The three Rs — reduce, reuse and recycle — are critical to the circular economy. If countries are to hit their net zero targets, then they’ll likely need to develop greener solutions to oil and plastic. This should put companies developing bioplastics and biofuels in the spotlight.

- President Biden wants the US to phase out 90% of fossil fuel-based plastics over the next 20 years.

- Costs may be a barrier to entry to producing bioplastics, but technology licensing could reduce risks.

- How to invest in the circular economy: the WisdomTree Recycling Decarbonisation UCITS ETF is up 5.2% in the past year.

Recycling may not appear the most glamorous of investment themes, but it is increasingly critical to the economy. Cities that are cleaner and greener are more likely to be happier and more economically productive.

In March 2023, US President Joe Biden issued an executive order on biotechnology and biomanufacturing, in which he set a target of replacing 90% of fossil fuel-based plastics with bio-alternatives over the next 20 years.

“An urgent global need exists to rapidly enable a more circular economy for today’s fossil carbon-based polymers production,” said the report, “and to source chemical building blocks for tomorrow’s recyclable-by-design plastics from bio-based and waste sources.”

It also calls for the development and expansion of research into increasing food recovery through recycling programmes, such as turning food waste into agricultural feed, fertilisers materials, bioproducts and biofuels.

Stephen Croskrey, chairman and CEO of Danimer Scientific [DNMR], hopes the report will spur broader uptake of bio-based materials. “It is not only the right thing for our environment, but it’s also smart business, as the public becomes increasingly aware of the scope of the plastic waste crisis and will gravitate toward products with environmentally friendly packaging,” he told Packaging Insights.

This top-down and bottom-up pressure to increase the recycling of waste products creates tailwinds for several of the theme’s key players.

Companies developing green solutions

Nebraska-based Green Plains [GPRE], which makes ethanol from corn byproducts, is to invest $400–500m to research and develop new ways to make fibre, protein, yeast and oil from corn kernels.

CEO Todd Becker told AgWeek in January that diversifying the business is important because relying on revenue from ethanol is challenging due to market volatility. “When we walk into any given year, we don’t know what ethanol is going to do… We don’t have a forward marketing strategy,” he said.

Texas-based Darling Ingredients [DAR] processes, manufactures and distributes a range of sustainable natural ingredients derived from edible and inedible bionutrients and biofuels. Some of the industries its products are sold in include agricultural feed, food, pet food, and pharmaceuticals.

Darling Ingredients’s adjusted EBITDA rose to $418.4m in the first quarter of 2203 from $330m a year earlier. “Diesel is expected to gain tremendous momentum in the second quarter as lower fat prices will boost renewable diesel margins on expected higher volumes," said CEO Randall C Stuewe in a statement. Low-carbon feedstocks can help to “illustrate the margin potential for renewable diesel in a lower priced feedstock environment”, he added.

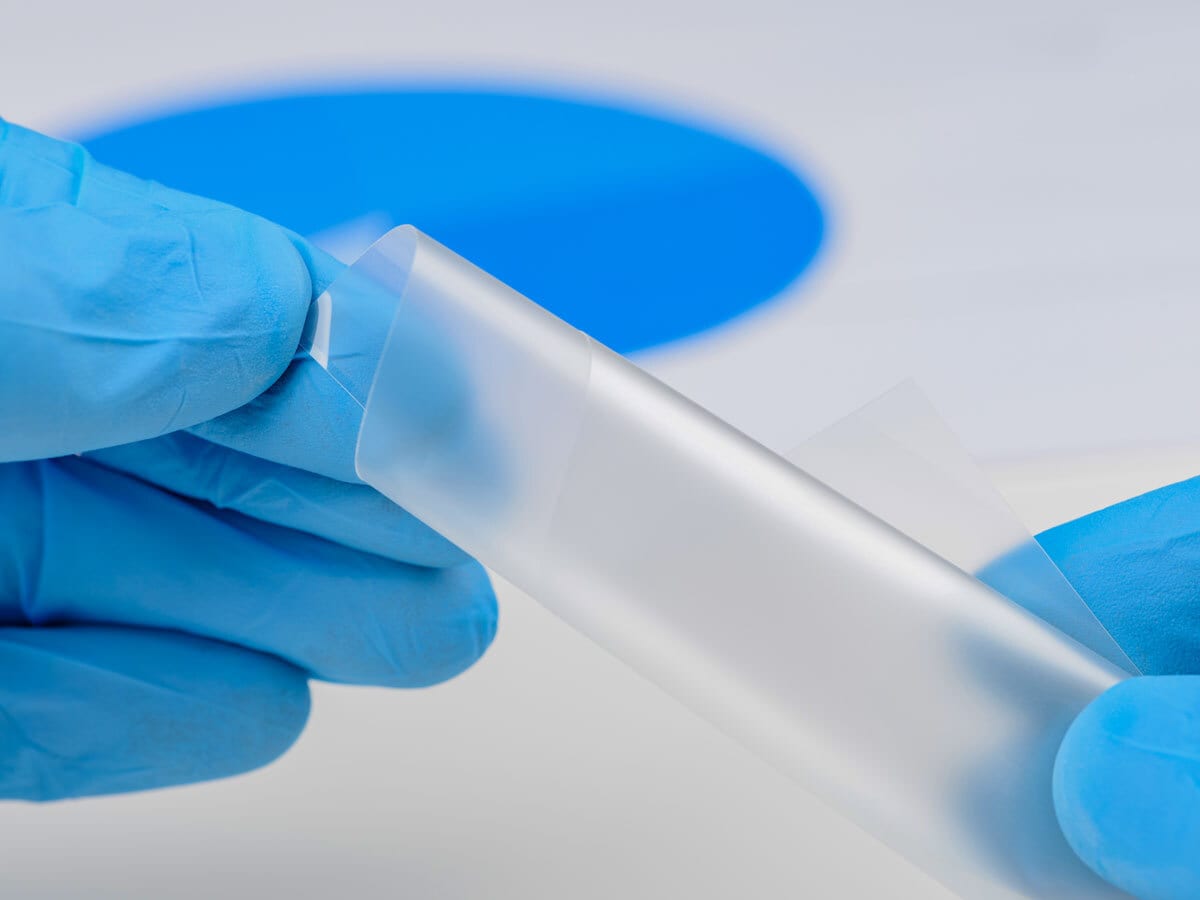

Ohio-based PureCycle Technologies [PCT] holds a global licence to use technology developed by Procter & Gamble [PG] to turn materials destined for landfill, including food packaging and liners, into resins that are 100% recyclable. The company produced its first pellets in June.

Circular economy demand expected to drive growth

According to a 2020 report from McKinsey & Company, bio-based processes could have a “direct economic impact of up to $4 trillion a year over the next ten to twenty years”.

In the near-term, growth in bio-based processes will be partly spurred by President Biden’s government drive to promote and support sustainability and circular economy initiatives.

Despite the current high inflation and interest rate environment weakening appetite for high-ticket items, consumer demand for bio-based alternatives will drive long-term demand, according to analysts at management consultancy Arthur D Little. This will include premium items — cost-of-living crisis aside, people are generally willing to pay more for ethical and sustainable products.

Are you finding this content insightful? Leave us some feedback here.

Technology licensing could reduce costs

Nevertheless, high costs could still be a barrier to entry and prevent bio-based plastics being adopted in the mainstream.

If bio-based plastics and biofuels are to be adopted more broadly, then the production costs will arguably need to come down. This, in turn, could reduce costs for customers and consumers. Technological innovations should help in this regard.

Developing new technology can be capital intensive, as Arthur D Little analysts point out, so companies may adopt a licensing model — as in the case of PureCycle Technologies and Procter & Gamble. This would reduce the risk and cost of developing new technologies or seeking M&A opportunities.

Government urged to go further

Despite the exciting potential around bio-based plastics and other materials, critics of the recent US push to phase out fossil fuels plastics believe it to be a false solution.

“By focusing on bioplastics and recycling, the administration is not addressing the root cause of the plastic pollution problem: we need to stop producing single-use plastics and switch to refill and reuse systems,” argued Kate Melges, Greenpeace USA plastics project lead, in March.

Rahul Bhushan, co-founder and investment strategies lead of Rize ETF, wrote in July: “The transition to a circular economy requires a collective effort from governments, businesses and individuals. It calls for a shift in mindset and a commitment to sustainability at all levels.”

How to invest in the circular economy

ETFs, or exchange-traded funds, offer an economical and diversified way to invest in a variety of stocks within a particular theme.

Fund in focus: WisdomTree Recycling Decarbonisation UCITS ETF

Rize ETF has recently launched the Circular Economy Enablers UCITS ETF [CYCL.L], which holds Darling Ingredients. Circular design and production accounts for 45.1% of the portfolio, followed by circular use (21.9%), circular value recovery (18.1%) and circular support (14.7%). The fund is up 13.04% through 26 July since its 19 June launch.

The VanEck CIrcular Economy ETF [REUS.F] tracks the MVIS Global Circular Economy ESG Index, which consists of companies involved in recycling services, waste management, waste-to-energy and biofuels. The fund is down 2.12% since its launch on 26 October last year through 25 July.

The WisdomTree Recycling Decarbonisation UCITS ETF [WRCY.L] holds Darling Ingredients, Green Plains and PureCycle Technologies. The industrials sector accounts for 43.07% of the portfolio, while the energy sector accounts for 28.45%. Materials and consumer staples have weightings of 11.43% and 10.78% respectively, while utilities and financials have been allocated 6.13% and 0.14% of the portfolio respectively. The fund is up 5.2% in the past year through 25 July, though down 0.6% in the past six months.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy