Time-Weighted Average Price (TWAP) is another popular algorithmic strategy that is used by traders to reduce the impact of larger trades. This strategy will execute trades evenly over a specified time period. It breaks up a large order and releases it to the market in smaller slices, using evenly divided time slots across a given period of time.

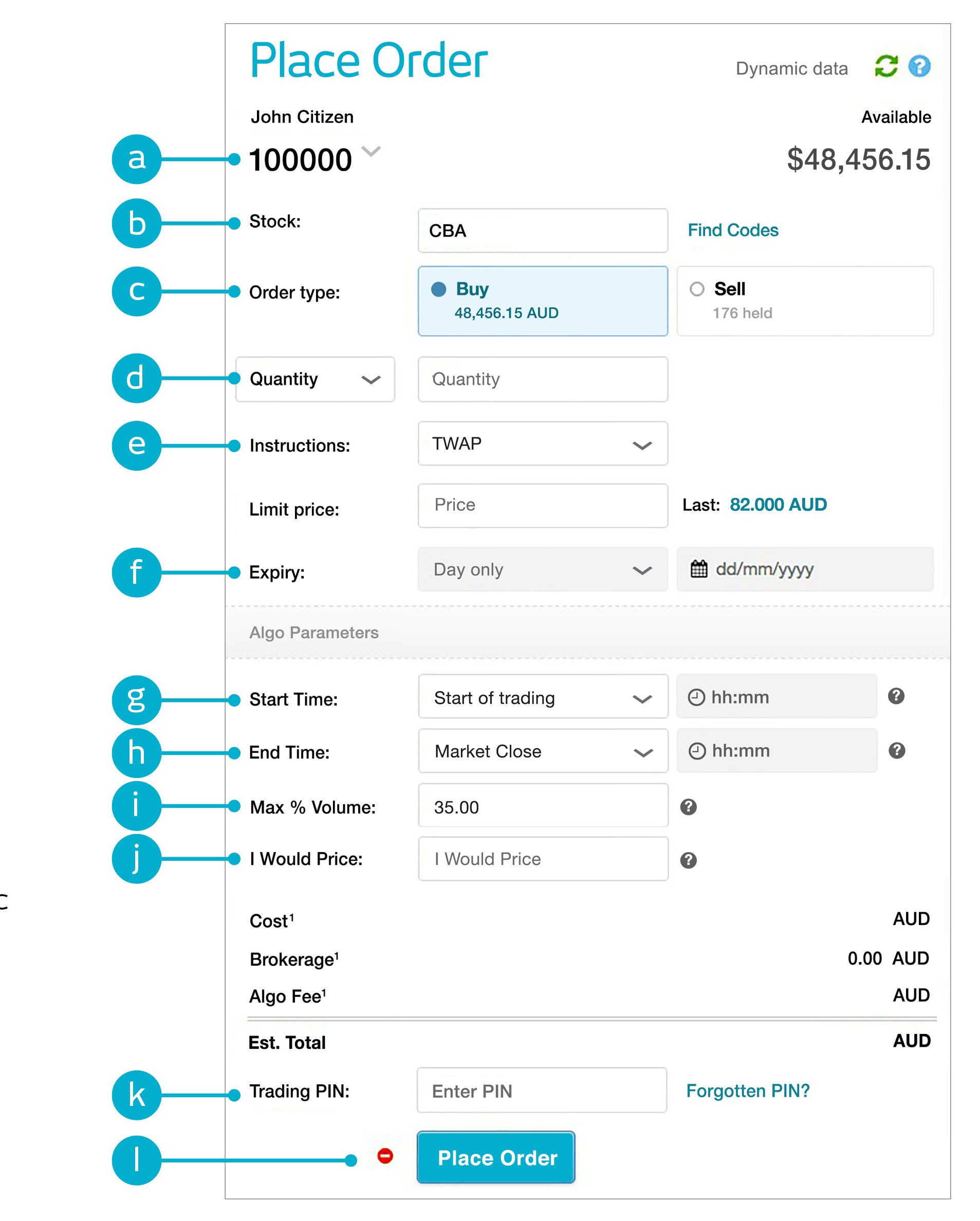

- Select your trading account from the top of the order ticket.

- Enter your stock code (or you can find codes by clicking on the Find Codes link)

- Select your order type; Buy or Sell

- Choose your quantity

- Set instruction to TWAP (under Algo Orders)

- Expiry is Day only

- Select the start time, this is the time you specify for the algorithmic order to start trading in the market

- Select the end time, this is the time you specify for the algorithmic order to stop trading in the market

- Set your max volume (optional), this is the maximum percentage that your order can trade as a proportion of total market volumes

- Enter your I would price (optional), this is the price at which your algorithmic order will exit the TWAP strategy and attempt to complete the order

- Enter your trading PIN

- Click Place Order to submit this to market