US-listed nuclear energy stocks Oklo [OKLO], NuScale Power [SMR] and Lightbridge [LTBR] have more than doubled their share prices since the start of the year.

Oklo is a nuclear power plant operator that aims to sell electricity from small modular reactors (SMRs), which are scaled-down versions of traditional light-water reactors. The company is also developing nuclear fuel recycling capabilities.

NuScale designs and licenses SMRs. It depends on third-party utilities and nuclear power plant companies to deploy its reactors.

Lightbridge is a nuclear fuel technology company. The company is developing advanced metallic fuel rods designed to lower reactor temperatures and boost power output at lower costs.

In this article, we focus on the US nuclear energy industry. We will cover regulatory developments, analyze each stock’s price performance and reflect on the bull and bear cases for OKLO, SMR and LTBR.

Sector Talk: Nuclear Comes Back Online

Nuclear energy is experiencing a resurgence in the US after years of skepticism over safety concerns, radioactive waste disposal and high capital costs.

Under the Biden Administration, the main agenda behind the nuclear energy sector push was clean energy. In 2021, Washington passed the Infrastructure Investment and Jobs Act, which allocated funds to prevent existing plants from retiring and to promote new reactor deployment to reduce carbon emissions. The Inflation Reduction Act followed in 2022, supporting the industry through tax credits and investment incentives for advanced reactors and fuel producers.

US President Donald Trump has also embraced the nuclear energy sector to power the energy-hungry artificial intelligence (AI) industry and to strengthen the nation’s energy security. In May, President Trump signed an executive order that directed the release of uranium fuel to private projects, the construction of nuclear power plants in military bases, and the cutting of “regulatory red tape hampering use of nuclear power”.

President Trump criticized the decline of US nuclear leadership, blaming “overregulated complacency” after reports showed that 87% of new global reactor builds use foreign designs. His administration now aims to restore US influence by developing commercial civil nuclear projects worldwide.

A growing share of nuclear energy demand is coming from AI companies, as nuclear power provides steady, round-the-clock electricity perfectly suited for 24/7 data-center operations. In contrast, alternative renewable sources like wind and solar are dependent on weather and daylight conditions.

Tech giants like Amazon [AMZN], Microsoft [MSFT] and Alphabet [GOOGL] have already signed direct supply deals with nuclear plant operators such as Talen Energy [TLN] and privately held Kairos Power to support their expanding AI data centers.

More recently, in late September, the US Department of Energy selected Oklo, alongside three private firms — Terrestrial Energy, TRISO-X and Valar Atomics — for a pilot program to build advanced nuclear fuel lines.

OKLO vs SMR vs LTBR: Power Surge

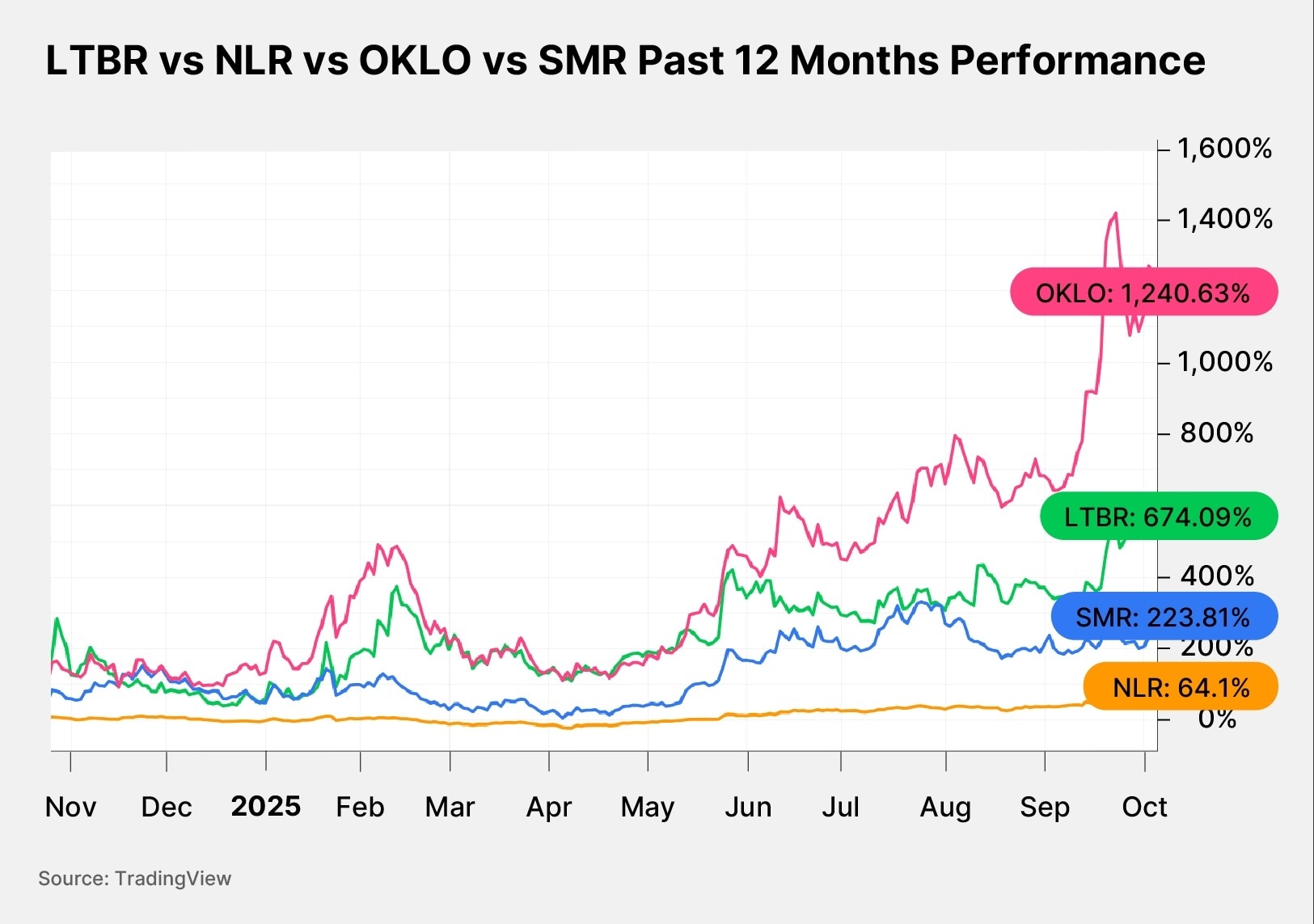

Over the past year, OKLO’s share price has surged 1,240.63% to $127.36, as of October 3. In year-to-date terms, OKLO stock is up nearly 500%.

New York-listed NuScale Power’s share price has climbed 223.81% in the past year, as of October 3. SMR stock has more than doubled from $17.93 at the start of 2025 to its last trading price of $40.12.

Nasdaq-listed Lightbridge has returned 674.09% to investors over the past year. LTBR stock is up 348.41% year-to-date and was trading at $21.21 as of October 3.

The VanEck Uranium and Nuclear ETF [NLR], which tracks uranium mining companies and nuclear power producers globally, was up 64.1% in the past year and up 73.83% year-to-date, as of October 3.

Here is how the fundamentals of the three stocks currently compare to each other.

OKLO | SMR | LTBR | |

Market Cap | $19.01bn | $5.29bn | $624.56m |

P/S Ratio | N/A | 81.84 | N/A |

Estimated Sales Growth (Current Fiscal Year) | 0% | 27.16% | N/A |

Estimated Sales Growth (Next Fiscal Year) | 0% | 223.76% | N/A |

Source: Yahoo Finance, as of October 3

OKLO, SMR and LTBR Stock: The Investment Case

The Bull Case for Oklo: Next-gen Fast Fission Plants

Oklo is developing next-generation nuclear power plants that can use both fresh and used nuclear fuel to produce energy. According to the company, conventional nuclear can only use 5% of the energy content in nuclear fuel, leaving over 90,000 metric tons of nuclear waste produced in the US over the last 50 years untapped.

As a power producer selling electricity through purchase agreements, Oklo could benefit from low-cost fuel by recycling nuclear waste. The company is also advancing fuel recycling technology, aiming to launch a commercial-scale facility in the US by the early 2030s.

“We are working with the Department of Energy on that recycling capability because there is enough nuclear fuel (waste) in storage to power the US for a hundred years, and every year the country generates another four years of the stuff,” said Oklo CFO Craig Bealmear in a recent conversation on the OPTO Sessions podcast.

The Bear Case for Oklo: Pre-revenue Risks

Oklo is still pre-revenue, with no commercial reactors built. The company expects to deploy its first nuclear power plant by late 2027 or early 2028.

Execution risk is high. For investors, there is no guarantee that the company will deliver on its promises. OKLO stock’s valuation surge over the past year leaves little buffer for missteps.

The Bull Case for NuScale: Deployment Gathers Pace

NuScale has proven its technology. In 2020, it became the first company to receive US design approval for its SMRs. In May 2025, NuScale received a second design approval for an upgraded 77MW electrical plant design.

US-based ENTRA1 Energy has since entered an exclusive strategic partnership to commercialize NuScale’s reactors, with plans to deploy them across seven states in what was described as the largest SMR deployment in US history.

The Bear Case for NuScale: Unproven Business Model

Despite seeing design approval, NuScale’s business model remains unproven. In November 2023, the company was forced to cancel the Carbon Free Power Project with the Utah Associated Municipal Power Systems after failing to secure “enough subscription to continue toward deployment”.

Additionally, NuScale and other nuclear power companies are heavily dependent on political stability, and their projects carry high capital costs and long lead times. In order to operate internationally, NuScale will have to acquire separate design approvals in each country of operation.

The Bull Case for LightBridge: Bullish on Reactor Buildout

With US nuclear energy capacity projected to triple by 2050, according to the US Department of Energy, an ancillary player like Lightbridge stands to benefit from the increased reactor buildout.

Lightbridge also expects its advanced nuclear fuel technology to upgrade existing reactors and boost their power-generating capabilities.

Bear Case for LightBridge: Research and Testing

Lightbridge’s technology remains in the research and testing phase, with no commercial adoption yet. The company relies heavily on government grants and partnerships, leaving limited near-term revenue visibility.

High R&D expenses, uncertain funding continuity and potential competition from alternative fuel developers add to execution risk. Unless the company successfully transitions from prototype to commercial validation, its long-term investment case remains speculative.

Conclusion

Oklo, NuScale and Lightbridge reflect renewed investor optimism in US nuclear energy. Policy support and AI-driven demand are driving growth in the sector, but high valuations and execution risks remain.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy