friday.

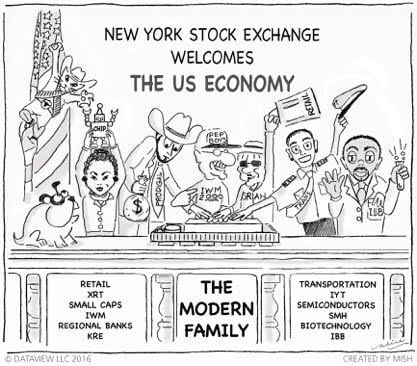

While NASDAQ closed down nearly 3%, the small caps or Russell 2000 closed up +0.70%. Additionally, the Transportation sector (topic of last week’s article) closed green along with retail, and most surprisingly, the financial sectors. All the market outperformers are part of what I call the Economic Modern Family. The Russell 2000, Transportation and Retail are what Stanley Druckenmiller calls the “inside of the market.”

I interpret this outperformance as further evidence the market believes Trump will recover readily and therefore, the economy will continue to open improving supply and demand.

For the coming week, keep your eyes on whether the rotation into value sustains or not.

Moreover, our Alpha Rotation quant model signaled a buy in NASDAQ, which means that the intermarket relationships were positive despite the selloff.

Of course, everything can change if Trump’s symptoms worsen, the stimulus package dies, or if the economy begins to shut down as more cases result in more hospitalizations and/or deaths.

For now, we at MarketGauge.com are heavily focused on food commodities such as wheat, corn, sugar and soybeans. All got a boost from the recent USDA report that crop yields are lower than expected. No surprise given the fires in western U.S. and rising temperatures due to climate change.

This also supports the inflation part of my food-driven stagflation theory, or that with global demand for food strong, supply chain disruption high, the rally in these commodities could be just the beginning.

And speaking of climate change and COVID-19 effects, for the first time in at least the last 60 years, Americans shelled out more for electricity than they did for gas. This has been a big reason why electric car companies like NIO and Tesla (TSLA) have done well.

It also explains why the solar energy sector has exploded in the last couple of weeks. As Covid-19 has been an accelerator of personal consumption trends, it has now pushed patterns in energy forward by years, just as it has in retail and e-commerce.

Bio

Michele 'Mish' Schneider currently serves as Director of Trading Research and Education at MarketGauge.com. She writes and produces daily market analysis in "Mish's Daily", and serves as a developer and trading mentor in several of our trading services, drawing on her 30+ Years of Trading and Teaching Experience.

Mish is a former floor trader on several New York Commodity Exchanges, including Coffee, Sugar and Cocoa, NYMEX and FINEX in NYC. While on the trading floor Mish also served as a market analyst for two of the largest commodity trading firms at the time - Continental Grain, and Conti-Commodities.

Mish also wrote the best-selling finance book, Plant Your Money Tree; A Guide To Growing Your Wealth.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy