In part three of this three-part series, Morgan Creek Capital Management’s China-based investment team continues to explore theevolution of corporate venture capital in China. In today’s article, the firm focuses on how Alibaba built a technology empire through strategic investments that helped to expand its reach.

In the previous issues, we discussed the evolution of corporate venture capital (CVC) and the opportunities and challenges it has faced while navigating changing investment environments, with last week’s focusing on Tencent [0700] Ventures. This week, we will discuss Alibaba’s [BABA] CVC and its investment strategy behind the scenes.

Alibaba Group, which was founded in 1999, has grown into a diverse company with business segments spanning ecommerce, cloud computing, media and entertainment. Alibaba’s main products today include Taobao, Tmall, Alicloud, 1688, Alimama and Cainiao.

Alibaba’s strategic investment department was established in 2008 with the mission of creating strategic and long-term financial value through investments, mergers and acquisitions (M&A) and expansion, and to become a core force in the ecommerce ecosystem. Alibaba aims to make majority/control investments, with the goal of ultimately integrating these portfolio companies into its own core businesses.

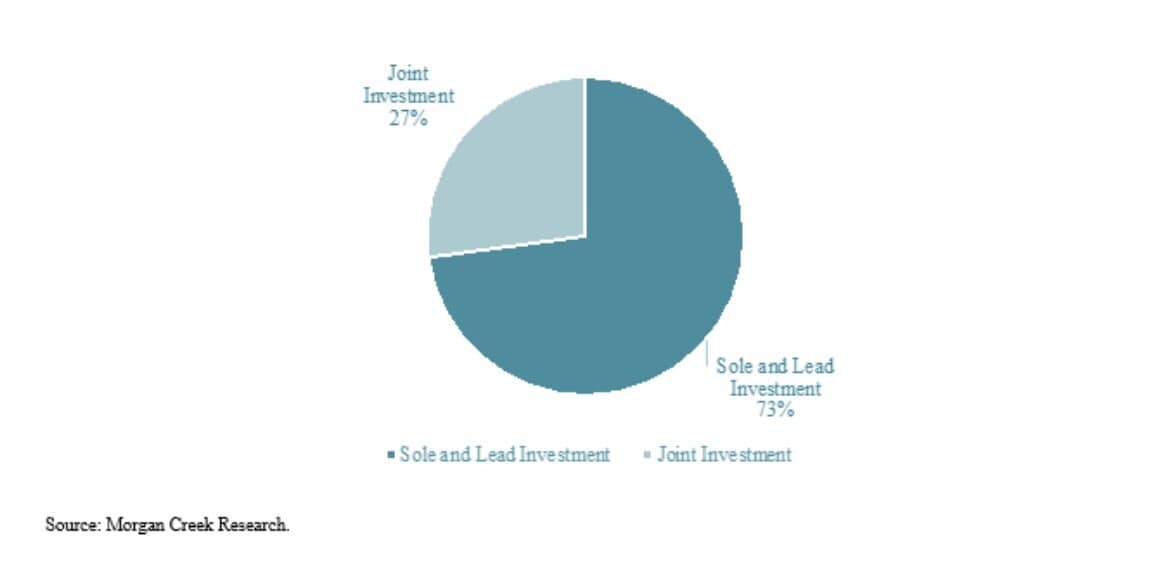

Alibaba acts as the sole or lead investor in the vast majority (approximately 70%, as illustrated in the chart below) of Alibaba's CVC investments. Many of these companies start out receiving minority equity investments from Alibaba in early financing rounds before eventually being acquired by Alibaba, reflecting the company’s cautious approach to its portfolio investments.

Alibaba prefers starting with a minority equity investment to test out the product or service for potential synergies with the Alibaba platform. When the strategic value of the portfolio company increases, Alibaba will choose whether to invest more capital in the company, acquire the company outright, or take no further action.

For example, in May 2013, Alibaba bought a 28% stake of map app Gaode for $294m, which made Alibaba Gaode’s largest shareholder. In 2015, Alibaba acquired Gaode for $1.05bn.

Another example of this strategy is when Alibaba invested in food delivery platform Ele.me four times, including two separate investments over $1bn each, before buying the company outright for $9.5bn in April 2018.

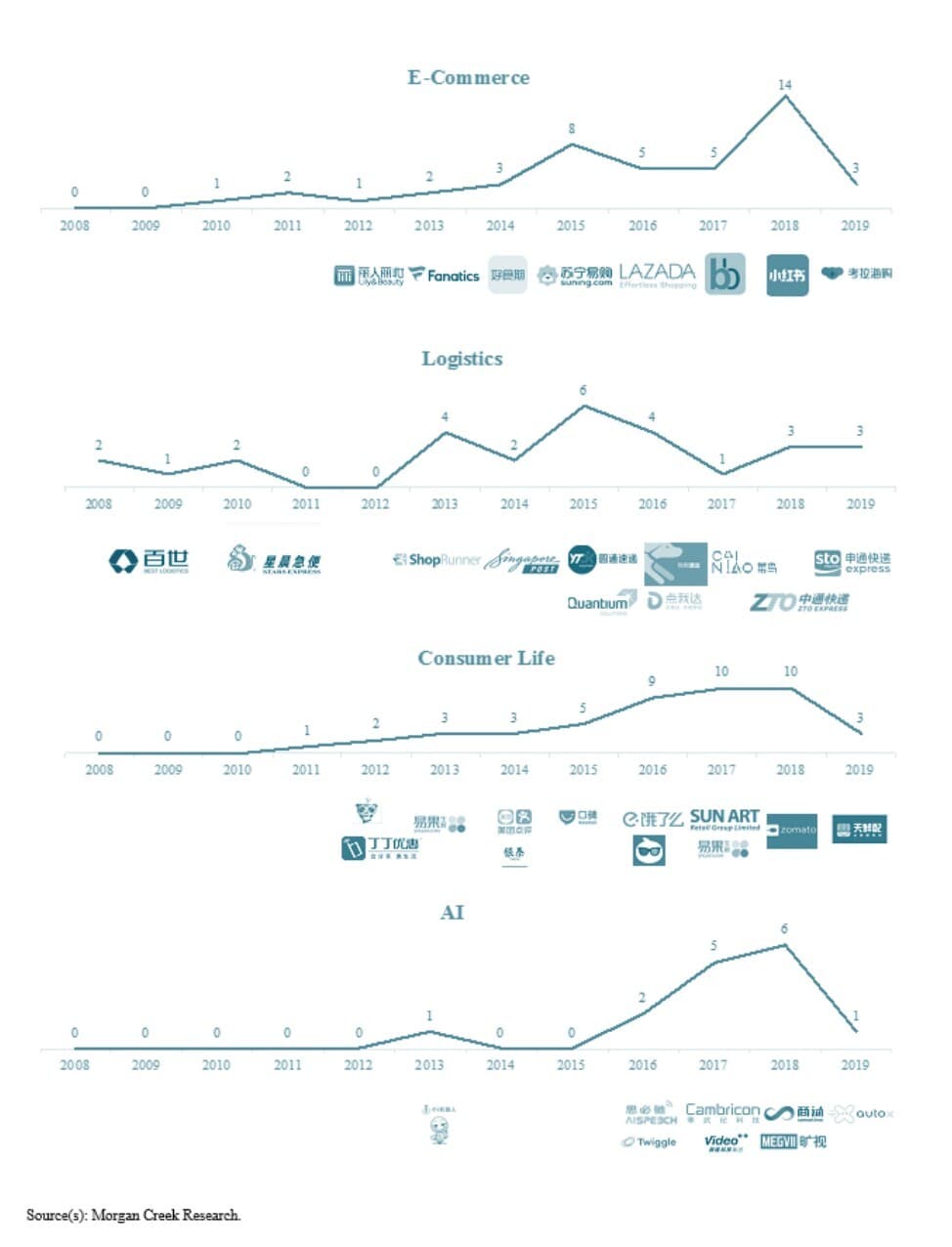

The investment focus of Alibaba mirrors its core businesses in the ecommerce, logistics, and consumer sectors. Alibaba invests in numerous ecommerce platforms to achieve cross-platform cooperation and to further expand its reach.

It also invests in logistics platforms to further build upon Alibaba’s logistics network and utilises IT to support the development of downstream express delivery enterprises around its ecommerce platform. As more enterprises upload their data on the cloud, Alibaba continues to build data centres and invest in cloud computing.

Alibaba also makes timely strategic adjustments to its portfolio companies, with Alibaba’s acquisition of Xiami being a prime example. After acquiring Xiami in 2013, Alibaba made significant changes to the senior management team, which changed the culture and incentives and ultimately led to Xiami being shut down in early 2021.

Alibaba once considered merging Xiami and another streaming platform, NetEase Music [NTES], to compete with Tencent Music, but the merger ended up not going through. Instead, in 2019 Alibaba led a $700m financing round in NetEase Cloud Music, effectively betting on NetEase as a standalone company and abandoning the Xiami venture.

NetEase Cloud Music has seen successful synergies with Alibaba's other businesses including Youku, Alipay, and Alibaba Pictures, while Xiami never successfully integrated with Alibaba’s other businesses.

Although the volume of CVC deals for both Alibaba and Tencent is similar, the fate of their respective portfolio companies differs primarily in how the companies channel user traffic.

After Alibaba acquires a product, it will channel all the product traffic to its ecommerce platforms, such as Taobao, and attempt to capitalise on the increased traffic. After this initial capitalisation, the product is abandoned in many cases.

In contrast, after Tencent acquires a product, it will channel its existing traffic (WeChat, QQ, etc.) into the new product, which drives growth in the product and helps it avoid obsolescence or abandonment. Despite these different methodologies, the two tech titans continue to dominate the corporate venture capital space in China.

This article was reproduced with permission from Morgan Creek Capital Management. It was originally published on the firm’s website on 25 March.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy