The world’s ‘super investors’ bought a combined $1.7bn worth of shares in Meta [META] in the final three months of 2023, according to data from Stockcircle.

While you may have heard of Baillie Gifford, Citadel’s Ken Griffin and Third Point’s Daniel Loeb — all three increased their Meta holdings between last September and December — the name Jim Simons might not be as familiar.

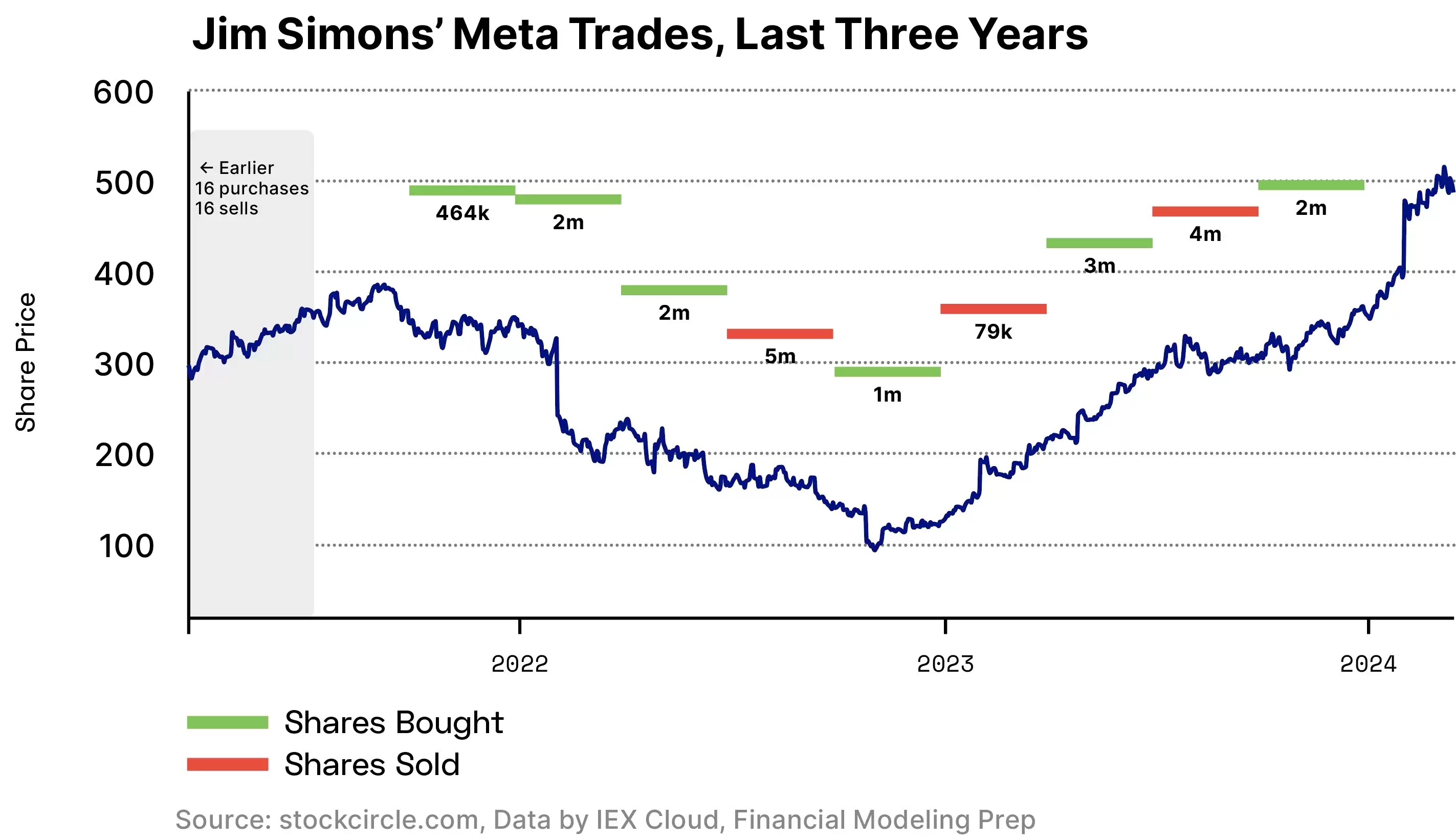

Simons was the biggest buyer of Meta shares in the last quarter, snapping up over 2 million shares at an average closing price of $323.65.

This marked a 2,055% increase on the 97,533 shares he held at the end of Q3 2023. His position in Meta is currently worth over $1bn and the holding accounts for 1.5% of Renaissance Technologies’ portfolio.

Who is Jim Simons?

Jim Simons founded Renaissance Technologies in 1982. Prior to his investment career, he had been a codebreaker with the US National Security Agency during the Vietnam War. His investment firm is a quant fund that uses algorithms to make its stock-picking decisions.

Simons rarely gives interviews, but in a 2022 discussion for Norway’s Abel Prize for mathematics, he gave some insight into his firm’s approach to investment, particularly recruitment. Interestingly, he has never hired from within the industry, but has preferred instead to bring in astronomers, mathematicians and statisticians.

“I like to say that you can teach a physicist finance, but you can’t teach a finance person physics,” said Simons.

As of 31 December, Renaissance Technologies’ portfolio had 3,683 holdings worth a combined value of $64.6bn, up from $58.7bn the previous quarter.

Its top holding was Novo Nordisk [NVO] — best known for its hugely popular obesity and diabetes drugs Wegovy and Ozempic — accounting for 2.2% of the portfolio, at a value of $1.4bn. However, the stake was reduced by 15% during the last three months of the year.

Simons’ Big Tech Bets

While Renaissance doesn’t share insight into its investment decisions, the purchase of Meta shares in Q4 2023 would seem to reflect a broader, bullish view on the tech sector.

Its position in Uber [UBER], the firm’s second-biggest holding as of the end of Q4, increased by 81.1% in the last three months of 2023.

Meanwhile, the fund took up 28.2% stock in third-biggest holding Nvidia [NVDA]. It also started a new position in Amazon [AMZN] and added 244% more shares to its stake in IBM [IBM].

Its Tesla [TSLA] holding increased 256.5%, but it reduced shares held in Apple [AAPL] by 46.2% and sold out of Microsoft [MSFT] completely.

Other tech stocks in which new positions were started in Q4 2023 include Alphabet [GOOGL], Oracle [ORCL], Intel [INTC], Broadcom [AVGO], Micron Technology [MU] and Roku [ROKU].

Meta Pivots to AI

It remains to be seen whether Simons has added to his Meta stake in Q1 2024.

In February, Facebook’s parent company announced its first-ever dividend of $0.50-per-share and also authorised a $50bn share buyback programme, a move that was cheered by investors.

The company has also been pivoting its focus away from the metaverse towards AI.

In a statement released alongside the Q4 2023 earnings report, Meta Founder and CEO Mark Zuckerberg said the company has “made a lot of progress on our vision for advancing AI and the metaverse”.

He expects “our ambitious long-term AI research and product development efforts will require growing infrastructure investments beyond this year”.

ETFs with META in their top 5 holdings | 5 days performance |

|---|---|

| First Trust Indxx Metaverse ETF | -0.59% |

| -0.78% | |

-1.13% | |

| Fidelity Metaverse ETF | -1.36% |

| ProShares Metaverse ETF | -3.37% |

Data correct as of Tuesday, 19 March.

Meta’s Mega Rally

Powered by AI hype, the Meta share price has rallied an impressive 147.7% in the past year through 18 March, which makes it the second-biggest gainer among the ‘magnificent seven’ behind Nvidia. It’s also up 36.9% year-to-date.

Investors who are looking to gain exposure to Meta within the broader AI theme might want to consider the Roundhill Generative AI & Technology ETF [CHAT], in which Meta is the fourth-biggest holding, with a weighting of 4.2% as of 17 March. The fund is up 34.8% in the past year through 18 March and up 13.1% year-to-date.

Alternatively, there’s the Roundhill Magnificent Seven ETF [MAGS], which has Meta as the second-biggest holding, with a weighting of 17.2%. The fund is up 53.7% since it launched on 11 April last year and is up 13.8% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy