In today’s top stories, Ryan Reynolds-backed Mint Mobile is acquired by T-Mobile, Credit Suisse shares rebound 32% and Stripe’s valuation is slashed by close to 50%. Meanwhile, Zipline launches a 10-minute drone delivery service and social media stocks jump following threats to ban TikTok in the US.

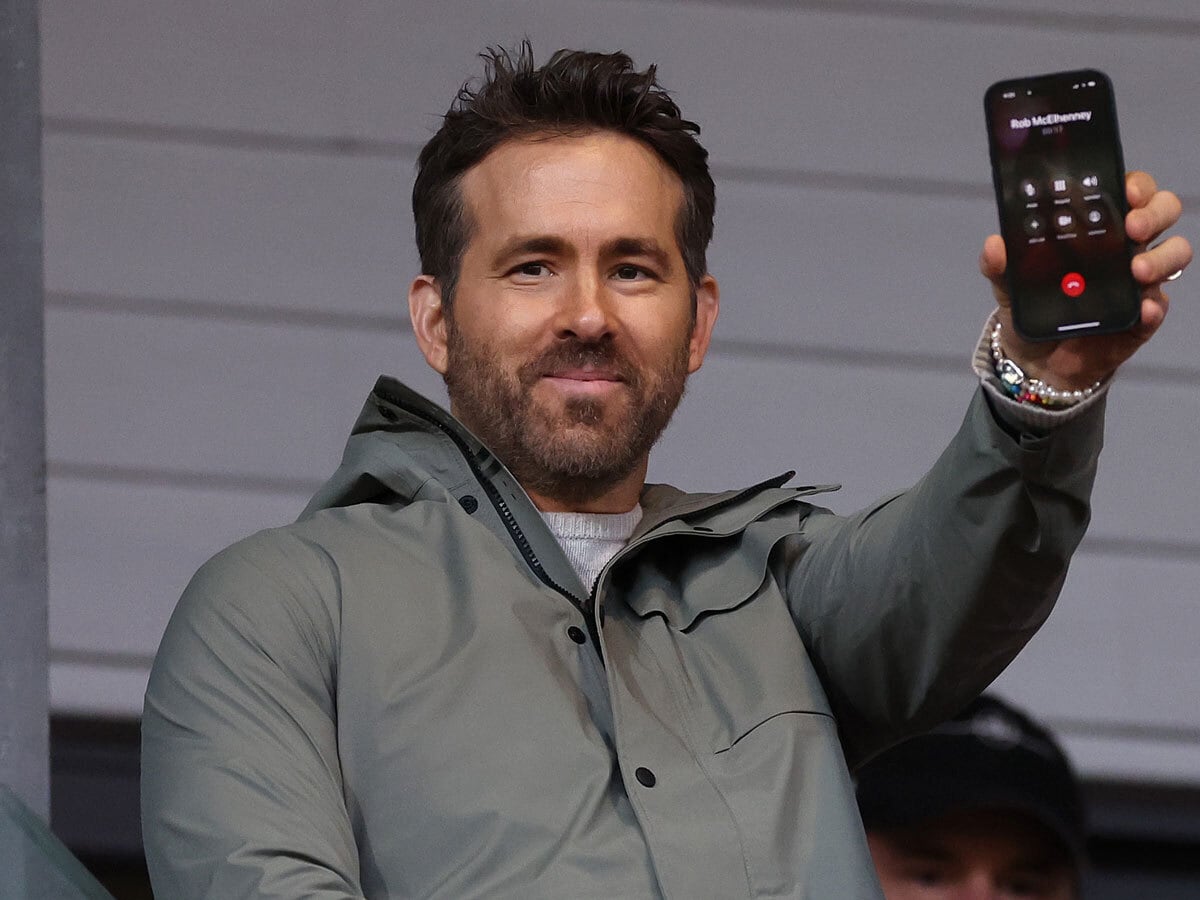

Reynolds makes a mint on wireless start-up sale

American actor Ryan Reynolds is set to rake in $300m in cash and stock by selling wireless start-up Mint Mobile to T-Mobile US [TMUS] for $1.35bn. Reynolds used his own celebrity status to market the company, in which he holds a 25% stake, as well as his own marketing agency. He will continue to appear on Mint Mobile’s ads, which will maintain its brand, and Reynolds will continue to play a creative role in the company, according to T-Mobile.

Credit Suisse swaps “panic” for “facts”

Credit Suisse [CSGN.SW] shares rebounded as high as 32.6% on Thursday morning on news that the Swiss National Bank would loan it up to CHF50bn. Default swaps for Credit Suisse bonds fell, though they remain in distressed territory. CEO Ulrich Körner urged employees to focus on facts when communicating to clients and stakeholders, while Saudi National Bank chairman Ammar Al Khudairy called the stock’s decline “a little bit of panic” and ultimately “unwarranted”.

Stripe’s value slashed in $6.5bn capital raise

In a reflection of the new reality for tech stocks, payment processing company Stripe has accepted an almost 50% reduction in its value over two years in order to raise $6.5bn new capital. The fund raise, from existing investors including Peter Thiel’s Founders Fund, Andreessen Horowitz and new investors including Temasek, saw Stripe valued at $50bn, compared to its peak valuation of $95bn in 2021.

Zipline launches 10-minute drone deliveries

Drone logistics startup Zipline has partnered with three US hospitals and salad restaurant chain Sweetgreen [SG] to launch a 10-minute drone delivery service. Customers within a 10-mile radius will be able to order drug prescriptions and custom-made salads to arrive within 10 minutes. Alphabet’s [GOOGL] Wing claims it has capacity to deliver 1,000 packages per day in select areas, and hopes to scale its drone delivery service to millions of daily packages within 18 months.

Snap shares bounce 8% on TikTok ban threat

Snap [SNAP] and Meta [META] shares gained 8% and 3% respectively following threats of a nationwide TikTok ban from US President Joe Biden. Unless TikTok is separated from its Chinese owner ByteDance, White House officials fear the app’s data could pose a security risk, though TikTok insists divestment wouldn’t restrict data flows to Beijing. Meanwhile, Morgan Stanley [MS] gives Amazon [AMZN] nearly 60% upside in its top tech picks note, and suggests the ecommerce giant could accelerate again in August.

ETF veteran Christian Magoon on Opto Sessions

One of the minds behind some of the first to market thematic ETFs — Christian Magoon — joins Opto Sessions to discuss Amplify’s ETF strategy, as well as why he believes that the blockchain revolution will make cryptocurrency look like email and why Amplify’s Lithium ETF allows investors to “own the future of electrification of fossil fuels”. He also explains how Amplify’s Thematic All-Stars ETF [MVPS] offers investors a snapshot of the ETF ecosystem.

Smartsheet gains 18% on surprise profits in Q4 earnings

Software companies Oracle [ORCL], Smartsheet [SMAR] and Adobe [ADBE] reported earnings this week. While Smartsheet posted unexpected profits and Adobe achieved record revenues of $4.7bn, Oracle missed analysts’ revenue expectations, and its share price fell 5% in after-hours trading Monday. Smartsheet shares gained 17.8% on Wednesday, while Adobe shares were up 5% after hours the same day.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy