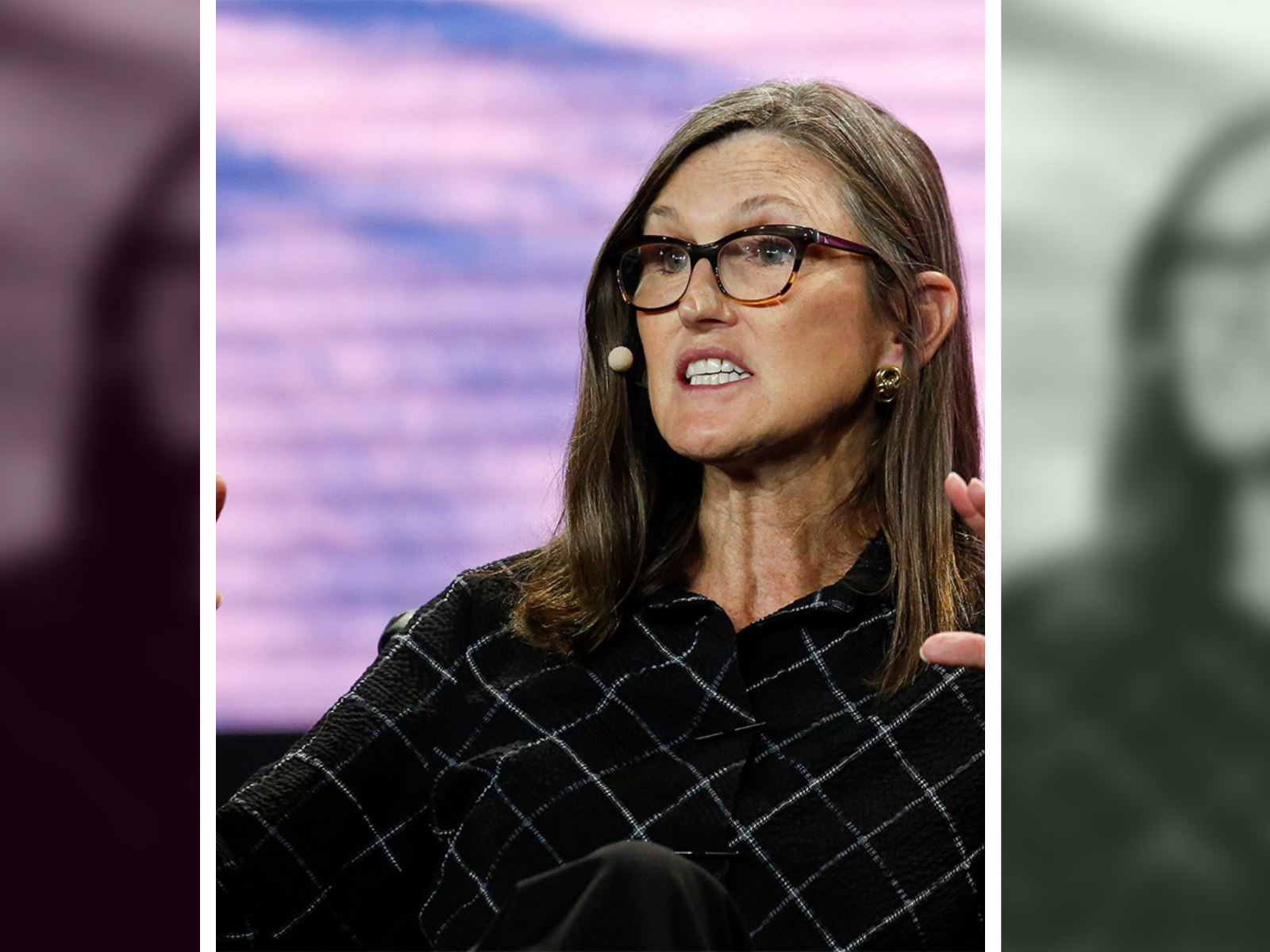

In today’s top stories, CEO of ARK Invest Cathie Wood (pictured) isn’t happy about Tesla being dropped from the S&P ESG index, Melvin Capital closes its funds and consumer stocks become the worst performing S&P 500 sector. Amid the broad market selloff, a Morningstar strategist reveals his stock picks for buying the dip, while Singapore and Indonesia markets buck the downturn.

Wood calls Tesla’s exclusion from ESG index “ridiculous”

ARK Invest’s Cathie Wood was not pleased with yesterday’s news that Tesla was dropped from the S&P 500 ESG Index in its annual rebalancing. While the carmaker has undoubtedly helped accelerate the shift to electric vehicles, S&P Dow Jones head of ESG indices Margaret Dorn said the company has “fallen behind its peers” in terms of ESG. The Tesla share price [TSLA] has tanked, prompting calls for a share buyback programme, though it had managed a slight recovery early Thursday, gaining 2.27% by 5pm GMT.

Consumer stocks outpace tech decline

Consumer stocks are the latest sector to be battered by dismal earnings and rising inflation, outpacing the decline seen by the tech industry. Consumer discretionary is the worst performing S&P 500 sector to date with a 30.8% decline, compared with information technology’s 24.5% fall. Major US retailers Walmart [WMT] and Target [TGT] were particularly badly hit after posting disappointing quarterly results: at 5pm GMT Thursday, Walmart was down 12.27% and Target down 27.13% since Tuesday's close

Melvin Capital to close funds

After making huge losses from betting on meme stocks last year and growth stocks this year, Melvin Capital founder Gabe Plotkin announced that he plans to close the fund and return cash to investors. Up until last year’s reversal, Melvin was one of the best performing hedge funds, with a strong track record of 30% annual growth and a reputation for successfully shorting stocks. However, in the 12 months through to April 2022, the fund had lost 23%.

Morningstar’s picks for buying the dip

Speaking to CNBC on Tuesday, Morningstar strategist David Sekera argued that US stocks are undervalued and gave his picks for long-term investors looking to get a good deal. Sekera mainly focused on mega-cap tech stocks like Alphabet [GOOGL], Amazon [AMZN], Meta [FB] and Microsoft [MSFT], but also said there are opportunities in the consumer space as spending returns to normal levels. He also named Uber [UBER], Delta Air Lines [DAL] and Carnival Cruises [CCL] as potential winners.

Southeast Asian indices buck downtrend

Asia-Pacific markets suffered heavy losses on Thursday, CNBC reported, with the Hang Seng down 2.5% and the Nikkei 225 falling 1.9%. Only two major indices in the Asia-Pacific region are trending upwards so far this year, and these are both in Southeast Asia. The Singapore Straits Times index is leading in the region, up 3.25% year-to-date on Thursday, while Indonesia’s Jakarta Composite is up 3.22%.

Gaming stocks to watch

Electronic Arts [EA], Roblox [RBLX] and Take-Two [TTWO] saw a surge in user numbers during the pandemic, but 2022 presents a more difficult environment with inflation and hardware shortages impacting sales. However, the gaming industry looks set to continue to grow, and these three companies should benefit in the longer term if they can continue to innovate and tap into the lucrative mobile gaming market.

Coinbase battles the crypto crash

The Coinbase share price plunged after disappointing Q1 earnings last week, at a time when investors were already turning away from cryptocurrency. With signs that we may have already seen the worst of the crypto selloff, the outlook could be improving for the stock. ARK’s Cathie Wood agrees, having bought 860,000 shares in Coinbase in the week to 12 May.

A bear market playbook

In this week’s episode of Opto Sessions, investment educator, author and YouTuber Brian Feroldi breaks down the psychology behind market movements. He explains that by understanding the emotions during market corrections and crashes, investors can better prepare for these down periods. Feroldi also explains why investing requires a long-term mindset and tells listeners his research process for picking stocks.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy