Adani Green Energy was ranked as the world’s largest solar power generational asset owner and solar photovoltaic (PV) developer in 2020. What will the Hindenburg-incited scandal mean for the Group’s highly leveraged expansion projects into renewable power and, by extension, India’s overall green energy sector?

- Adani Group companies had $108bn wiped off their total market valuation in a week so far.

- On Wednesday, Credit Suisse assigned a zero-lending value to notes issued by Adani Green Energy.

- Indian markets opened lower on Thursday, weighed down by Adani Group companies.

Confidence in Indian markets shakes

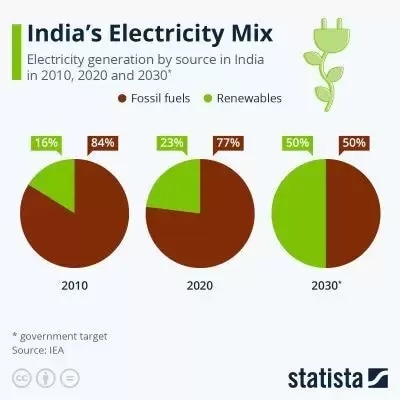

India’s economy was on track to becoming one of the world’s economic heavyweights. It overtook the UK to become the fifth largest economy in 2022, and the IMF expects the new ranking to become status quo. The country is also an emerging renewable energy producer, targeting 50% of their electricity generation to be from renewable sources by 2030, as visualised in the Statista infographic below.

However, havoc ensued after US short-seller Hindenburg Research published a report last week accusing Adani Group, parent of New York-listed Adani Enterprises [ADANIENT], of a range of fraudulent malpractices that led to a staggering $108bn (and counting) market valuation wipe-out from the Indian conglomerate’s subsidiaries.

Since then, Adani Group companies plummeted in US trading in a $92bn stock market crash, and banks are demanding more collateral for loans as they re-evaluate the company’s debt leverage. Meanwhile, financial institutions and business partners consider their exposure to the Group’s activities, and speculators wonder how far the collateral damage will go.

Adani Group companies weighed down on Indian markets, which opened lower on Thursday.

The conglomerate’s diverse ventures range from utilities to infrastructure, logistics and renewable energy. Its ambitious projects are highly leveraged, and with the sudden drop in investor confidence, analysts say Adani is at high risk of losing access to financing.

On Wednesday, Credit Suisse assigned a zero-lending value to notes issued by three subsidiaries, including Adani Green Energy [ADANIGREEN], unnamed sources familiar with the matter told Bloomberg.

Adani’s ambitious green energy projects

After its first solar project launch in 2015, Adani Green Energy quickly climbed the ranks to dominate the national and global solar power industries.

The company was ranked as the largest solar power generational asset owner and PV developer in the world, in terms of projects in operation, under construction and awarded, according to an August 2020 report by clean energy research firm Mercom Capital Group.

With a 12.3 gigawatt (GW) capacity, Adani’s renewable energy portfolio exceeded the total capacity installed by the entire US solar industry in 2019 and was forecasted to displace over 1.4 billion tons of carbon dioxide over its asset lifespan.

Hong Kong-listed independent solar power producer GCL New Energy [0451.HK] (7.1 GW) ranked second, followed by Tokyo-based renewable energy developer SB Energy (7 GW).

What’s next for India’s renewables sector?

Adani Power was the conglomerate’s most profitable company, gaining a staggering 200% in 2022. The company, which generates thermal energy from non-renewable sources like coal alongside solar, is India’s largest private power supplier.

While it is too early to measure the impact of the Adani scandal on the country’s renewable energy sector, it’s a safe bet to expect a loss of this magnitude to affect the group’s resources and budget negatively. This scandal is likely to have a knock-on detrimental effect on the entire renewables and solar power sector, given that Adani is a dominator in the space, both nationally and globally.

Given the recent events, the company’s vision “to have a portfolio of 25 GW of RE projects by 2025" looks unrealistically optimistic. Will it recover, or will Adani’s downfall severely stunt growth in India’s renewable energy sector?

Funds in Focus: Invesco Global Clean Energy ETF

The Invesco Global Clean Energy ETF [PBD] offers exposure to a broad range of clean energy companies and was up 17.21% in the last month.

The Global X Solar ETF [RAYS] includes a 3.26% holding in GCL Technology [3800.HK], and it was up 13.26% in the last month and 19.18% year-over-year.

The KraneShares Global Carbon Strategy ETF [KRBN] offers exposure to the most traded carbon credit futures contracts and was up 11.86% in the last year.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy