Brandon Rakszawski, VP and Director of Product Management at VanEck, discusses the performance of the VanEck Morningstar Wide Moat ETF [MOAT] compared to the S&P 500 over the short and the long term, as well as why it is underweight in “Magnificent Seven” stocks. He also highlights some rather unexpected holdings.

Performance Comparison

The VanEck Morningstar Wide Moat ETF [ETF] is a long-term core product, Brandon Rakszawski, VP and Director of Product Management at VanEck, tells Opto Sessions.

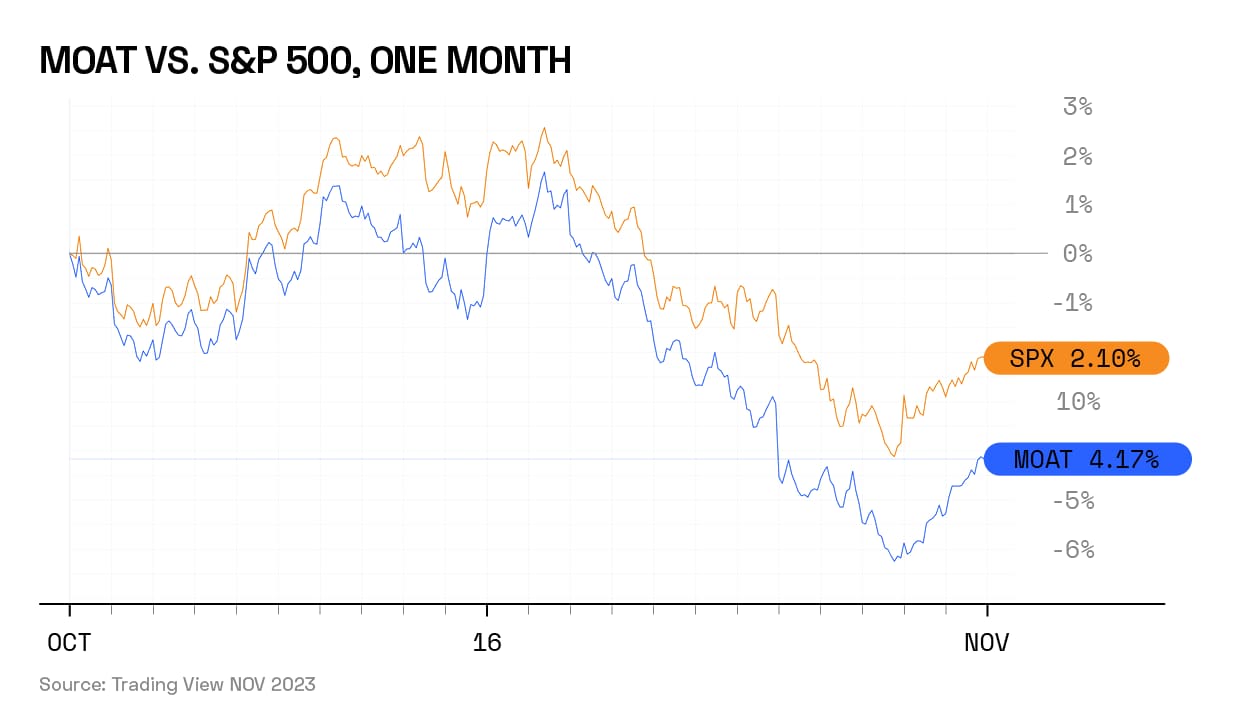

Rakszawski is clear that the fund is not designed for short-term exposure. “If you hold this strategy and look at one-month periods, it will outperform the broad market 50% of the time but will also underperform 50% of the time.”

In the month to 31 October, the fund fell 4.17% compared to the S&P 500’s losses of 2.1%.

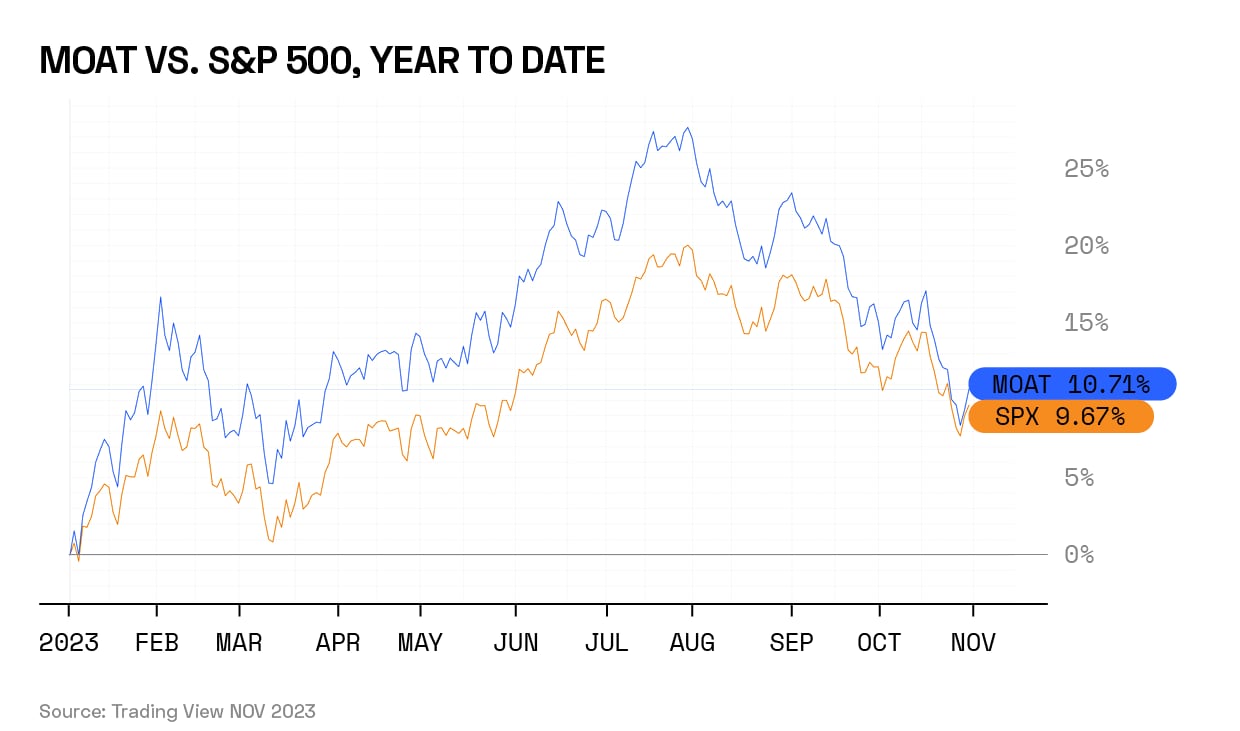

In the year to date, the fund slightly outperformed the S&P 500, gaining 10.71% compared to the S&P’s 9.67%.

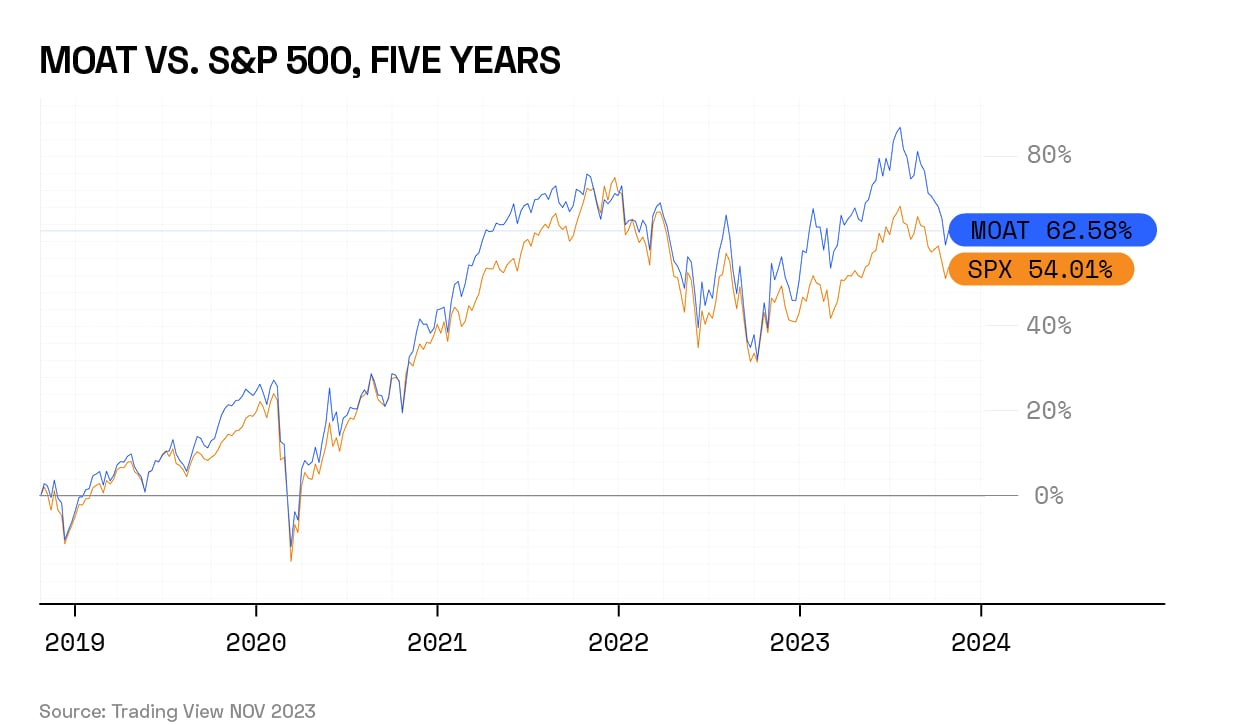

However, when looking at a five-year period, the fund has more widely outperformed the index, gaining 62.58% compared to the S&P 500’s 54.01%.

The reason for this is that the strategy is designed to work across market cycles. The stock selection process identifies stocks that, in Morningstar’s view, are undervalued. As such, the stocks it adds tend to be underperforming in the short term due to market conditions. Over the long term, however, these below-fair-value acquisitions drive the fund’s performance because they are sold off when market conditions turn favourable.

“Almost all of the fund’s excess return has been driven by stock selection,” says Rakszawski. Rather than smart sector allocation, the strategy is “really about allocating to the right companies at the right time”.

Magnificent Seven

The S&P’s recent performance has been driven largely by the “Magnificent Seven” stocks: Nvidia [NVDA], Tesla [TSLA], Meta Platforms [META], Apple [AAPL], Amazon [AMZN], Microsoft [MSFT], and Alphabet [GOOGL].

As Rakszawski explains, “There is a natural underweight in this strategy to those companies.” This is partly because some of them are not given wide moat ratings by Morningstar. The fund specifically targets companies to which Morningstar attributes a wide moat rating; Tesla, for example, does not qualify on this basis, according to Rakszawski.

Additionally, the gains the stocks have seen in their share prices naturally lead to them being overpriced, according to Morningstar’s metrics. Given that the fund’s strategy relies on buying wide moat stocks at attractive valuations, it is unsurprising that it is underweight in these stocks following a rapid surge — although Rakszawski mentions that the fund did hold Nvidia prior to its sharp rise, and hence was able to profit from it.

The fund has an equal weighting strategy, “so even if it was allocated to every eligible Magnificent Seven company that had a wide moat rating, it would be underweight compared to the S&P 500.”

However, in Rakszawski’s view, this only underlines the effectiveness of the fund’s strategy.

“What I find fascinating is that the index has managed to outperform over the long term, despite being structurally underweight in the companies that are so well documented as having essentially driven market returns for the last decade.”

Delivering Surprises

One surprising holding for Rakszawski is Domino’s Pizza [DPZ]. “We get a ton of questions from investors and our existing clients” about its position in the top holdings, says Rakszawski. “But Domino’s is a pretty notable company. Morningstar cites that one-in-five pizzas sold globally are sold by Domino’s.”

Domino’s moat (or crust) also consists of a technological infrastructure that delivers competitive and cost advantages. “The company is able to make pizzas at such scale and has a captive audience.”

A lesser-known holding is Keysight Technologies [KEYS], which provides equipment for research, developing and testing across a wide range of manufacturing industries.

“Keystone has built this intangible asset source of moat, as well as a switching cost source of moat, because it is so entrenched in the testing and diagnostics phase of the product lifecycle.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy