San Diego-headquartered chipmaker Qualcomm [QCOM] has long been a major player in the smartphone industry, providing central processors (CPUs) and modems for Apple’s [AAPL] iPhones and Samsung [SSNLF] handsets. Now, it’s expanding into artificial intelligence (AI) data centers to keep pace with Advanced Micro Devices (AMD) [AMD] and Nvidia [NVDA].

Qualcomm has been lagging behind these two powerhouses — until now. At the end of October, Qualcomm, led by CEO Cristiano Amon since 2021, announced AI accelerators designed to help deliver the computing power required to train and run large language models.

The AI200 is due to go on sale in 2026 and the AI250 is targeting a 2027 launch — both will come in liquid-cooled server racks, similar to chips offered by AMD and Nvidia.

According to Amon, Qualcomm’s addressable market for AI data centers is “all of it”. He made the bold claim when speaking to CNBC on November 6, following Qualcomm’s Q4 2025 results, which were reported after the market closed on November 5.

Qualcomm’s Q4 Earnings Beat

Revenue for fiscal Q4 rose 10% year-over-year from $10.24bn to $11.27bn, surpassing the consensus expectation of $10.79bn. Earnings were $3.00 per share versus Wall Street expectations of $2.88.

Breaking down the revenue, Qualcomm’s handset business saw sales rise 14% to $6.96bn. The automotive chips segment reported a 17% increase to $1.05bn, and the Internet of Things unit, which includes sales of chips for Meta’s [META] smart glasses and virtual reality headsets, was up 7% to $1.81bn.

Collectively, the three units are reported as the QCT segment, while the rest of the revenue — approximately 12.5% in Q4 2025 — comes through licensing, reported as QTL.

“We are excited about our business momentum, the availability of our automated driving stack, and our expansion to data centers and advanced robotics,” said Amon in the earnings press release.

Reducing Reliance on Sales to Apple

Qualcomm also reported that non-Apple QCT revenue rose 18% year-over-year, a slight uptick from the 15% growth seen in Q3.

Continued growth in non-Apple QCT revenue will be crucial. The iPhone maker launched its first in-house modem, the C1 in February, ending its chip dependency on Qualcomm. Apple is expected to phase out reliance on Qualcomm’s modem chips completely by 2027.

Amon said on the Q4 earnings call that non-Apple QCT revenue has been “driven by Android customers and primarily premium tier with the launch of our new Snapdragon chip”.

Snapdragon-Powered Android Sales to Drive Q1 Sales

Qualcomm is expecting QCT handset revenue to hit a record high in Q1 2026, thanks largely to sales of new Snapdragon-powered flagship Android smartphones.

Revenue for the three months to the end of December is forecast to be in a range of $11.8bn–12.6bn, level with the analyst consensus of $12.08bn, according to Yahoo Finance. Earnings are projected to be in the $3.30–3.50 per share range, while Wall Street is expecting $3.41 per share.

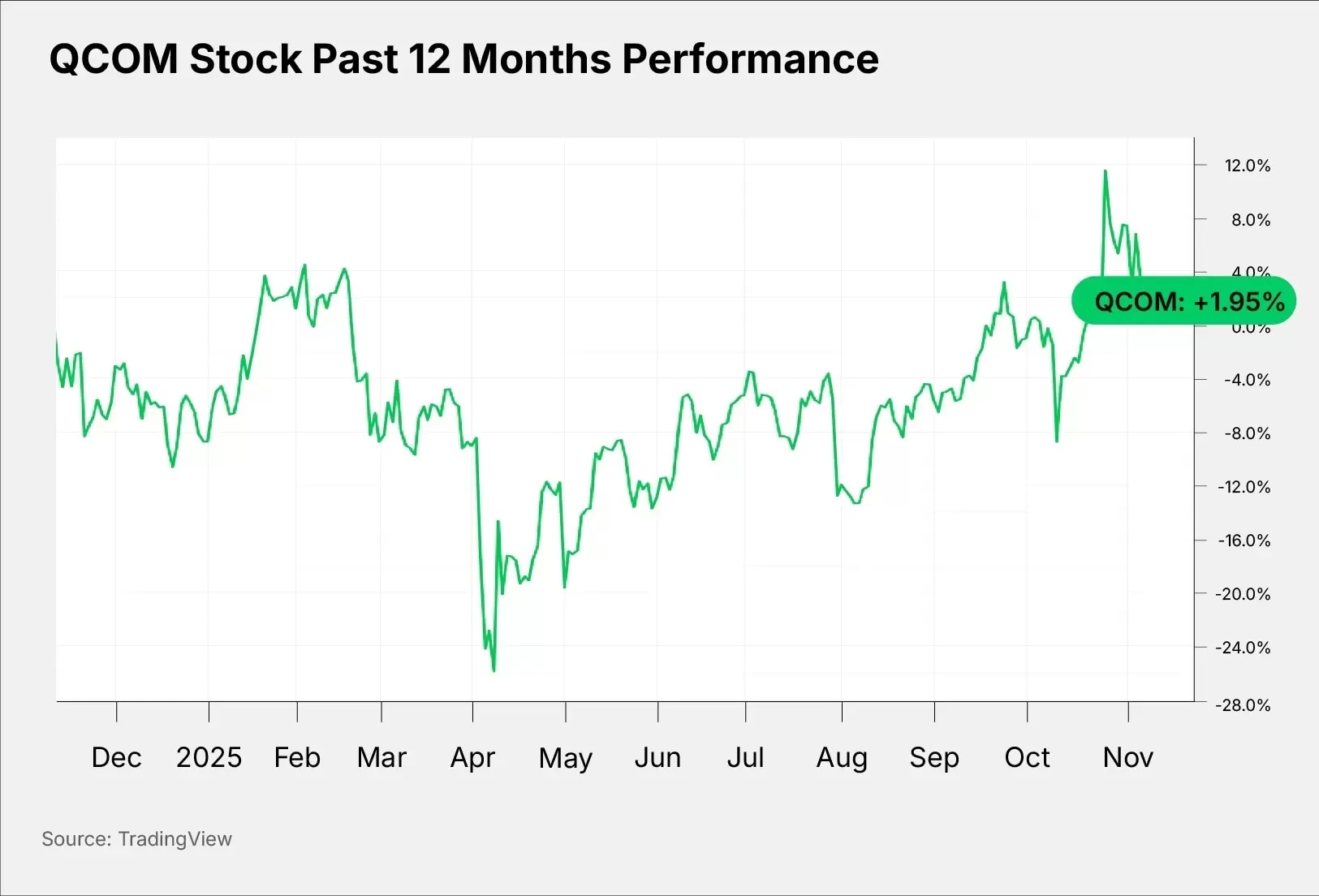

QCOM Stock Sells Off

Despite the strong Q4 numbers, QCOM stock has tumbled 5.1% in the week to $171.57 at the close on November 10. The share price had set a 52-week high of $205.95 on October 27.

Last week’s fall could be attributed to the broader tech selloff as opposed to the earnings themselves.

The Data Center Competition

Qualcomm will face a tough job trying to compete against Nvidia and AMD in the data center market.

Nvidia, which is set to report its fiscal Q3 2026 earnings on November 19, saw data center revenue jumping 56% year-over-year in Q2 to $41.1bn, accounting for approximately 88% of total revenue of $46.7bn.

AMD reported a 22% rise in data center revenue to $4.34bn in its Q3 2025, making up approximately 47% of total revenue.

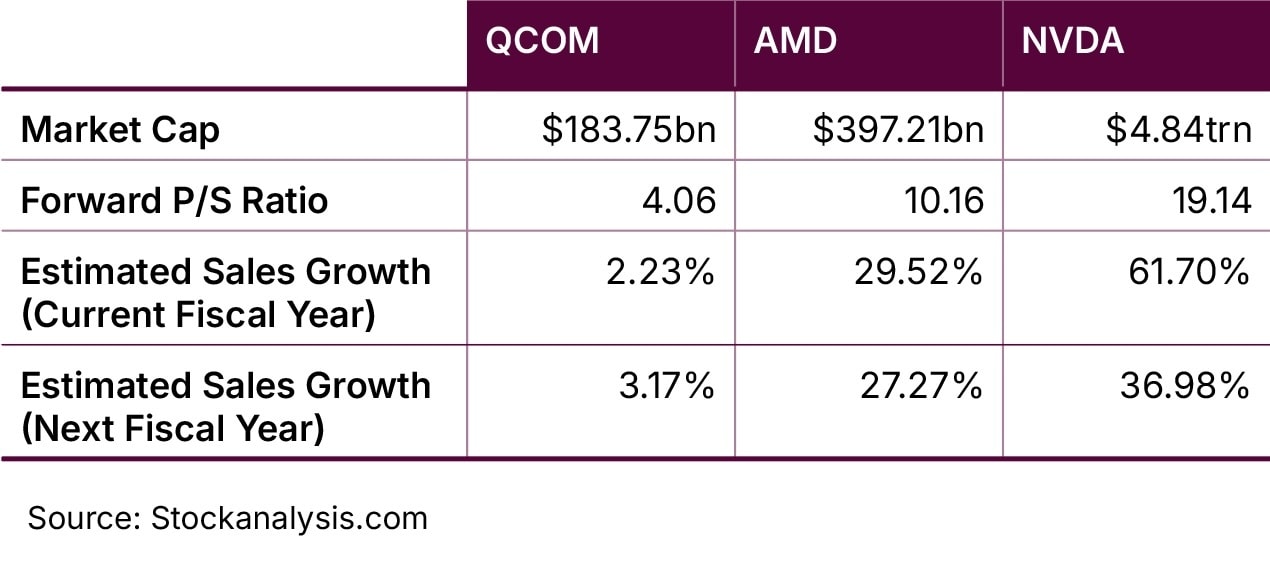

Here is how the fundamentals of the three companies currently compare:

Qualcomm’s projected revenue growth over the next couple of years is unlikely to excite investors. However, if the company can execute on its AI data center push, then this could accelerate growth, and Qualcomm could potentially see a forecast like AMD and Nvidia’s.

Based on the current forward P/S ratio, QCOM stock could be considered an undervalued AI play.

QCOM Stock: The Investment Case

The Bull Case for Qualcomm

Amon is confident that Qualcomm can make a mark in the data center market, telling analysts on the Q4 earnings call that the AI200 and AI250 have a competitive edge.

“We believe we have one very strategic asset in the industry, which is a very competitive, power-efficient CPU that is both for the head node of AI clusters as well as general-purpose compute,” said Amon, adding that it’s “been building what we think is a new architecture dedicated for inference”.

QCOM stock received a boost following the earnings after Bank of America analysts raised their price target from $200 to $215, partly on the “potential strength of the company’s QCT business beyond smartphones”. The analysts also believe the AI200 and AI250 could add $2bn in annual revenue to Qualcomm’s top line.

The Bear Case for Qualcomm

The obvious risk is if Qualcomm fails to secure enough customers for its AI200 and AI250 chips. Not only could the company lose further ground to AMD and Nvidia, but investors might lose interest in the chipmaker as well.

Conclusion

It may have taken a while for Qualcomm to join the AI chip race, but, as the saying goes, it’s better late than never. That said, given that the first in the line of AI chips will not be available commercially until next year, it will be a while yet before Qualcomm starts reporting sales.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy