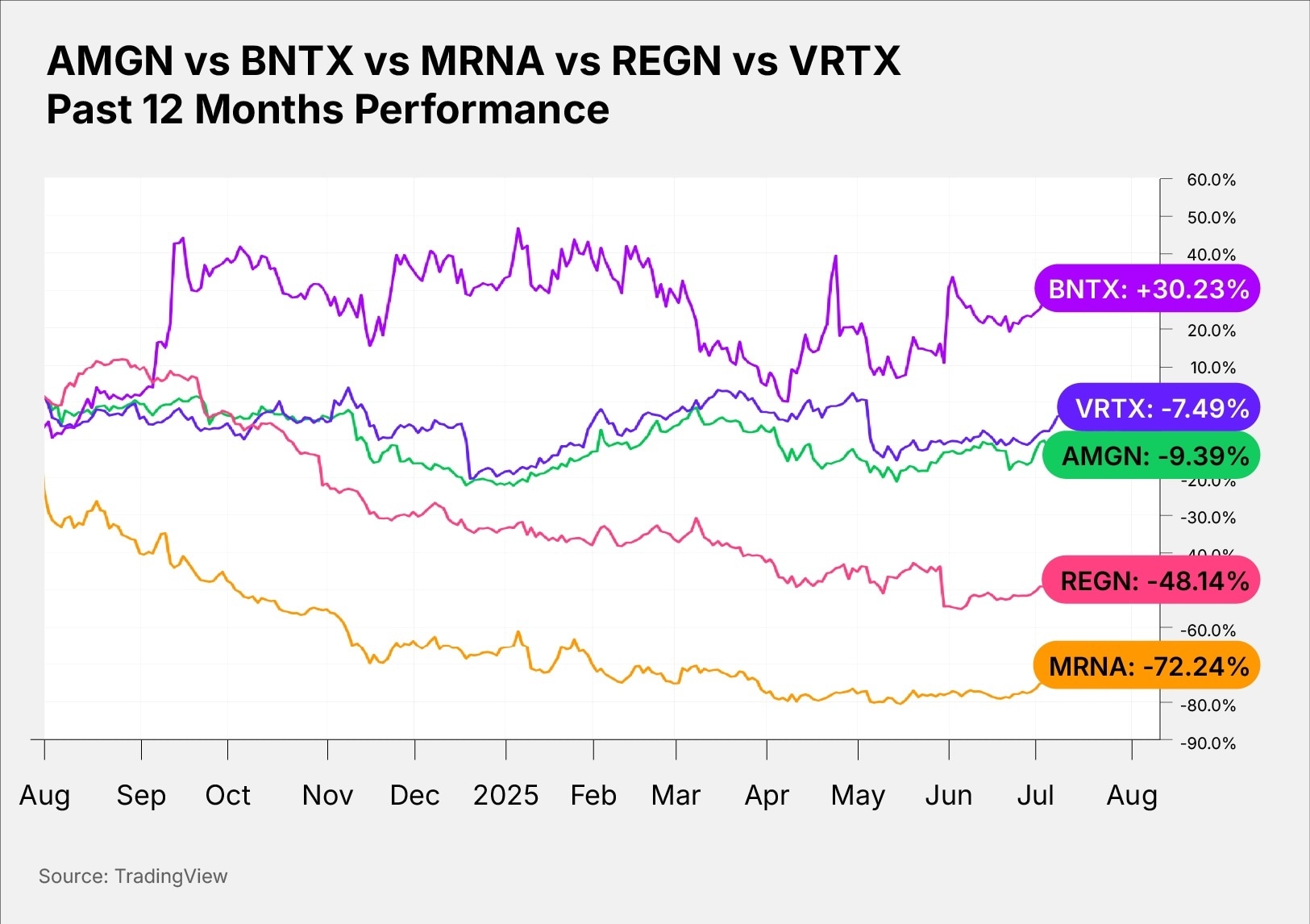

The upcoming biotech earnings season will reveal how key industry players are navigating post-Covid-19 demand shifts, R&D expenses and new product rollouts.

In this article, we highlight key themes to watch for in earnings reports from Regeneron [REGN], Moderna [MRNA], BioNTech [BNTX], Vertex Pharmaceuticals [VRTX] and Amgen [AMGN].

Regeneron is among the first biotechs to report, and investors have asked whether competition will eat into the market share of its cash-cow ophthalmology drugs. As for vaccine manufacturers Moderna and BioNTech, it is all about managing investor expectations after falling off pandemic-era highs.

Vertex’s non-opioid painkiller drug will see its first full quarter of sales, while Amgen’s upcoming weight-loss drug is expected to overshadow quarterly earnings yet again.

| AMGN | BNTX | MRNA | REGN | VRTX |

Market Cap | $162.01bn | $27.11bn | $13.11bn | $60.31bn | $118.34bn |

P/S Ratio | 4.79 | 8.40 | 4.16 | 4.53 | 10.69 |

Estimated Sales Growth (Current Fiscal Year) | 5.77% | -18.05% | -36.08% | -5.39% | 8.36% |

Estimated Sales Growth (Next Fiscal Year) | 1.83% | 1.76% | 16.32% | 6.00% | 9.82% |

Source: Yahoo Finance

Regeneron Pharmaceuticals: Eyes on EYLEA

Earnings Date: August 1

Regeneron is expected to report June quarter earnings during pre-market hours on August 1. Investor focus will be on the quarterly sales of its flagship eye disease drug EYLEA.

The company has been promoting a high-dose version of Eylea called Eylea HD to patients, which has contributed a substantial portion of Regeneron’s revenues since gaining US Food and Drug Administration (FDA) approval in August 2023.

In the full year 2024, Eylea and Eylea HD represented 42% of Regeneron’s product sales in the US. Eylea sales outside the US are made in collaboration with German pharmaceutical Bayer [BAYRY].

However, in Q1 2025, Regeneron saw total Eylea HD and Eylea US net sales decrease by 26% from a year ago, hurt by biosimilar products and competition from rivals.

Even more worrying was a growing trend that saw Eylea and Eylea HD net product sales fall 30% on a sequential basis as well.

REGN stock is down 21.36% in the year to July 28.

Moderna: Transitional Period

Earnings Date: August 1

Moderna has seen its stock price crater by about 72% in the past year due to the sharp decline in demand for Covid-19 vaccines. After enjoying its time in the limelight as a pioneer of mRNA vaccines, Moderna now has to navigate a transitional period.

The company entered 2025 with two approved products: a Covid-19 vaccine branded Spikevax, which accounted for nearly 100% of its net sales last year, and a 2024-approved lower respiratory tract disease vaccine called mResvia.

In 2025, the market will be mainly focusing on the financial discipline Moderna maintains to reduce its operating costs. The company is spending heavily on clinical trials of new cancer vaccines.

MRNA share prices are down 18.45% year-to-date.

BioNTech: A Tepid Financial Year

Earnings Date: August 4

BioNTech has already advised investors not to expect anything special from its earnings in 2025. In March, the Covid-19 vaccine maker said that revenues in 2025 will fall to a range of €1.7bn–2.2bn from the €2.75bn reported in 2024.

The announcement did not take the market by surprise, as sales of BioNTech’s Covid-19 vaccines have sharply declined from a peak of €18.98bn reported in 2021.

For 2025, the company has forecast research and development expenses will not exceed €2.8bn; selling, general, and administrative expenses will come up to €750m; and capital expenditures will be capped at €350m.

BioNTech was in a healthy position with €15.85bn in cash and cash equivalents at the end of Q1 2025. Any progress in the clinical evaluation of BioNTech’s upcoming cancer vaccines and antibody portfolio should be in focus.

BNTX shares are down a marginal 1.02% in the year to date.

Vertex Pharmaceuticals: A Critical New Cystic Fibrosis Drug

Earnings Date: August 4

Vertex Pharmaceuticals enters earnings season riding the momentum from recent approvals of a first-of-its-kind non-opioid painkiller branded Journavx in the US and its next-generation cystic fibrosis treatment drug called Alyftrek in the EU.

The EU approval of Vertex’s cystic fibrosis drug is a welcome boost for the company, which disappointed investors by reporting lower-than-expected sales in Q1 2025. However, EU approval for Alyftrek has come too late to impact Q2 results, as the drug was only approved on July 1.

Alyftrek, which received US FDA approval in late December 2024, is seen as critical to expanding Vertex’s dominance in the market for cystic fibrosis treatment.

The upcoming earnings report will see investors focus on the performance of Alyftrek and the acute pain drug Journavx, especially after Vertex raised the lower end of its FY 2025 revenue forecast.

The VRTX stock price is up 14.44% in the year to date.

Amgen: High Hopes for Weight Loss Drug

Earnings Date: August 4

Amgen outperformed Wall Street’s profit expectations in Q1 2025, supported by double-digit sales growth from 14 products and a newly launched cancer drug.

The best may be yet to come for Amgen as the company looks to break into the highly lucrative weight loss medicine market. The company is developing a once-a-month injectable weight loss drug called MariTide, which is currently in the final stage of clinical trials.

In November 2024, AMGN stock saw its worst trading session in over two decades after trial results showed that patients lost up to 20% of their weight at 52 weeks, which was lower than the 25% loss in body weight from rival drugs produced by Eli Lilly [LLY] and Novo Nordisk [NVO].

According to Bloomberg, updates related to MariTide have persistently overshadowed Amgen’s quarterly results, even though the drug is not expected to hit the market until 2027.

AMGN shares are up 17.55% since the start of the year.

Conclusion

Investor focus will be on Regeneron’s ability to address Eylea’s competitive pressures, as well as Moderna’s and BioNTech’s transitions beyond pandemic-era highs. Vertex’s momentum from regulatory wins is bullish, but market execution of new drugs will be even more important. Meanwhile, Amgen investors remain laser-focused on updates around MariTide.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy